My mid-week morning train WFH reads:

• Make Money Day-Trading from Home! Change is happening in the financial markets. Can you feel it? It’s like the ground is shifting beneath my feet. Something new is happening, and maybe, just maybe, this time really is different. (Belle Curve)

• The Fed Is Paying 0.00%. Such a Deal! Depositors Are Flocking Starting in April, “No Interest” started looking interesting to certain investors with too much cash on their hands. The amount of money they placed at the Fed overnight at 0.00% grew from nothing to single-digit millions to billions and, as of June 8, $497.4 billion. That’s the most ever. (BusinessWeek)

• Built-to-rent suburbs are poised to spread across the U.S. Economic forces and generational preferences are leading to a new kind of housing: subdivisions designed for renters and managed like apartment buildings. They could become a force in the rental housing market, with implications for the communities that surround them, and the nature of home ownership. What does it mean for suburbia? (Wall Street Journal)

• How Food Trucks Endured and Succeeded During the Pandemic Embracing technology, scaling down costs and general flexibility have helped them through a difficult time. (New York Times)

• The Worst Business Ever Food delivery just isn’t a very good business. It’s hard to make a profit when you don’t make any money. This describes the state of the food delivery business, which according to the founder and CEO of GrubHub, “is and always will be a crummy business.” (Irrelevant Investor)

• Farewell, Millennial Lifestyle Subsidy The price for Ubers, scooters and Airbnb rentals is going up as tech companies aim for profitability. (New York Times)

• A company you’ve probably never heard of caused half the internet to go dark Countless websites, including major news outlets, were offline after an outage at Fastly, a cloud computing provider. (Vox)

• How A New Team Of Feds Hacked The Hackers And Got Colonial Pipeline’s Ransom Back That said, the attackers made an unusual error in this case by failing to keep money moving. The $2.3 million that ultimately was recovered was still sitting in the same Bitcoin account it had been delivered to. (NPR)

• The Retreat of Exxon and the Oil Majors Won’t Stop Fossil Fuel National oil champions are likely to fill the gap left by private-sector players—meaning emissions won’t shrink as fast the supermajors (Bloomberg Green)

• As Long As A Basketball Court: Australia’s Largest Dinosaur Confirmed Researchers in Australia have confirmed the discovery of Australia’s largest dinosaur species ever found. Australotitan cooperensis was about 80-100 feet long and 16-21 feet tall at its hip. It weighed somewhere between 25 and 81 tons. For comparison, the Tyrannosaurus rex was about 40 feet long and 12 feet tall. (NPR)

Be sure to check out our Masters in Business interview this past weekend with Harindra de Silva, of Wells Fargo Asset Management. He is a pioneer in low volatility and factor-based investing, and leads the Analytic Investors group, running quantitative strategies, and managing $20 billion in client assets.

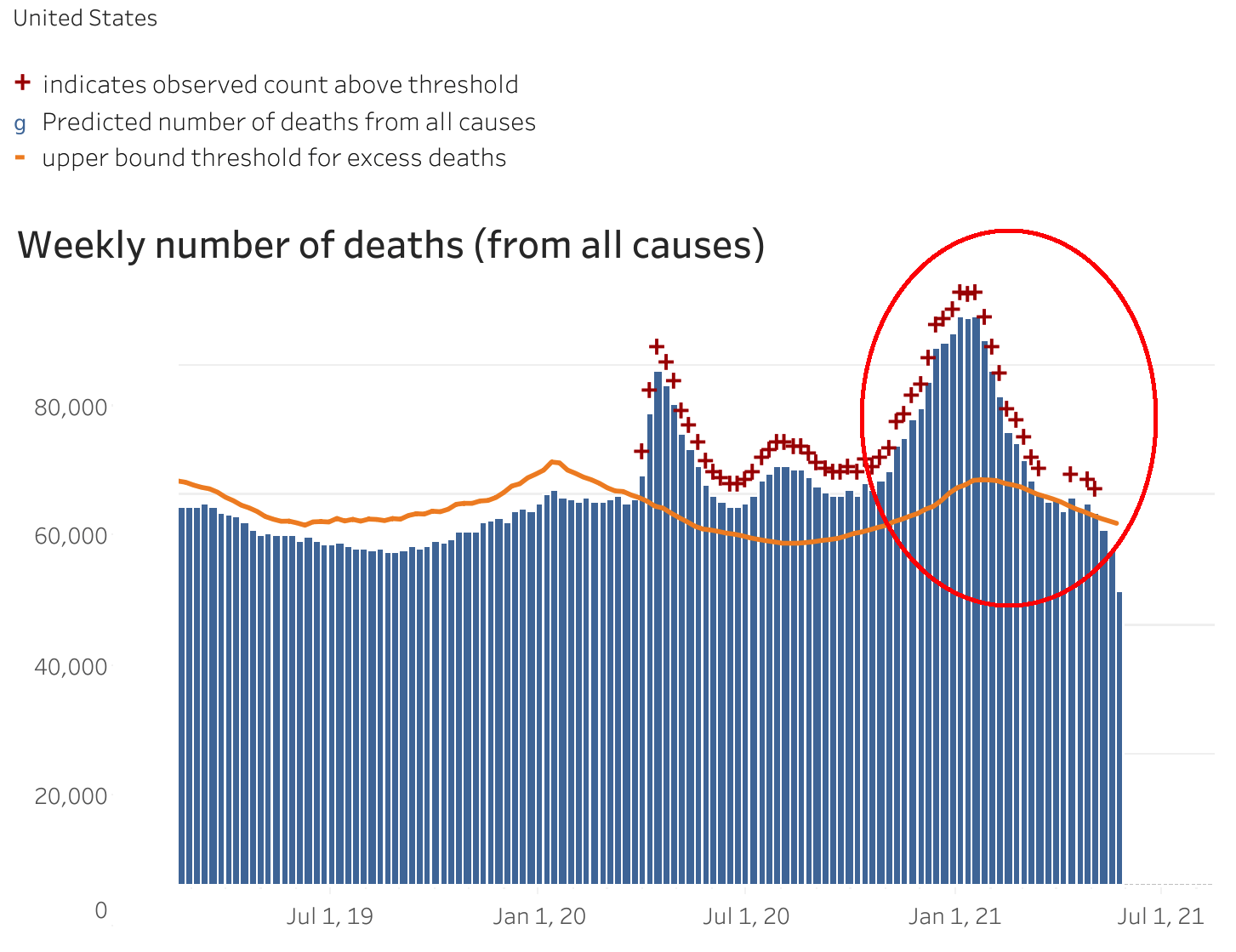

Excess Deaths Associated with COVID-19 Have Plummetted

Source: CDC

Sign up for our reads-only mailing list here.