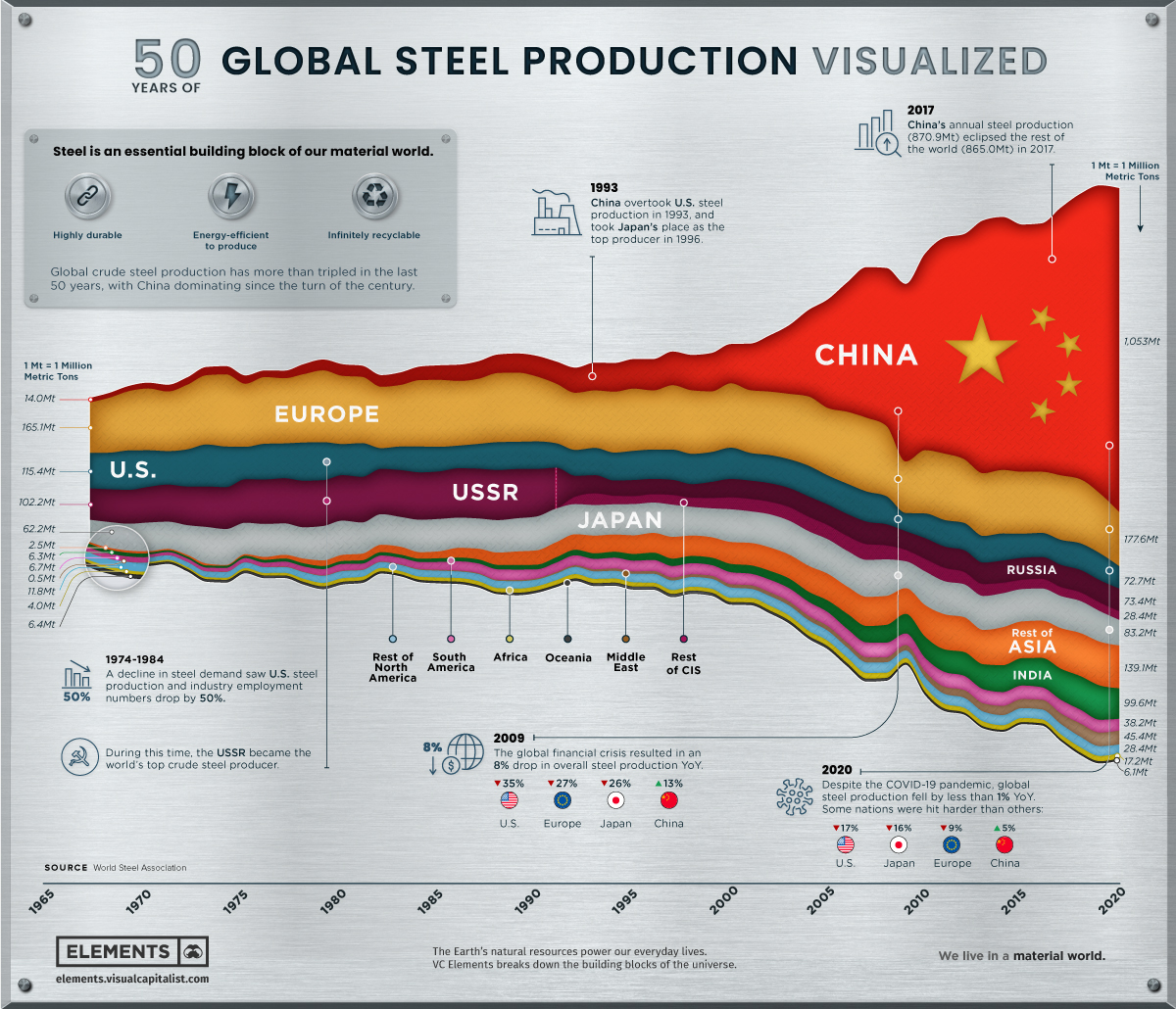

What global steel production has looked like over the last 50 years

Source: World Economic Forum

In today’s episode of confirming my priors, we look at Steel.

Last time out, we looked at the price of Lithium-Ion batteries — they cost 97% less than they did 3 decades ago (Deflation, Punctuated by Spasms of Inflation).

Along the same lines, consider Steel: The industrial metal has not had that sort of price movement, but it has dramatically lagged global price increases.

In 1965, 4 regions accounted for most of the production by tonnage — Europe, USA, USSR, and Japan — were nearly 90% of all steel produced. 55 years later, one nation dominates nearly half of all steel produced: China.

They did not get to that level of market share because it’s a superior product — it is essentially a commodity — they got there through relentless cost-cutting and government-subsidized production. Buyers do not care, cheaper steel costs mean lower input costs that gives them more flexibility with their margins.

The last 20 years have seen this key industrial metal lag CPI inflation substantially. The recent spike in prices is fighting against a lot of history.

I am not a fan of posting every chart that confirms my views, so instead, I will link to two others you might find interesting: See YCharts for 1990-2021 of Steel vs CPI costs; and the “Price History, Tables and Charts” at Steel benchmarked, for what looks like deflation with spasms of inflation.

Previously:

Inflation

The Inflation Reset (June 1, 2021)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)