My mid-week morning train WFH reads:

• How the Pandemic Helped Us Recover From the Great Recession For certain industries, 2021 will be their biggest revenue numbers ever, whether it’s in motorcycles or boats or certain other industries. They never recovered from 2006, their prior peak revenue. And in 2021, some of these companies think they’re going to have even higher revenue than that. And so in some weird way, the pandemic has actually led to the recovery from the last recession. (Slate)

• Lessons From the Rise and Fall of the Pedestrian Mall Car-free shopping streets swept many U.S. cities in the 1960s and ’70s, but few examples survived. Those that did could be models for today’s “open streets.” (CityLab)

• Peter Thiel Gamed Silicon Valley, Donald Trump, and Democracy to Make Billions, Tax-Free In an exclusive excerpt from The Contrarian, a new biography, the disruption-preaching power broker is revealed as just another rich guy desperate to keep his fortune from the IRS. (Businessweek)

• Why most gas stations don’t make money from selling gas With gas prices climbing up, you may think station owners are getting greedy. But the economics behind the pump tell a different story. (The Hustle)

• Inflation Is Popping From Sydney to San Francisco. It May Be a Good Sign. Inflation has surged across advanced economies. The shared experience underlines that price gains come from temporary drivers — for now. (New York Times) see also Inflation panic? Don’t tell the bond market 5 and 10-year breakevens are circa 2.5 per cent — far below where year-on-year inflation has hit for the majority of the year — suggesting the bond market is very much in the Team Transitory camp at the moment. (FT)

• ETF Taxation In The Crosshairs ETF tax efficiency comes into play because when the Authorized Participants goes to ETF issuers with a block of ETF shares, the ETF issuer gets to decide exactly which shares of stock they hand back to the AP as part of the redemption. As a result, every time there’s a redemption in-kind of an ETF, the tax basis of all the positions in the fund ratchets up a bit. Do this enough times, and essentially the ETF ends up with no overhanging implied capital gains to speak of. (ETF Trends)

• Ebooks Are an Abomination If you hate them, it’s not your fault. If you hate ebooks like I do, that loathing might attach to their dim screens, their wonky typography, their weird pagination, their unnerving ephemerality, or the prison house of a proprietary ecosystem. If you love ebooks, it might be because they are portable, and legible enough, and capable of delivering streams of words, fiction and nonfiction, into your eyes and brain with relative ease. (The Atlantic)

• We’ve been radically underestimating the true cost of our carbon footprint The Biden administration needs to factor in climate change’s cost in human lives — and what we owe to future generations. (Vox)

• So You’ve Been Canceled: A Yom Kippur Atonement Guide What I sometimes wonder — both in my role as a rabbi myself and as a denizen of our broader culture of accountability — is how my friend, or any one of us, can find a path back from shame to acceptance.(New York Times)

• How to Grieve for a Very Good Dog When my yellow Lab died last spring, I was flattened by an overwhelming sadness that’s with me still. And that’s normal, experts say, because losing a pet is often one of the hardest yet least acknowledged traumas we’ll ever face. (Outside)

Be sure to check out our Masters in Business interview this weekend with Campbell R. Harvey, professor of finance at Duke University’s Fuqua School of Business. He is a partner and senior advisor at Research Affiliates. He is best known for his work on Yield Curve Inversion & Recessions. His most recent publication is a new book on crypto and blockchain: “DeFi and the Future of Finance.”

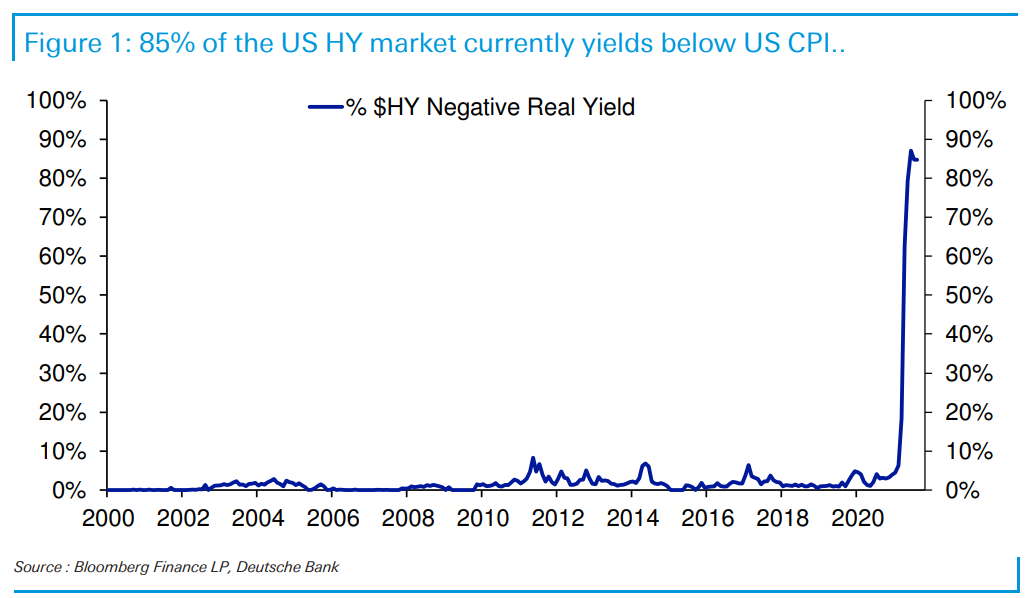

Should we rename High Yield?

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.