My mid-week morning train WFH reads:

• How Long Might the Next Bear Market Last? The fear is that today’s high valuations will mean a long decline. But bear markets don’t necessarily work that way. (Wall Street Journal) see also How Long Does it Take For the Stock Market to Double Off a Bear Market Bottom? Investing during a market crash can be lucrative. After the Great Financial Crisis caused the market to fall 56%, the S&P bottomed on March 9, 2009. The market snapped back in a hurry, surging nearly 70% from those lows through the end of the year. (A Wealth of Common Sense)

• Private Equity Still Outperforms Listed Stocks — But It’s Losing Its Edge Investors can blame stimulus from central banks and government spending as well as private equity’s unstoppable popularity for the sector’s narrower win over public equities. (Institutional Investor)

• In Defense of Global Stocks Global stocks are nothing to be overlooked. While the U.S. is clearly an outlier on the world stage, most of the strategies discussed here can be applied just as well to equity markets around the globe. Consider how a typical global equity investor would have performed over the last few decades as an asset class. (Of Dollars And Data)

• Welcome to the year of wage hikes. Workers are returning — to higher-paying firms. Average pay just topped $15 an hour at U.S. restaurants, one of many sectors forced to raise wages to lure back millions of workers. (Washington Post)

• Interview: Jason Furman, former chair of the Council of Economic Advisers The Harvard economist talks about inflation, wages, and where the Obama administration fell short (Noahpinion)

• How to Shamelessly Knock Off Supreme Worldwide and Get Away With It: An Italian fashion entrepreneur has made a career out of legally producing fake designer clothing. An 11-step look at his scheme. (Businessweek)

• No Soil. No Growing Seasons. Just Add Water and Technology. A new breed of hydroponic farm, huge and high-tech, is popping up in indoor spaces all over America, drawing celebrity investors and critics. (New York Times)

• Trump Country Rejects Vaccines Despite Growing Delta Threat President Biden missed a July 4 target for shots after politically conservative areas balked at getting jabbed. (Bloomberg)

• How a lizard’s venom inspired the promising weight loss drug Wegovy Semaglutide is the start of a new chapter in obesity treatments. (Vox)

• Shohei Ohtani Isn’t Babe Ruth—He’s Better Ohtani is a once-in-a-century player in a year when we need to be awed, inspired and distracted. Comparing him to the Babe is no longer enough. (Sports Illustrated)

Be sure to check out our Masters in Business interview this weekend with Steve Romick, Managing Partner at FPA, which manages $26 billion in equity, fixed income, and alternative strategies. Romick manages the $11 billion FPA Crescent Fund since its 1993 inception and was named Morningstar’s U.S. Allocation Fund Manager of the Year.

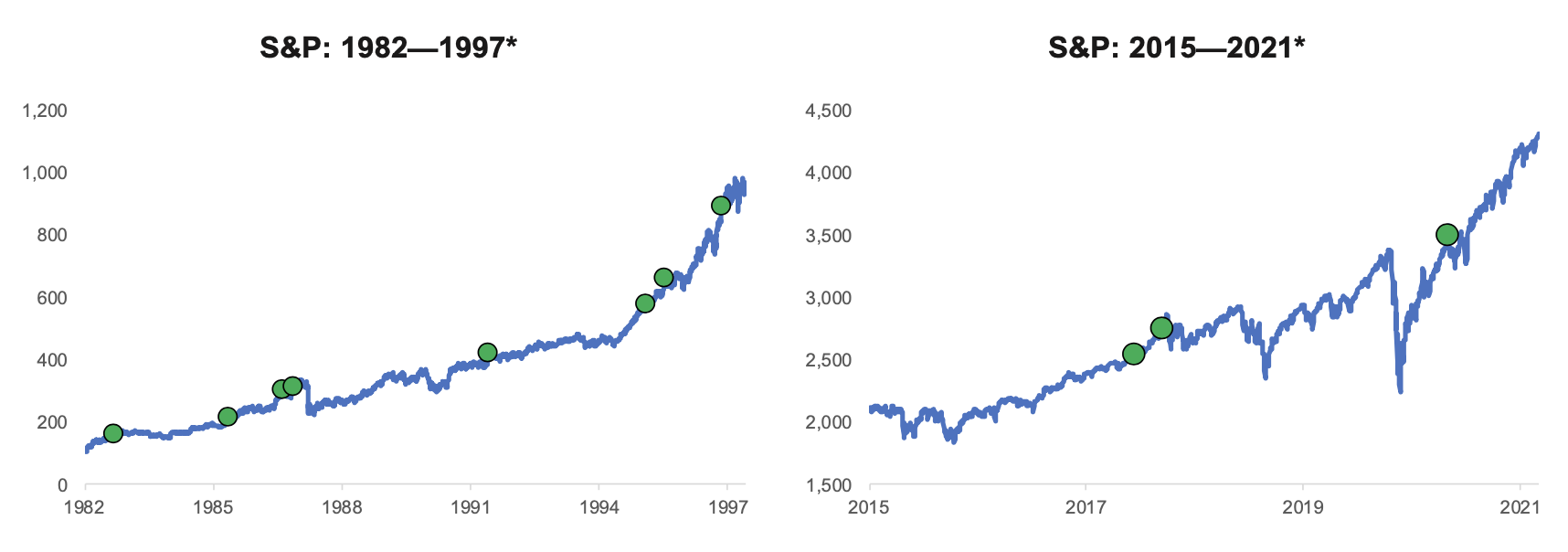

July 1 marked the 6th consecutive day the S&P 500 hit an all-time high. This has happened eleven other times since 1982. (longest streak = 8 days (9/14/95 and 6/17/97).

Source: Birinyi

Sign up for our reads-only mailing list here.