My morning train WFH reads:

• Crypto Scammers Rip Off Billions as Pump-and-Dump Schemes Go Digital Billions are getting pilfered annually through a variety of cryptocurrency scams. In today’s cryptocurrencies, it’s known as the rug pull: Shit Coins, obscure digital something-or-others are being minted by the thousands. Telegram (a popular instant messaging app) has become a major crypto boiler room “Everybody I know has gotten rug-pulled.” The way things are going, this will only get worse. (Bloomberg Wealth)

• Is This the End of the ‘Fiery’ Public Versus Private Equity Debate? 60/40 portfolios: when private assets are included within the equity allocation, the fund’s performance is stronger than its private equity-less counterparts. This is true even when underperforming funds are involved. (Institutional Investor)

• The Sound of My Inbox The financial promise of email newsletters has launched countless micropublications — and created a new literary genre. The contemporary email newsletter is not a novel form; often it amounts to a new delivery system for the same sorts of content — essays, explainers, Q&As, news roundups, advice, and lists — that have long been staples of online media. (The Cut)

• Other People’s Money Once you start to view your personal balance sheet as a business, you start to question where your capital is parked and why. Do you really need a ton of equity in your home, a slow growing asset? Would that money earn more in the stock market? Are you comfortable with how borrowing changes your monthly cash flow? (The Belle Curve)

• Before investing in Robinhood or trusting it with your money, read these documents Finra accused Robinhood of plying millions of customers with “false or misleading information” about their account balances, of leaving millions of customers unable to trade because its IT systems broke down at crucial moments, and of approving thousands of customers for options trading even though it should have known they were unqualified to play the options market. (Los Angeles Times) see also The Robinhood Conundrum 47% of traders use the product on a daily basis. Among those customers who visted the app on a daily basis, the average number of visits was seven per day. More than 98% of users use the app on a monthly basis. This type of engagement and usage is insanely high for an investment product. (A Wealth of Common Sense)

• The Downtown Office District Was Vulnerable. Even Before Covid. The modern downtown business districts of many large American cities were created through subtraction: First residents left the center city, then the craftsmen and wholesalers, then the museums, theaters and smaller retailers, and — the final blow — the department stores. (Upshot)

• Why do we buy what we buy? A sociologist on why people buy too many things. What’s at the root of modern American consumerism? It might not just be competition among the brands trying to sell us things, but also competition among ourselves. American consumerism is also built on societal factors that are often overlooked. And in an increasingly unequal society, the Joneses at the very top are doing a lot of the consuming, while the people at the bottom struggle to keep up. (Vox)

• To Expand U.S. Vaccine Access, Consider the Dollar Store: The dollar store footprint lends itself to thinking about this broader aim of making vaccines available right where people are located, and the people that are disproportionately under-vaccinated in so many of our cities and communities right now. Dollar stores could be key access points for reaching vulnerable populations who have limited access to health care services, and sometimes lack trust in the system. (Citylab)

• These Superheroes Could Sharply Reduce Heat Deaths At a time when climate change is making heat waves more frequent and more severe, trees are stationary superheroes: They can lower urban temperatures 10 lifesaving degrees, scientists say. (New York Times)

• Hubble on the Bubble: Can NASA fix the world’s most famous telescope? Hubble is over 30 years old, and before this latest issue still working very well. It has tech considered ancient in it, but it’s still ticking. Or at least it will be once again when this problem is righted. (Syfy Wire)

Be sure to check out our Masters in Business interview this weekend with Christine Hurtsellers, CEO of Voya Investment Management. The firm manages over $245 billion in assets. Hurtsellers was recently named to Barrons’s top 10 most influential women in wealth management.

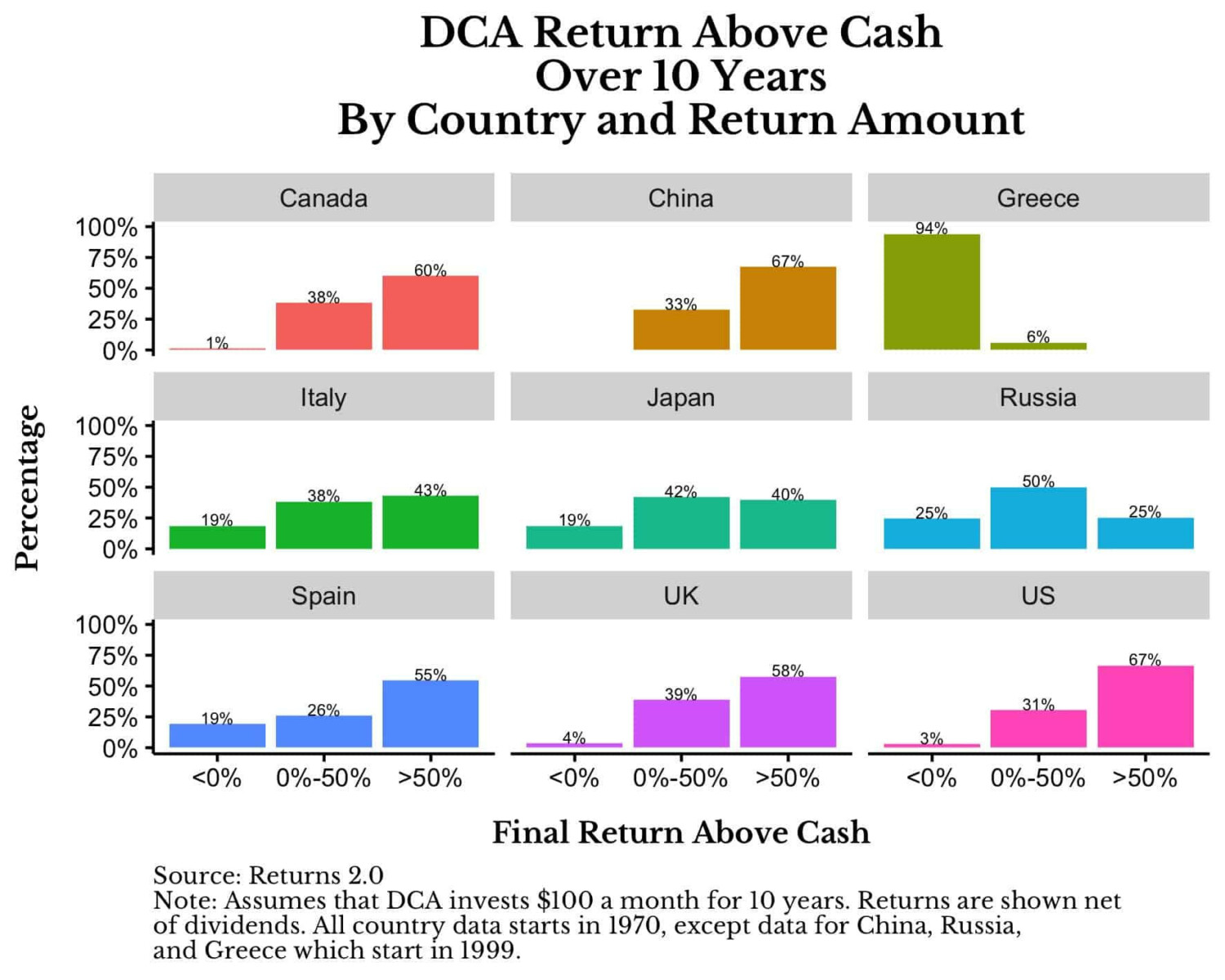

In Defense of Global Stocks

Source: Of Dollars and Data

Sign up for our reads-only mailing list here.