My back to work morning train WFH reads:

• Surging Delta Cases Reverse the World’s March Back to the Office The worst of the coronavirus pandemic may be receding into the rear-view mirror, but office workers are little closer to returning to their desks full-time. The spread of the delta variant has forced many U.S. employers that had been hoping to get staff back to their desks after Labor Day to delay those plans until at least October—or even next year. (Bloomberg) see also Remote Work May Now Last for Two Years, Worrying Some Bosses The longer that Covid-19 keeps people home, the harder it may be to get them back to offices; ‘There is no going back’ (Wall Street Journal)

• Americans Turn Against China Stocks as Crackdown Angst Deepens For American investors, Chinese stocks are becoming the asset not to own. Influential investors like George Soros have trimmed their China exposure, and Cathie Wood’s ARKK ETF no longer holds any such shares. Many others got hit with losses, according to their 13F filings. Betting against the country’s stocks was one of the most crowded trades among managers surveyed by Bank of America Corp. In London, Marshall Wace — one of the world’s largest hedge funds — says Chinese ADRs are now uninvestable. (Bloomberg)

• Here’s More Evidence That Factor Investing Works in Fixed Income With investors concerned about future inflation as well as persistently low yields, Northern Trust researchers find that systematic factors may provide some new portfolio opportunities. (Institutional Investor) see also Vanguard Total Bond Market: A Success Story For more than 30 years, the fund has delivered on all counts. (Morningstar)

• The U.S. could be on the verge of a productivity boom, a game-changer for the economy Rapid adoption of robots and artificial intelligence during the pandemic combined with a rebound in government investment is making some economists optimistic about a return of a 1990s economy with widespread benefits. (Washington Post)

• Biden and the Fed Wanted a Hot Economy. There’s Risk of Getting Burned. So far, in a real-world test of a new approach to economic policy, prices have been rising faster than wages. (Upshot)

• New Regulation Could Cause a Split in the Crypto Community The infrastructure bill is a watershed moment in the history of cryptocurrency. The technology—at its core a crypto-anarchist, anti-bank, borderline anti-government manifesto disguised as code—has finally acquired that great marker of prestige: a lobby. The fact that some senators were ready to fight in crypto’s corner appears to show that the cryptocurrency industry is more than a gaggle of Twitter accounts and some blue-sky venture capitalists. (Wired)

• How an Obscure Green Bay Packers Site Became the Biggest Thing on Facebook The Facebook platform is absolutely flooded with crappy meme spam (Wired)

• Afghans are being evacuated via WhatsApp, Google Forms, or by any means possible The only hope for many caught by the Taliban takeover is a chaotic and sometimes risky online volunteer response. (MIT Technology Review)

• Child Covid-19 hospitalizations soar, filling pediatric wings, data show The U.S. faces another peak in child hospitalizations as the delta variant hits communities hesitant to get vaccinated. (NBC News) see also GOP governors, school districts battle over mask mandates Millions of students in Florida, Texas and Arizona are now required to wear masks in class as school boards in mostly Democratic areas have defied their Republican governors and made face coverings mandatory. (AP)

• Chris and Rich Robinson swore never to speak again. But for the Black Crowes, rock heals all wounds The reunion, which has also spun off a deluxe reissue of “Money Maker,” marks Robinson’s reconciliation with his younger brother, guitarist Rich Robinson, with whom Chris formed the band near Atlanta in the mid-1980s — and with whom he fought explosively over money and creative control even as the Crowes went on to sell millions of records and blanket MTV with soulful, hard-hitting Southern rock songs. (Los Angeles Times)

Be sure to check out our Masters in Business this week with Fran Kinniry, who is a principal in the Vanguard Investment Strategy Group, and became Global Head of Private Investments at investing giant Vanguard Group in 2019. Kinniry is behind the drive to bring Private Equity investments to Vanguard’s 401k investors.

