My end of week morning train WFH reads:

• It’s About to Be the Biggest Year for ETFs. Ever. Wall Street has surrendered to the $500 billion ETF rush; Vanguard leads the way as industry prepares to shatter annual record with months to go. (Bloomberg)

• The five-day workweek is dead; It’s time for something better. But there’s nothing inevitable about working eight hours a day, five days a week (or more). This schedule only became a part of American labor law in the 1930s, after decades of striking by labor activists who were tired of working the 14-hour days demanded by some employers. (Vox)

• The Car Market Is Insane. It Might Stay That Way for a While. How long will we be stuck with these shortages? Is the car biz’s COVID hangover destined to linger on? Or will the industry, like the rest of our once-dreary-eyed economy, soon return to normal? It could be well into next year before prices fall back to earth and customers see the sort of selection they’re used to at dealerships. (Slate)

• Spotify’s Top Lawyer Has Spent Years Making Apple the Bad Guy Horacio Gutierrez has done more than almost anyone to push the narrative of the iPhone maker as an abusive monopolist (Businessweek)

• The Biggest Differences Between Now & The Housing Bubble This doesn’t look like a bubble to me. It looks like a housing shortage, a demographic wave and a pandemic-induced buying frenzy but not speculative excess. (A Wealth of Common Sense)

• Two-Thirds of Miami Condo Buildings Are Older Than 30 Years. The Repair Bills Are Coming Due. Many towers line the beachfront, where salt corrosion is speeding their decline; decision-making is often left to condo boards (Wall Street Journal)

• Going for brokers: Justice Department takes on one of the country’s worst cartels For decades, the National Association of Realtors has maintained monopolistic control of the real estate market. This has benefited the NAR’s members but imposed significant costs on consumers. Stuck with few options but to use NAR-approved brokers, Americans pay some of the highest commission fees in the developed world. (Washington Examiner)

• How Twitter ruined everything The site has distorted our perception of reality (UnHerd)

• The stampede away from Trump’s voting-machine claims continues apace, as legal liability looms for allies These theories carry one very significant drawback: legal liability. While broad claims of voter fraud are relatively unspecific and involve many potential perpetrators, there are relatively few voting-machine companies. Making such claims impugns them specifically and creates a situation in which those assertions can lead to calculable personal and business harm, which is important when it comes to suing someone for defamation. (Washington Post)

• The Best Memes of 2021 (So Far) What is the internet, but memes persevering? (Thrillist)

Be sure to check out our Masters in Business interview this weekend with Matt Ishbia, CEO of United Wholesale Mortgage. UWM is the number 1 wholesale lender and the number 2 overall mortgage lender in the nation. The firm went public in the biggest SPAC ever (UWMC) this year. Ishbia is also the author of “Running the Corporate Offense: Lessons in Effective Leadership from the Bench to the Boardroom.”

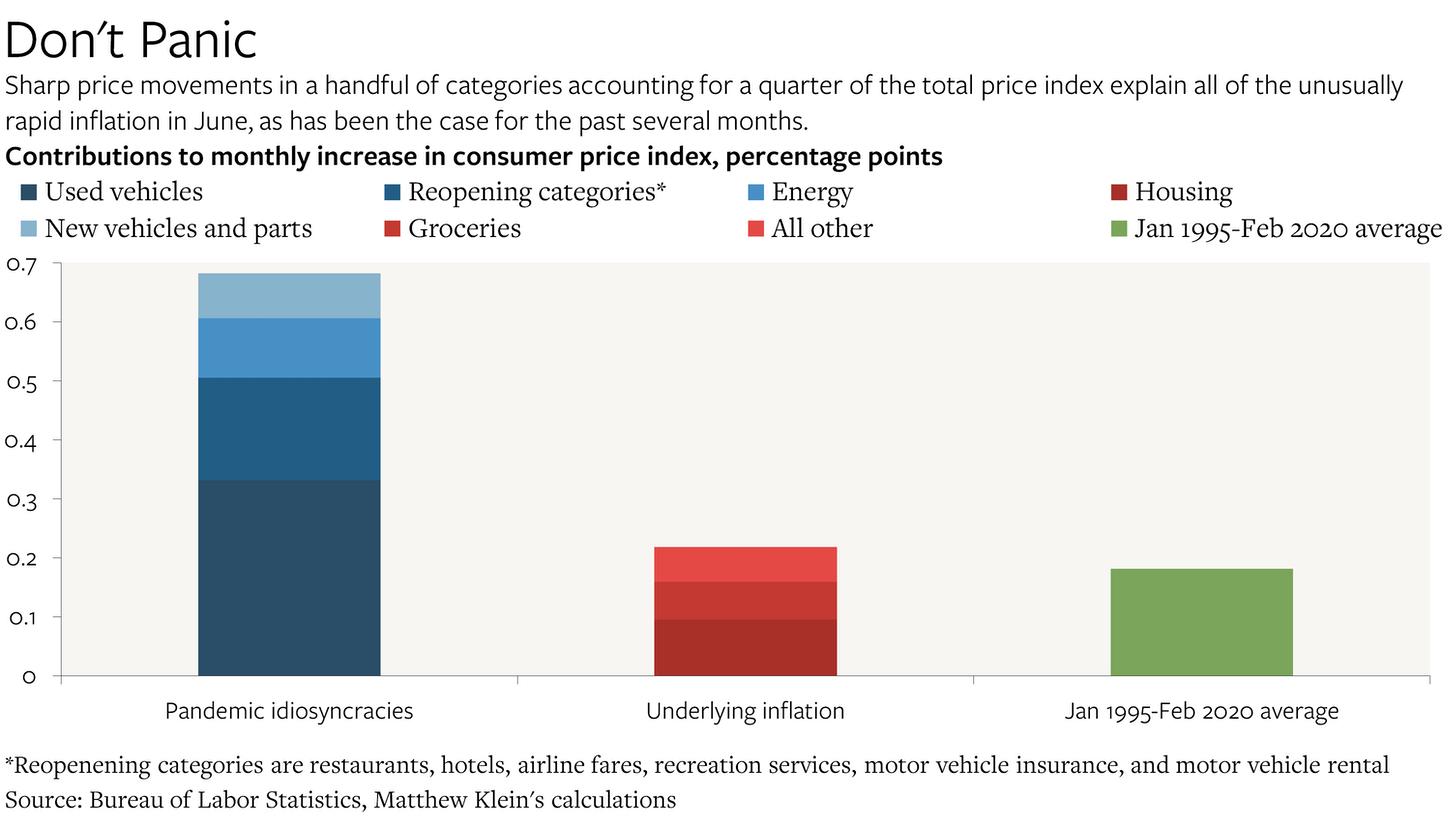

U.S. CPI inflation story is mostly about reopening and motor vehicle supply issues

Source: The Overshoot

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.