My “The internet is down” morning train WFH reads:

• The Bottom 90% of Americans Are Borrowing From the Top 1% The savings of the rich are recycled into household and government debt (Businessweek)

• A Commodities Crunch Caused by Stingy Capital Spending Has No Quick Fix Limited inventory of resources is converging with a buying spree to supercharge prices, spurring inflation concerns (WSJ)

• A Guide to Moving from Cash to Investments “Valuations are high.” “Stocks have had an incredible run, how much higher can they go?” “Interest rates are near historic lows. What happens when they rise?” These are all reasonable things to think about when allocating a lump sum of money that has been sitting on the sidelines. But what does the data suggest? (Compound Advisors) see also Dollar Cost Averaging vs. Lump Sum: The Definitive Guide One of the biggest problems in personal finance is deciding when to invest a sum of money. Whether you have $10, $10,000, or $10 million that you could put to work, the question is: Should you invest all that money over time (dollar cost averaging) or now (lump sum)? (Dollars & Data)

• SEC mulls GameStop, AMC ‘gamification’ crackdown with regulatory layer As SEC Chair Gensler eyes crackdown, Robinhood could be in the firing line (Fox Business) see also AMC, Other Meme Stocks Turn Options Market Upside Down Flurry of activity in meme-stock options underscores investors’ fear of missing out on surges (WSJ)

• U.S. Trophy-Home Market Poised for a Banner Year The market for $50 million-plus home sales got off to an incredibly strong start to 2021, with the number of listings and sales on pace to outdo previous years (Mansion Global)

• Is New York’s Year of Lavish Tipping Coming to an End? As the pandemic eases, data suggests customers may no longer see service workers as deserving of “hazard pay.” (NYT)

• America’s scarcity mindset: Is our society turning into a zero-sum competition for survival? Is our society turning into a zero-sum competition for survival? (Noahpinion)

• Behavioral Scientist’s Summer Book List 2021 We’ve prepared this summer’s list by tracking down the new titles and selecting those that deepened our understanding and appreciation of human behavior, and helped us think differently about questions that matter—both in the public sphere and more personally. (Behavioral Scientist)

• Earth’s carbon dioxide levels hit 4.5 million-year high The amount of carbon dioxide in the Earth’s atmosphere has reached its annual peak, climbing to 419 parts per million (ppm) in May, according to scientists from Scripps Institution of Oceanography and the National Oceanic and Atmospheric Administration (NOAA). (Axios) see also CO2 levels are at an all-time high — again The historic CO2 record was pretty unfazed by the pandemic (The Verge)

• N.B.A. Fans Wanted a Show. They’re Also Getting a Reckoning. The entertainment of the playoffs has been coupled with a pressing message from players that fans have disrespected them for too long. (NYT)

Be sure to check out our Masters in Business interview this weekend with Harindra de Silva, of Wells Fargo Asset Management. He is a pioneer in low volatility and factor-based investing, and leads the Analytic Investors group, running quantitative strategies, and managing $20 billion in client assets.

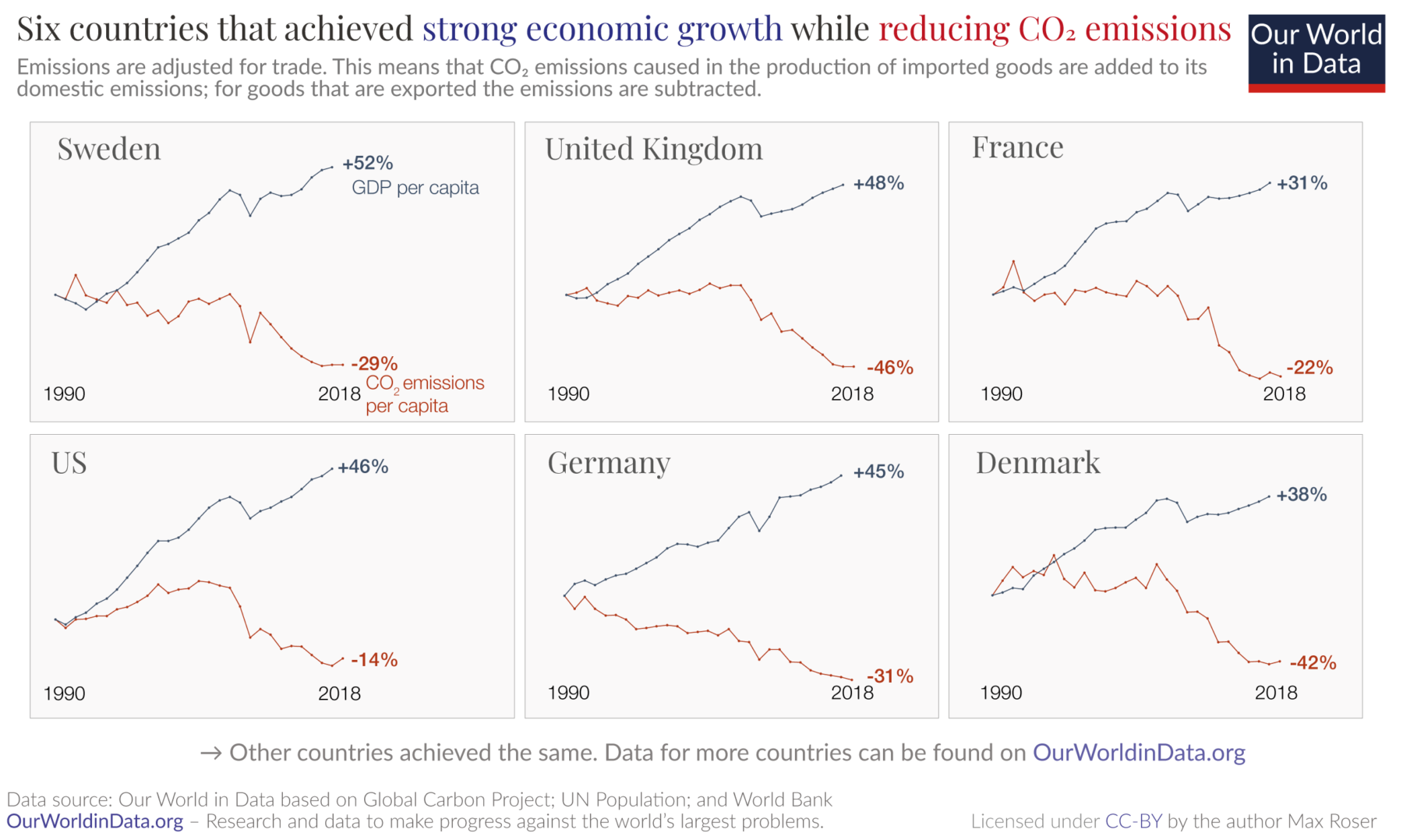

The argument for a carbon price

Source: Our World In Data