My Two-for-Tuesday morning train WFH reads:

• Elon Musk, Chamath Palihapitiya and Cathie Wood Face a Reddit Reckoning Profits beat prophets in today’s stock market. While the broader stock market remains near record levels, the trio’s portfolios and businesses have been pummeled by inflation worries and rising bond yields. (Bloomberg) see also US day trading frenzy eases as investors ‘move on to other things’ The day trading bonanza that took Wall Street by storm early in 2021 has cooled sharply as US authorities lift social curbs and amateur investors spend more time away from home. (Financial Times)

• The World Economy Is Suddenly Running Low on Everything ‘It is anything but efficient or normal.’ Surging corporate demand is upending global supply chains. (Bloomberg)

• Bitcoin is Crashing. This is What it Does This is the noisiest selloff in quite some time, but other than that, this is rather ordinary. Bitcoin routinely falls 30% or more from its all-time highs, as you can see in the charts below. (Irrelevant Investor) see also As cryptocurrency goes wild, fear grows about who might get hurt “Right now the exchanges trading in these crypto assets do not have a regulatory framework, either at the SEC or our sister agency, the Commodity Futures Trading Commission,” SEC Chair Gary Gensler told Congress earlier this month in one of his first remarks on cryptocurrency regulation. “Right now there’s not a market regulator around these crypto exchanges. And thus there’s really not protection against fraud or manipulation.” (Washington Post)

• Bond Market Rejects Inflation Alarmism If investors were really worried about inflation, there is one really obvious thing they would do – buy TIPS, inflation-protected bonds. And yet, with inflation readings providing all kinds of headlines, investors didn’t do that. In fact, on the day of that much higher than expected CPI, investors sold long-term TIPS, the 10-year yield rising by 4 basis points. If inflation fear is driving markets, TIPS investors are curiously brave. (Alhambra)

• Most People Are Thinking of Herd Immunity All Wrong A scenario where so few people have a disease that even those who can’t be vaccinated will never get sick, simply because they’ll never have the chance. One of herd immunity’s hallmarks is that cases are so rare that they make news. It’s not a cutoff, it’s not a magic number, and it’s usually not even an ending. (Slate) see also The Future of Virus Tracking Can Be Found on This College Campus Colorado Mesa University and the Broad Institute of M.I.T. and Harvard have spent the last year exploring new approaches to managing outbreaks. (New York Times)

• The FCC’s big bet on Elon Musk The billionaire’s space internet project could connect millions of remote American homes. If it actually works. (Vox)

• That Time My 7-Year-Old Son Taught Me Something Important About Autopilot There’s a lot more at stake when one puts a digital assistant in charge of 2 or 3 tons of rapidly moving metal, though. If Siri malfunctions, you’ll need to manually Google for something. If Autopilot malfunctions and there isn’t a human at the helm ready to take over, the consequences are sometimes deadly (Clean Technica) See also A Fatal Crash Renews Concerns Over Tesla’s ‘Autopilot’ Claim But even people who shell out for Full Self-Driving don’t own a self-driving car, and vehicles with Autopilot can’t automatically pilot themselves (Wired)

• The strange deal that created a ghost town: An infamous blue plume of pollution from one of the US’s largest coal-fired plants changed the course of history for one once-thriving town. (BBC)

• How Disruptive Will NFTs Be on the Art Industry? While art in the form of nonfungible tokens has been making headlines the past few months, the traditional art industry, with the exception of the major auction houses and a few high-profile artists, has approached the market with caution. Despite the hype, what actually is the size of the NFT art market? How disruptive will it be? And what roles should the traditional industry player play in its future development? (Barron’s) see also Bitcoin, dogecoin, NFTs, GameStop — is this the peak of investment absurdity? investment absurdity? (Los Angeles Times)

• For some Navy pilots, UFO sightings were an ordinary event: ‘Every day for at least a couple years’ The shift — from kooky conspiracy theory to object of congressional inquiry — has accelerated in recent years, fueled by the revival of a Pentagon unit to investigate the sightings. And in the next six weeks, a report is due that is required to make public everything the government knows about UFOs. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Danny Kahneman, winner of the 2002 Nobel Memorial Prize in Economic Sciences and author of Thinking, Fast and Slow. His empirical findings with Amos Tversky challenge the assumption of human rationality prevailing in modern economic theory, and established a cognitive basis for human error. His latest book is Noise: A flaw in human judgment cowritten with Oliver Sibony and Cass Sunstein.