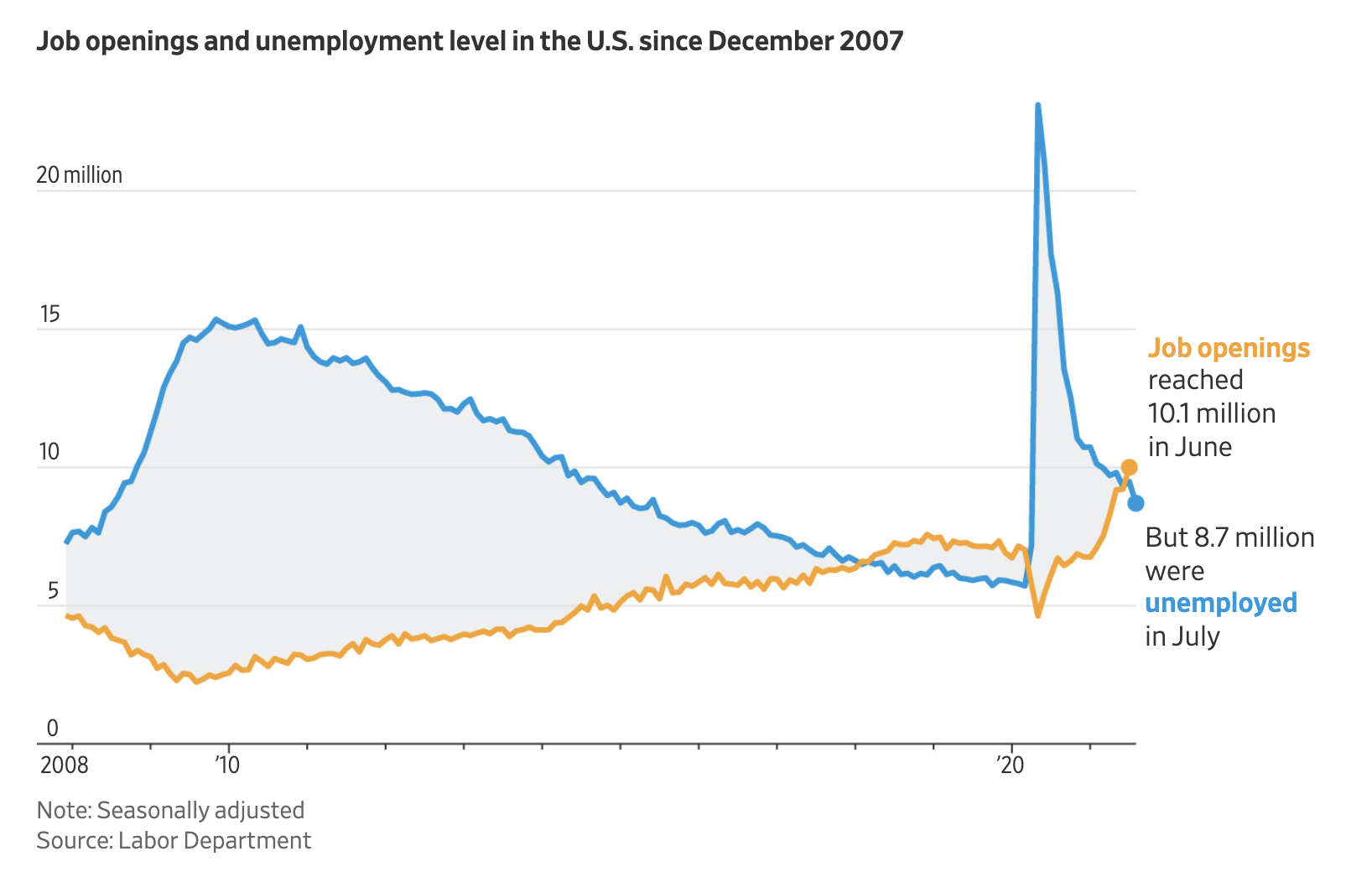

Millions of Americans Are Unemployed Despite Record Job Openings

Source: Wall Street Journal

Sign up for our reads-only mailing list here.