My Two-for-Tuesday morning train WFH reads:

• Archegos Appeared, Then Vanished Start with a lot of money. Borrow a lot more money. Use all that money to buy a ton of small stocks, cornering the market and pushing up their prices. Prices go up, you have more equity — your positions automatically deleverage. You use that to borrow more money and plow it back into those stocks, pushing them up more. Repeat forever? (Bloomberg) see also Purposeless Capital Money without a goal is mere lucre. Capital without a purpose is simply currency awaiting mischief. Without a purpose, money is merely an entry in an accounting ledger. But capital tied to a useful purpose has magical powers. (The Big Picture)

• China Creates its Own Digital Currency, a First for Major Economy A cyber yuan stands to give Beijing power to track spending in real time, plus money that isn’t linked to the dollar-dominated global financial system (Wall Street Journal)

• Why Sotheby’s and Christie’s Adore NFTs Billionaire-owned auction houses like Sotheby’s and speculative crypto-art make logical bedfellows (Bloomberg) see also NFTs Are the Latest Investing Mania—and They’re Here to Stay The hottest asset of 2021 has been met by a near-universal reaction: disbelief. Nonfungible tokens—NFTs—have taken in more than $200 million in just the past month, and that’s not even counting the recent $69 million sale of a digital artwork by an artist named Beeple.(Barron’s)

• 2020-2021 Power 100 In a bizarre and unprecedented year, these leading allocators took advantage of opportunities during market volatility and achieved stellar gains. (Chief Investment Officer)

• The Mortgage Market Is Roaring, But Lots of People Can’t Get a Loan Mortgages are going almost exclusively to borrowers with pristine credit histories (Wall Street Journal) see also Manhattan Homebuyers Are Back, But They’re Here for the Deals Manhattan homebuyers are coming back to the market they left a year ago. Just don’t expect them to overpay. Buyers priced out of the city’s costliest borough before the pandemic are sensing opportunity and committing to Manhattan if they can find a place that meets their budget. (Bloomberg)

• Goaded by a Robot, Students Took Greater Risk Than They Otherwise Would Can a robot encourage risk-taking behavior? A new study, titled “The Robot Made Me Do It,” suggests it may be possible. (Wall Street Journal)

• Biden’s $2 trillion infrastructure plan, explained in 600 words $621 billion for roads and bridges; another $165 billion would go toward public transportation, with a big chunk of that going to Amtrak. It would also pay for electric car recharging stations, water systems (including eliminating all lead pipes), high-speed broadband infrastructure, and modernizing the electrical grid (Vox) see also Embracing the Softer Side of Infrastructure Investments in the future don’t always involve concrete. (Krugman)

• Words Have Lost Their Common Meaning The word racism, among others, has become maddeningly confusing in current usage. (The Atlantic)

• Scientists: Virus Variants Threaten to Draw Out the Pandemic Declining infection rates overall masked a rise in more contagious forms of the coronavirus. Vaccines will stop the spread, if Americans postpone celebration just a bit longer.(New York Times) see also We Have All Hit a Wall: Confronting late-stage pandemic burnout, with everything from edibles to Exodus. Malaise, burnout, depression and stress — all of those are up considerably. People are saying they’re less productive, less engaged, that they don’t feel as successful (New York Times)

• Schumer Pushes Senate on Pot Legalization as States Leap Ahead Majority Leader Chuck Schumer is pushing the Senate toward lifting the federal prohibition on marijuana with legislation that would represent the biggest overhaul of federal drug policy in decades. (Bloomberg)

Be sure to check out our Masters in Business interview this weekend with Shirl Penny, founder and CEO of Dynasty Financial Partners. Dynasty has 50 RIA offices, 250 advisors + over $60B in assets on their platform. Penny was recently named to Investment News’ 40 under 40 list.