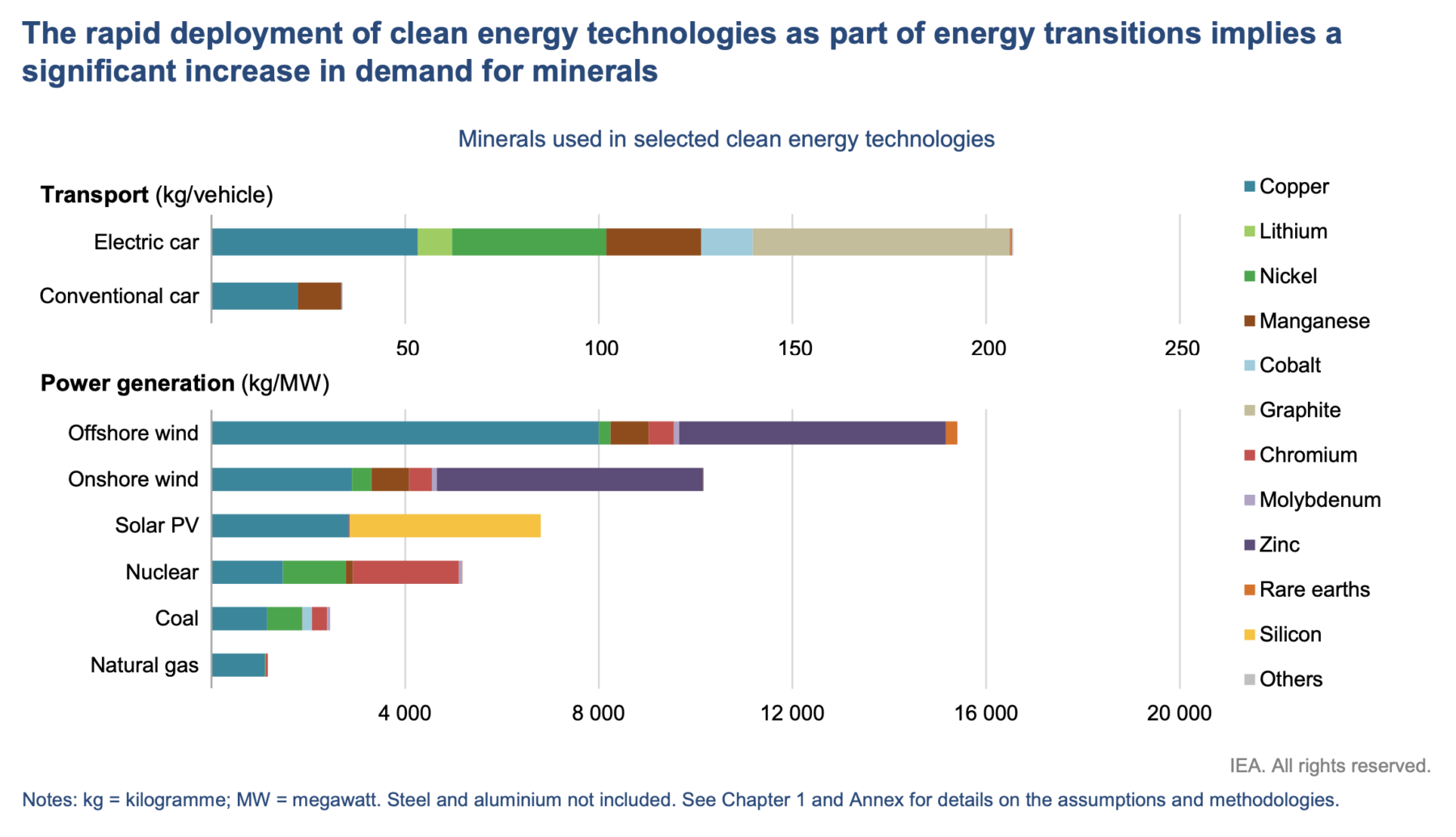

The rapid deployment of clean energy technologies as part of energy transitions implies a significant increase in demand for minerals

Source: International Energy Agency

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.