My Two-for-Tuesday morning train WFH reads:

• The economy isn’t going back to February 2020. Fundamental shifts have occurred. A new era has arrived of greater worker power, higher housing costs and very different ways of doing business. (Washington Post)

• What Investors Can Learn From the History of Inflation Price spikes post-World War II and the 1970s show how inflation can dominate stock market returns (Wall Street Journal) See also As Lumber Prices Fall, the Threat of Inflation Loses Its Bite Costs soared partly because of do-it-yourselfers’ spending stimulus checks, but a month of declines show that consumers aren’t about to. (New York Times)

• Kill the 5-Day Workweek Reducing hours without reducing pay would reignite an essential but long-forgotten moral project: making American life less about work. (The Atlantic)

• The Housing Conundrum The current demographics are now very favorable for home buying – and will remain positive for most of the decade. (Calculated Risk) see also For Many Home Buyers, a 5% Down Payment Isn’t Enough Half of mortgage borrowers put down at least 20% in April. That is locking many people out of homeownership. (Wall Street Journal)

• This one email explains Apple I love this email for a lot of reasons, not the least of which is that you can extrapolate from it the very reasons Apple has remained such a vital force in the industry for the past decade. The gist of it is that SVP of Software Engineering, Bertrand Serlet, sent an email in October of 2007, just three months after the iPhone was launched. (TechCrunch)

• What Quitters Understand About the Job Market More Americans are telling their boss to shove it. Is the workplace undergoing a revolution—or just a post-pandemic spasm? (The Atlantic) see also How Do They Say Economic Recovery? ‘I Quit.’ With new opportunities and a different perspective as the pandemic eases, workers are choosing to leave their jobs in record numbers. (New York Times)

• Harder Than It Looks, Not As Fun as It Seems The more we describe successful people as having guru-like powers, the more everyone else looks at them and says, “I could never do that.” Which is unfortunate, because more people would be willing to try if they knew that those they admire are probably normal people who played the odds right.(Collaborative Fund)

• The Power of Product Thinking Nurturing and developing product thinking is therefore relevant to anyone in the business of covering trends or building great products. And in a time where technology companies focus more on product-led innovation than, say, financial engineering, it’s not just an academic or technologist exercise — it’s one that actively contributes to market value, too. (A16Z Future) see also The Most Important Thing That’s Happened in Our Lifetime? It never made sense to me that Silicon Valley was creating all of these wonderful applications yet so many people in tech still had to work in Silicon Valley. That’s obviously changing now and not just for those in the Bay Area. (A Wealth of Common Sense)

• How Republicans Became the ‘Barstool’ Party The Barstool-ification of the GOP could reconfigure its cultural politics for a generation. (Politico)

• ESG Has So Far Been a Rich World Phenomenon. But Emerging Markets Are Catching Up. Investors weigh in on the importance of ESG in these markets and investment opportunities in a post-pandemic world. (Institutional Investor) see also Climate Change Batters the West Before Summer Even Begins Global warming, driven by the burning of fossil fuels, has been heating up and drying out the American West for years. Now the region is broiling under a combination of a drought that is the worst in two decades and a record-breaking heat wave. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Social Psychologist Robert Cialdini, Professor Emeritus of Psychology and Marketing at Arizona State University. He is the author of the book Influence, which has sold over 5 million copies in 30 languages. The latest revision is out Influence, New and Expanded: The Psychology of Persuasion.

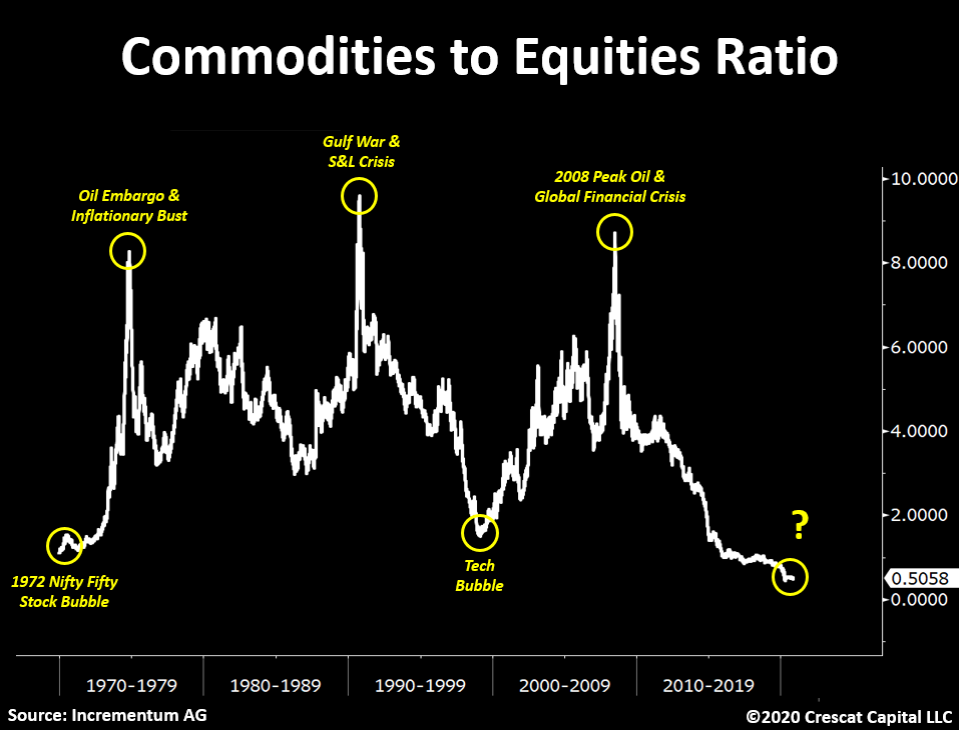

Commodities relative to stocks

Source: Incrementum AG via Peter Boockvar