My Two-for-Tuesday morning train WFH reads:

• After Pandemic, Shrinking Need for Office Space Could Crush Landlords Some big employers are giving up square footage as they juggle remote work. That could devastate building owners and cities. (New York Times) but see Why New York May Emerge From Covid Richer Than Ever Cities with strong foundations in technology should recover quickly from the pandemic, while the Sun Belt could go the way of the Rust Belt.(Bloomberg)

• The Most Important Rule in Investing With all due respect to Warren Buffett, the most important rule in investing is not anything close to “never lose money.” In fact, the entire notion is absurd. Anyone who has ever invested in the history of the world has lost money at one time or another. Buffett himself lost over 50% from late 2007 to early 2009 (Compound)

• Who Owns Stocks in the United States? Politicians should be figuring out ways to get more people invested in it to take advantage of the ever-growing profits and dividends paid out by corporations. Stock market ownership trends are slowly but surely heading in the right direction. We should encourage more people to take part in the stock market to keep it going. (Wealth of Common Sense) see also Pandemic Exacerbating US Wealth Disparity: An already wide gap in wealth disparity among Americans was only magnified and exacerbated by the COVID-19 pandemic, according to a panel discussion at CIO’s virtual conference “Inside the Minds of CIOs.”(Chief Investment Officer)

• How America’s Great Economic Challenge Suddenly Turned 180 Degrees Recent supply problems suggest businesses may have trouble responding to rising consumer demand. (Upshot)

• The dispiriting housing boom No one seems to be happy about the current housing frenzy. It’s a discouraging scene: Bidding wars, soaring prices, and fears that homeownership is becoming out of reach for millions of Americans. We’re in a housing frenzy, driven by a massive shortage of inventory — and no one seems to be happy about it. (Axios) see also As the Housing Supply Hits a Record Low, Is There Anything Left to Buy? After a flurry of market activity in 2020, pending home sales data suggests there may not be much left for eager buyers (Architectural Digest)

• Are NFT Purchases Real? The Dollars Are. Dive down a rabbit hole and explore nonfungible tokens, multimillion-dollar digital art and the nature of reality. (New York Times)

• What Will Happen to Friendships When We Crawl Out of Our Pandemic Hidey Holes? A year of isolation has left our lives strewn with carcasses of friendships once held sacred—but can reopening revive them? (Vanity Fair) see also The Best Friends Can Do Nothing for You: If your social life is leaving you unfulfilled, you might have too many deal friends, and not enough real friends. (The Atlantic)

• Matt Gaetz (R–TV) “If you aren’t making news, you aren’t governing.” This approach to politics hasn’t made him many friends in Washington or imbued him with the air of gravitas that ambitious politicians once craved. But as scandal has swirled around him, it has served as something of a shield. (New York Magazine)

• For One Glorious Summer, Americans Will Vacation Like the French Workers are on the verge of going bonkers with their PTO. (The Atlantic) see also You’re Vaccinated. Can You Finally Take a Vacation? The CDC still warns against travel, even for fully vaccinated people. We asked three epidemiologists when it will be safe to travel again. (Wall Street Journal)

• ‘Big Shot’: Vaccine Theme Songs Have Their Moment Tunes that evoke Covid inoculation are spreading on TikTok, Spotify and YouTube—from new numbers like ‘Vaccinated Attitude’ to oldies from Billy Joel and Pat Benatar (WSJ)

Be sure to check out our Masters in Business interview this weekend with John Schlifske, CEO of Northwestern Mutual. The firm underwrites over $2 trillion in life insurance, with $200 billion in client assets. Schlifske joined Northwestern Mutual in 1987 as an investment specialist, and climbed through the ranks, becoming CEO 11 years ago. The firm announced a record $6.2 billion dividend in 2021.

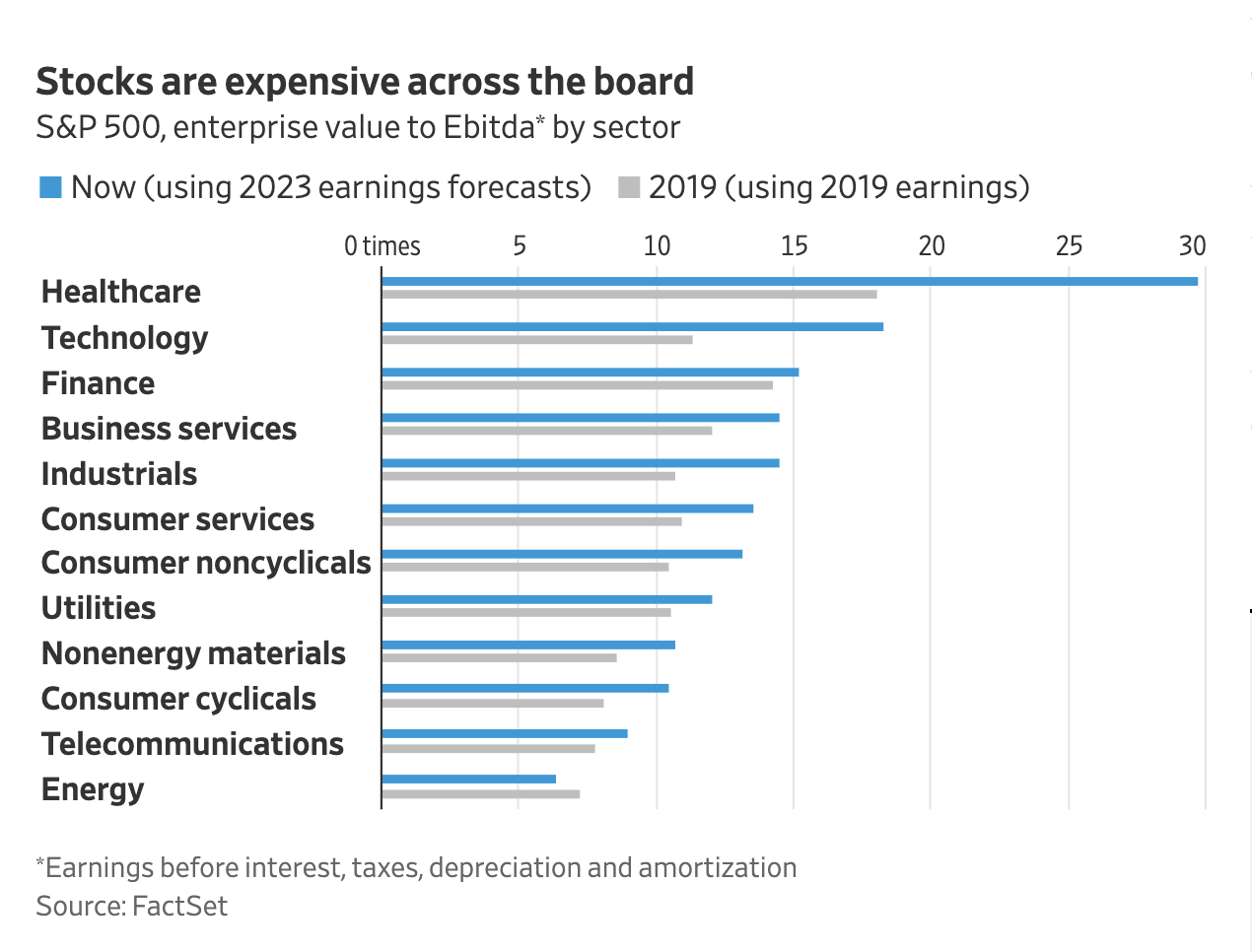

Stock valuations are stretched for the beginning of an economic cycle

Source: Wall Street Journal

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.