My Tuesday morning train WFH reads:

• The Great American Cleanup: Deodorant, Teeth Whitener Fly Off the Shelves ‘Everyone wants to look their best’: As restrictions ease, stores say sales are shifting away from toilet paper and baking flour to cosmetics and swimsuits (Wall Street Journal)

• The Economy Is Booming. Why Don’t Firms Believe It? Rather than an economic crash during the pandemic, we have instead seen aging supply lines straining under a surge in demand, the likes of which hasn’t been seen for decades. Whether in lumber, shipping, semiconductors, or any of a range of industries, this has been a fascinating through-line (Bloomberg)

• How Regulators Killed Hedge Funds Hedge funds generated much larger returns than stocks and bonds for years — but everything changed after the financial crisis. Regulations stopped unwanted activity , reducing insider trading — and Alpha (Institutional Investor)

• Houses Have Gotten Bigger and Nicer Part of the unaffordability problem is that expectations have gotten ahead of reality. Houses were more affordable for our parents because the ones they were buying bare little resemblance to the ones we’re buying. (Irrelevant Investor) see also Did HGTV Ruin the Housing Market For Millennials? First-time homebuyers aren’t thrilled with the housing market at the moment. It’s not a buyer’s market despite (or because?) Interest rates remain at generationally low levels. What if young people are unhappy with the housing market because their expectations are too high? What if our tastes have become too expensive? (A Wealth of Common Sense)

• Don’t Blame David Swensen for 2-and-20 Hedge Funds The Yale endowment pioneer relied as much on “soft” people skills for his success as on the alternative assets that fueled the growth of an industry. (Bloomberg)

• Why Amazon is paying $9 billion for MGM and James Bond Amazon isn’t competing with Netflix, but it is spending billions trying to figure out Hollywood. Maybe 007 can help. (Recode)

• The evidence is clear — COVID lockdowns saved lives without harming economies The published data point to two related conclusions: First, lockdowns played a significant role in reducing infection rates. Second, they had a very modest role in producing economic damage. Conversely, lifting lockdowns has done very little to spur economic resurgence. (Los Angeles Times)

• Ethereum Closes In on Long-Sought Fix to Cut Energy Use Over 99% Shift could boost Ether as Bitcoin’s environmental rap worsens; ETH’s 45,000 gigawatt usage may fall to 1/10,000th of that. (Bloomberg)

• Green Finance Goes Mainstream, Lining Up Trillions Behind Global Energy Transition After years of intermittent excitement and fizzled expectations, environmental-oriented investing is no longer just a niche interest (Wall Street Journal) see also How the Green Economy Will Be a Gold Mine for Copper A linchpin of the old energy economy, Copper will play a crucial role in the new green one: Cables made of the metal are the most cost-effective means of transmitting electricity from solar and wind sources. “There is no decarbonization without copper, aka the new oil.” (Barron’s)

• Chernobyl Is Heating Up Again, and Scientists Aren’t Sure Why The disaster at Chernobyl nuclear power plant occurred more than 35 years in the past, but the possibility of another disaster is still present” Engineers completed the construction of the New Safe Confinement to stabilize the highly radioactive and full of fissile material site. Some worrying signals have emerged, suggesting the remains could still heat up and leak radiation into the environment all over again. (ExtremeTech)

Be sure to check out our Masters in Business interview this weekend with Scott Sperling, Co-Chief Executive Officer of private equity firm Thomas. H. Lee. The Co-CEO is a member of the firm’s Management and Investment committees. THL has completed more than 100 investments in excess of $125 billion of aggregate purchase price. Their flagship fund has more than $5B in it, and their Automation Fund has over $900 million in LP assets.

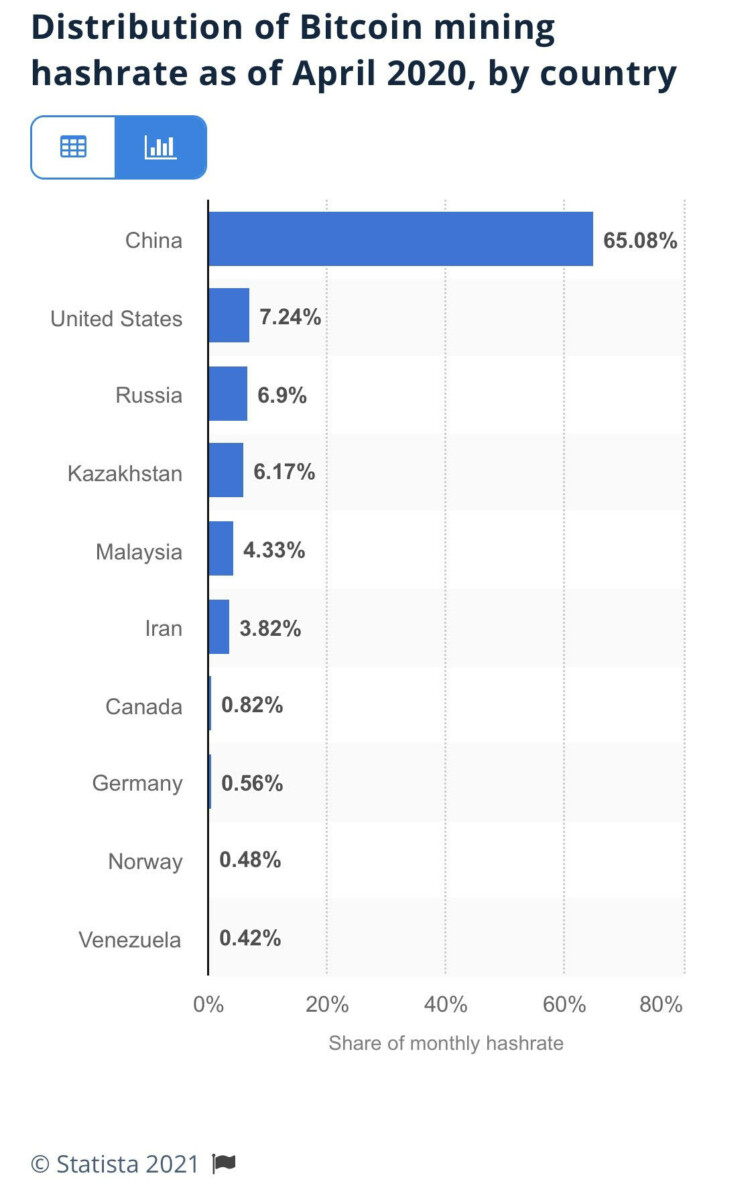

In case anyone was wondering where #BTC mining happens

Source: TBPInvictus