My morning train WFH reads:

• Your father’s stock market is never coming back With a Robinhood account, your first exposure to cryptocurrencies does not frame them as an unproven alternative to stocks. The two stand on equal footing. Coke and Pepsi. Feel like trading one or the other? Have at it, no difference. This is radically different from the experience of the Gen X and boomer investors logging in through Schwab, Fidelity, or Vanguard to check their balances or download a statement. (Fortune)

• How Allocators Are Honing Asset Strategies, Amid a Problematical Future Many institutional investors have positioned their funds to generate returns, while others are girding for further volatility. (Chief Investment Officer)

• DeFi Is Helping to Fuel the Crypto Market Boom—and Its Recent Volatility Decentralized finance differs from traditional banks because there is no centralized system. It can be risky. (Wall Street Journal)

• The $10 Billion Bright Spot in the Battered World of Office Real Estate Blackstone, KKR and other investors are betting on laboratory space as vaccines fuel the economic rebound. (Bloomberg)

• How to fix America: Take a road trip from New York to California to see infrastructure projects with the potential to make cities more livable and equitable. (Bloomberg)

• What Germany Can Teach America About Renewable Energy Bringing energiewende across the Pacific—this time with nuclear in the mix. (Slate)

• Billionaires are racing to sidestep President Biden’s plan to raise their taxes How Silicon Valley might beat the Tax Man. (Vox)

• Hot beach summer is coming 2020 was the summer of road trips. 2021 is the summer of resorts. (Vox)

• And the band played on… The appointment of a chief conductor little affects the general performance of an orchestra (The Critic)

• The real Lord of the Flies: what happened when six boys were shipwrecked for 15 months When a group of schoolboys were marooned on an island in 1965, it turned out very differently from William Golding’s bestseller, writes Rutger Bregman (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Harindra de Silva, of Wells Fargo Asset Management. He is a pioneer in low volatility and factor-based investing, and leads the Analytic Investors group, running quantitative strategies, and managing $20 billion in client assets.

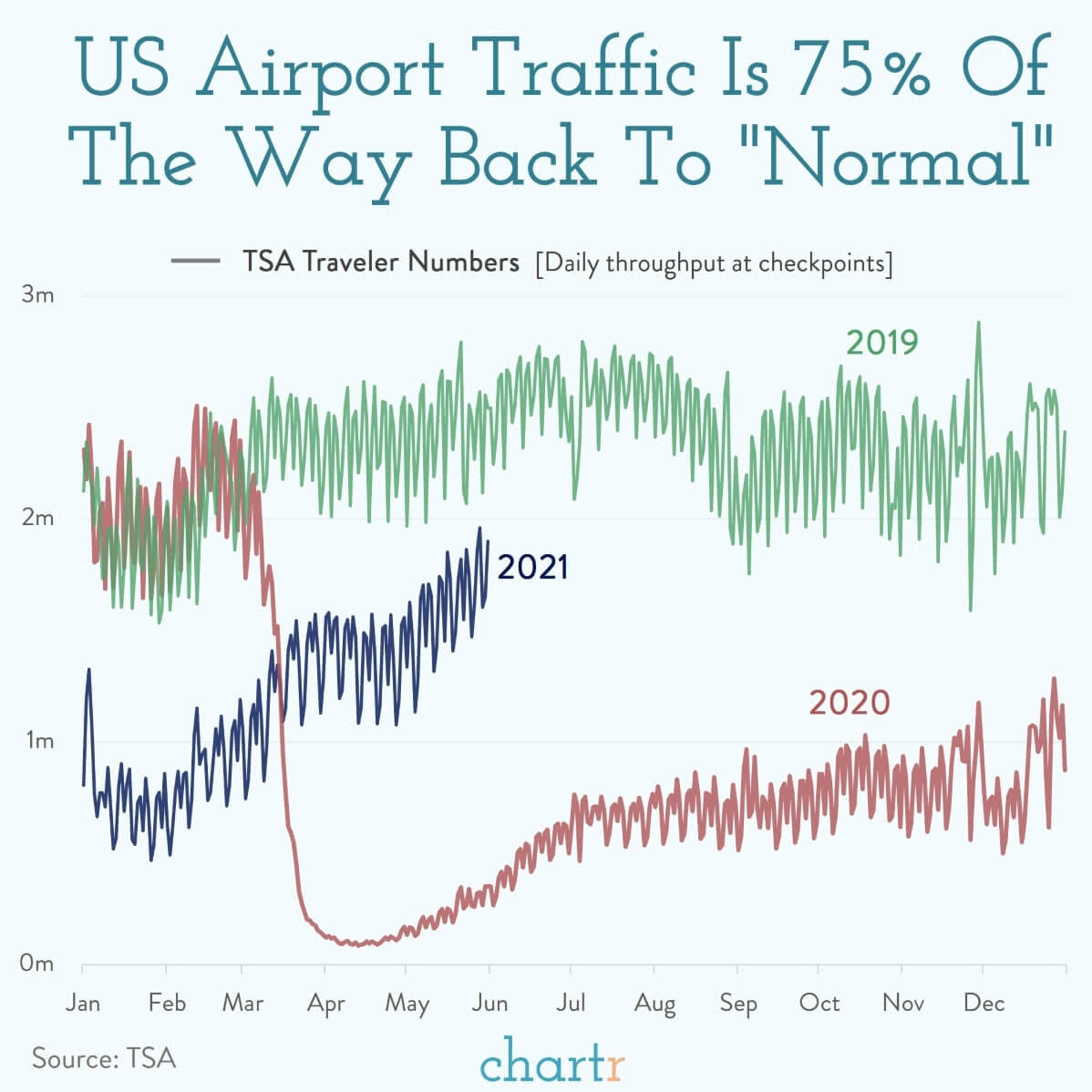

Air travel is back. Kinda.

Source: Chartr

Sign up for our reads-only mailing list here.