My back to work morning train WFH reads:

• When Money Is No Object: Sure, using a credit card is easy, but paying with invisible money makes saving harder and spending easier. People behaved differently when they saved—and spent—cold, hard cash (Wall Street Journal) see also Buy, Borrow, Die: How Rich Americans Live Off Their Paper Wealth Banks say the wealthy are borrowing more than ever, using low-interest loans backed by their investments (Wall Street Journal)

• The Meme Stock Trade Is Far From Over. What Investors Need to Know. While trading volume at the big brokers has come down slightly from its February peak, it remains two to three times as high as it was before the pandemic. And a startling amount of that activity is occurring in stocks favored by retail traders. (Barron’s)

• Meet the Four-Eyed, Eight-Tentacled Monopoly That is Making Your Glasses So Expensive Luxottica controls 80% of the major brands in the $28 billion global eyeglasses industry. This monopolistic structure of the market leads to profits that are “relatively obscene” (Forbes)

• Binance Booms as Crypto Trading Unfolds Beyond Nations’ Reach It pays its people in a digital token of its own devising. It’s based wherever its founder happens to be. A growing list of countries want no part of it. And Binance Holdings Ltd. might just be the biggest, craziest thing in the big, crazy realm of cryptocurrencies. (Bloomberg)

• Unknown Unknowns America has a science problem. We don’t understand the basic concepts of scientific methodology, the importance of admitting the limitations of models and experiments, or how to interpret results. These shortcomings are combined with our predisposed natural tendencies to seek patterns and cling to certainty over skepticism. (The Belle Curve)

• Rent prices are soaring as Americans flock back to cities 33 percent rent increases and bidding wars on rentals are the new norm in some parts of America as reopening comes with big price hikes. (Washington Post)

• Everything You Need to Know About the Great Lumber Crisis of 2021 Lumber prices are coming back down to Earth, but the crisis shows how many industries can be rocked by the price of wood. (Vice)

• QAnon Pivots Its Exiled Online Movement to the Real World Text-based political disinformation in the United States has risen over the past year, with real world consequences. One reason these strategies are effective, as our research has shown, is because across countries, platforms, and political groups, the most effective way to spread messages at scale is through dedicated human advocates. Even without a sophisticated digital infrastructure, political messengers innovate new ways to disseminate messages. (Wired)

• Britney Spears’s Conservatorship Nightmare: How the pop star’s father and a team of lawyers seized control of her life—and have held on to it for thirteen years. (New Yorker)

• From Cacao to Clitoria: Luscious 19th-Century French Botanical Illustrations of the Most Vibrant Flora of the Americas How the world relished the world before Instagram. (Brain Pickings)

Be sure to check out our Masters in Business interview this weekend with Christine Hurtsellers, CEO of Voya Investment Management. The firm manages over $245 billion in assets. Hurtsellers was recently named to Barrons’s top 10 most influential women in wealth management.

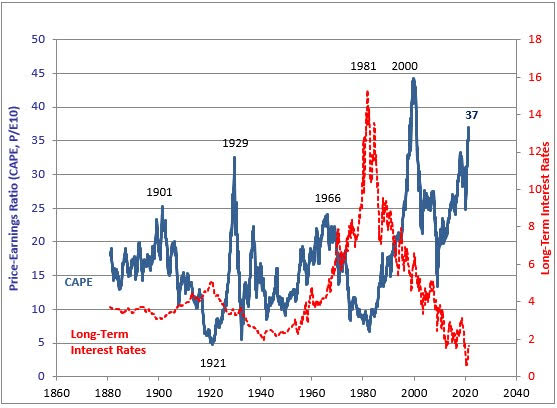

What’s Driving the Stock, Bond & Housing Markets Right Now?

Source: A Wealth of Common Sense

Sign up for our reads-only mailing list here.