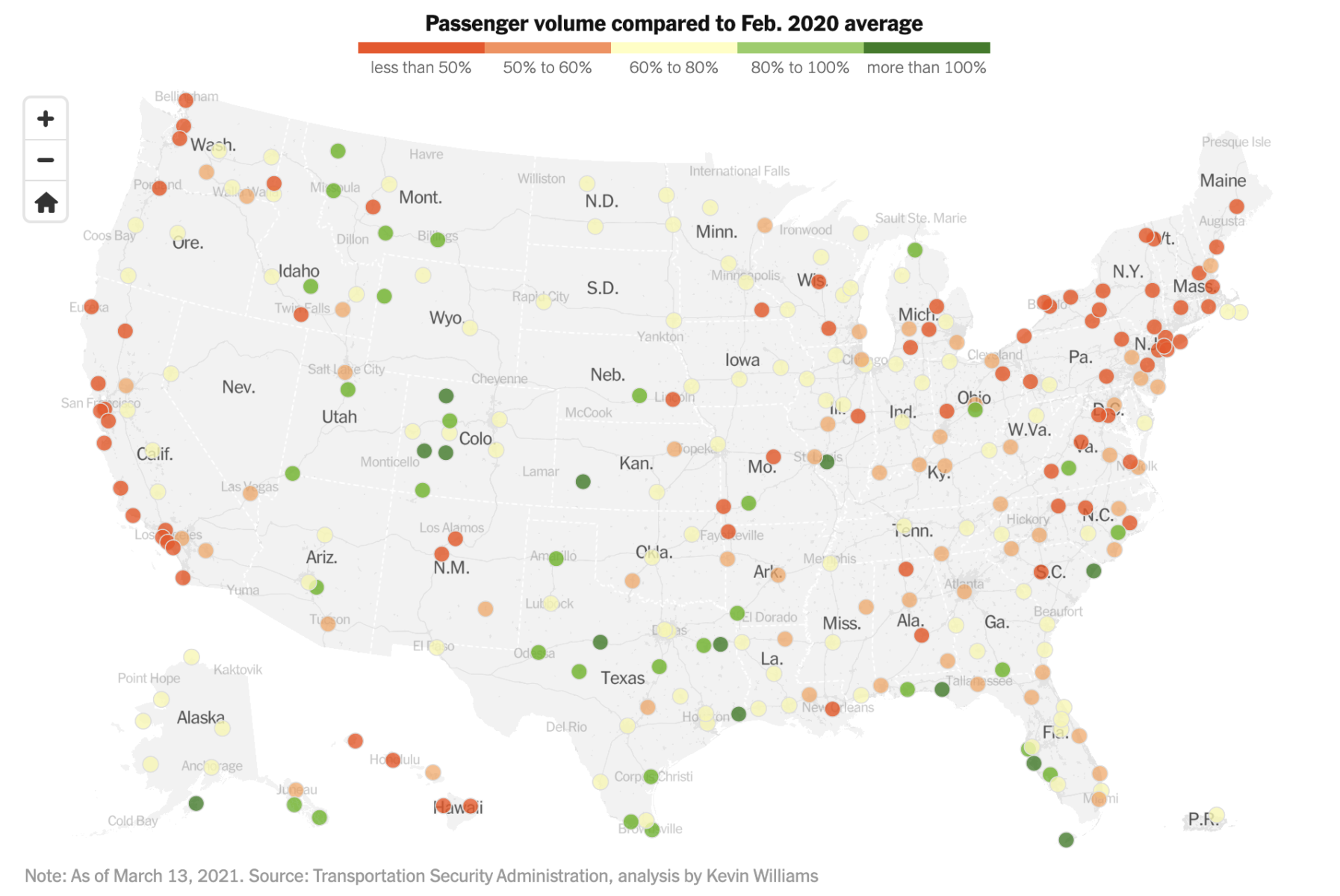

Air Travel Is Already Back to Normal in Some Places. Here’s Where.

Source: New York Times

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.