The weekend is here! Pour yourself a mug of Bella Vinca coffee, grab a seat in the sun, and get ready for our longer-form weekend reads:

• Dinosaur Cowboys Are Hunting for the Next $32 Million T. Rex Fossils have become a hot new asset class. Paleontologists aren’t thrilled, but for Clayton Phipps and his peers, it’s a living. (Businessweek)

• The Trillion-Dollar Fantasy: Linking ESG Investing to Planetary Impact Here’s what’s wrong. Investors are finally taking ESG investment seriously. But as currently practiced, most ESG investing delivers little to no social or environmental impact. (Institutional Investor)

• Decentralized Autonomous Organizations and the Promise of Utopia Blockchain-enabled groups, such as Friends With Benefits, invest in their own creative communities using cryptocurrency tokens. This technology has potentially revolutionary implications for the music industry—if harnessed responsibly. (RA)

• The Exponential Age will transform economics forever It’s hard for us to fathom exponential change – but our inability to do so could tear apart businesses, economies and the fabric of society (Wired)

• Peter Thiel Gamed Silicon Valley, Donald Trump, and Democracy to Make Billions, Tax-Free In an exclusive excerpt from The Contrarian, a new biography, the disruption-preaching power broker is revealed as just another rich guy desperate to keep his fortune from the IRS. (Businessweek)

• Evolving Threat: New SARS-CoV-2 variants have changed the pandemic. What will the virus do next? SARS-CoV-2 evolved to better avoid human antibodies. But it has also become a bit more virulent and a lot more infectious, causing more people to fall ill. That has had an enormous influence on the course of the pandemic.(Science)

• The Search for America’s Atlantis: Did people first come to this continent by land or by sea? The genomes of living Native Americans suggest that their ancestors first arrived in North America more than 15,000 years ago. In only a few thousand years, they ripped down from the polar cold of northeastern Eurasia through two continents of terra incognita, which encompassed every known terrestrial biome. This feat of exploration surely ranks among humanity’s greatest, but the route and identity of those who achieved it remain matters of fierce dispute. (The Atlantic)

• The tangled history of mRNA vaccines In late 1987, Robert Malone performed a landmark experiment. He mixed strands of messenger RNA with droplets of fat, to create a kind of molecular stew. Human cells bathed in this genetic gumbo absorbed the mRNA, and began producing proteins from it. Sinc then, hundreds of scientists had worked on mRNA vaccines for decades before the coronavirus pandemic brought a breakthrough. (Nature)

• The mind does not exist: A view of human beings, as a big bundle of overlapping, intelligent systems in near-constant communication, is increasingly defended in cognitive science and biology. The terms ‘mind’ and ‘mental’ are messy, harmful and distracting. We should get rid of them (Aeon) but see The Mystery of People Who Speak Dozens of Languages What can hyperpolyglots teach the rest of us? An extreme language learner has a more-than-random chance of being a gay, left-handed male on the autism spectrum, with an autoimmune disorder, such as asthma or allergies. (New Yorker)

• Most Hollywood Writers’ Rooms Look Nothing Like America Negotiated authenticity is the phrase Felicia D. Henderson uses to describe what many Black screenwriters are tasked with producing—Blackness, sure, but only of a kind that is acceptable to white showrunners, studio executives, and viewers. Could that finally be changing? (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Campbell R. Harvey, professor of finance at Duke University’s Fuqua School of Business. He is a partner and senior advisor at Research Affiliates. He is best known for his work on Yield Curve Inversion & Recessions. His most recent book is on decentralized finance, crypto and blockchain: “DeFi and the Future of Finance.”

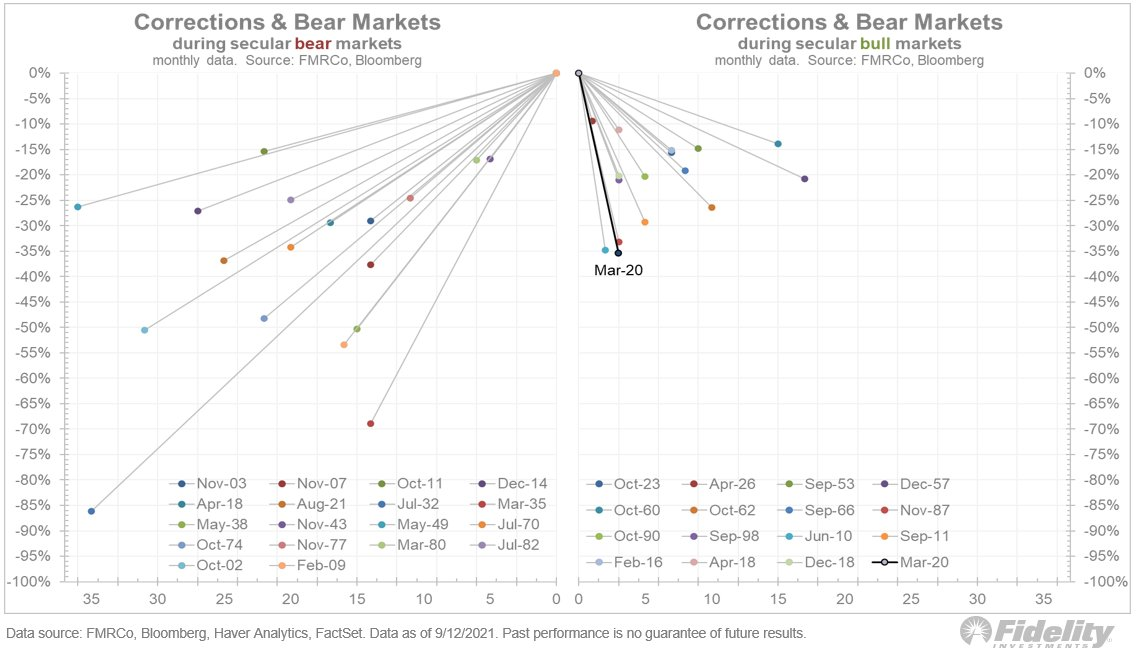

Secular bull markets are not immune from recessions and cyclical bear markets, but they tend towards Shorter, shallower, with swifter subsequent rebounds.

Source: @TimmerFidelity

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.