My back to work morning train WFH reads:

• After 9/11, the U.S. Got Almost Everything Wrong A mission to rid the world of “terror” and “evil” led America in tragic directions. (The Atlantic)

• What Has the Stock Market Taught Us Since 2010? (1) We are in the midst of a paradigm shift. It is different this time. Markets have fundamentally changed. The top performers are going to continue outperforming. (2) Everything is cyclical so it’s time to be a contrarian. It’s not different this time. We’ve seen this movie before. Nothing works forever and always. (A Wealth of Common Sense)

• Workers Want to Do Their Jobs From Anywhere and Keep Their Big-City Salaries Employers see remote work as an opportunity to save money by cutting pay; employees argue that their work has the same value no matter where they do it (Wall Street Journal)

• Yes, Dow 36,000 Was Very, Very Wrong This is exactly the kind of error-laden mentality that happens during huge stock booms: A stock boom causes people to say to themselves “Why do I own cash or bonds in the first place? I should just own 100% stocks!” And then 2001 lops your head off, then 2002 kicks you in the groin, and then 2008 crushes your soul — and you give up on stock investing because 100% stocks is a wildly volatile way to manage your finances, so you sit in cash for a decade. (Pragmatic Capitalism)

• Housing: A Look at “Affordability” Indexes Affordability probably hints at the level of demand (although there was plenty of demand during the housing bubble due to loose lending practices). But affordability tells you nothing about future returns. (Calculated Risk)

• Star of the Munich Auto Show? The Push for Faster Electrification German car makers emphasized sustainability and climate policy as they unveiled all-electric concept cars and promised to end tailpipe emissions sooner (Wall Street Journal)

• Five Extremely Simple Reasons Why Biden Made the Right Call Mandating Vaccines Conservatives have collectively gone wild with rage and indignation over President Joe Biden’s new vaccine mandate for private businesses, which will require large employers to make sure their workers have either been inoculated or get tested weekly. It seems like a good moment to point out the very simple reasons why Biden’s move is in fact entirely sensible, especially since parts of the media seem intent on framing the whole thing as just another round in America’s culture war rather than an actual matter of life and death. (Slate)

• A key legacy of 9/11? The way conspiracy theories spread online. In our pandemic moment, in the aftermath of a presidential administration that weaponized accusations of “fake news” against its political enemies while promoting egregious falsehoods, this is no small matter. A recent report in The Washington Post underscores how concentrated and deadly the dissemination of false information has become: A vast amount of anti-vaccination content is generated by just 111 (out of billions of) Facebook accounts. (Washington Post) see also The Silent Partner Cleaning Up Facebook for $500 Million a Year The social network has constructed a vast infrastructure to keep toxic material off its platform. At the center of it is Accenture, the blue-chip consulting firm. (New York Times)

• The Pandemic Caused a Baby Bust, Not a Boom Birth rates in many high-income countries declined in the months following the first wave, possibly because of economic uncertainty (Scientific American)

• How To Remember Minoru Yamasaki’s Twin Towers Perceived as symbols of strength after their destruction on 9/11, the Twin Towers and their Japanese American architect were once criticized in racist and sexist terms. (Bloomberg) see also The Rise of the Twin Towers Photo Essay (Bloomberg)

Be sure to check out our Masters in Business interview this weekend with Jack Devine, a 32-year veteran of the Central Intelligence Agency (“CIA”). He served as both Acting Director and Associate Director of CIA’s operations. His latest book is Spymaster’s Prism: The Fight against Russian Aggression

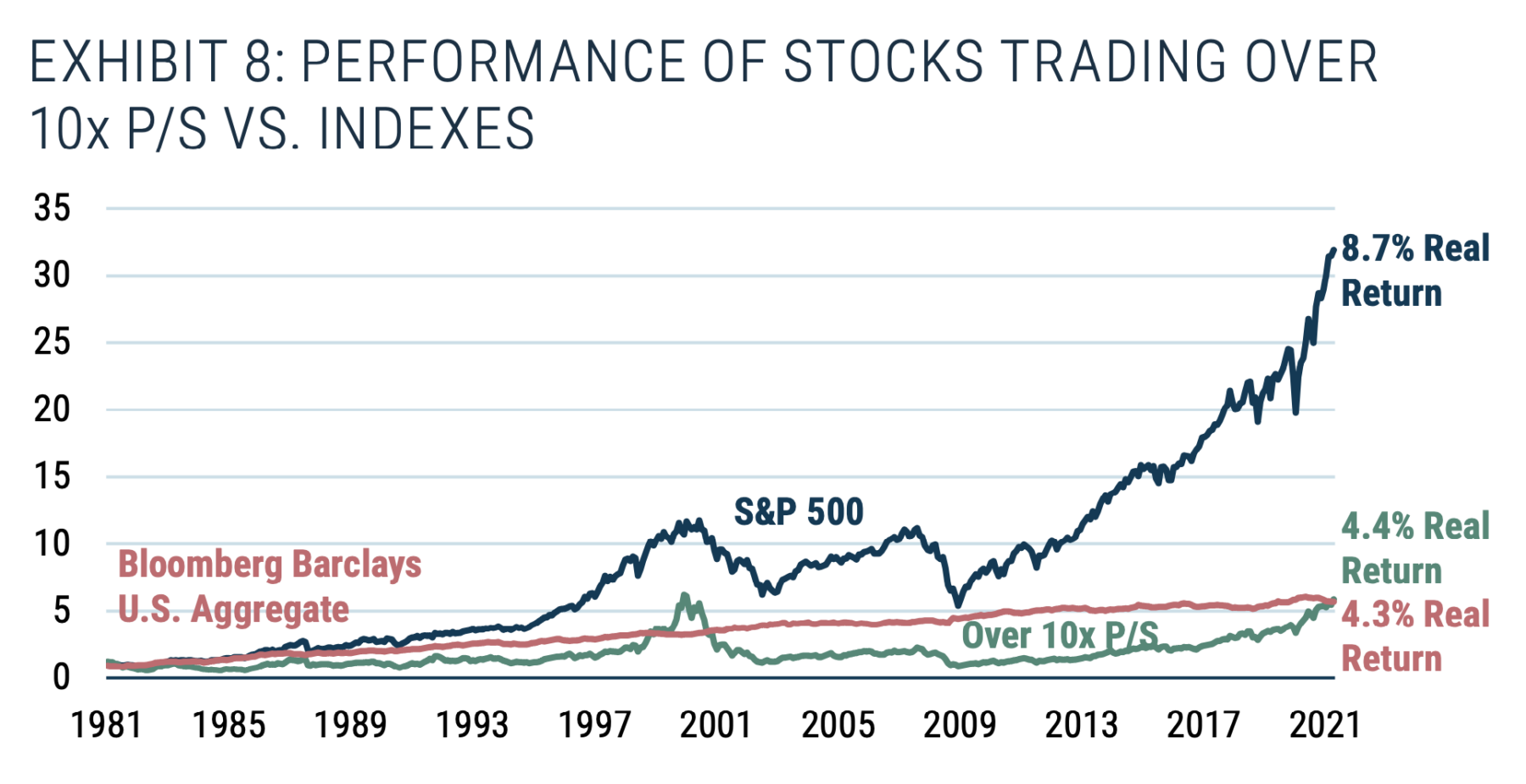

Advantage Growth: Performance of Stocks Trading Over 10x P/S vs. Indexes

Source: GMO

Sign up for our reads-only mailing list here.