My morning train reads:

• Stores to Customers: You’re Already Behind on Your Christmas Shopping Retailers are nudging buyers to get started early for the holidays with crash courses in supply chains; ‘Best time to order? Right now!’ (Wall Street Journal)

• A History of Wealth Creation in the U.S. Equity Markets U.S. stock market investments increased shareholder wealth on net by $47.4 trillion between 1926 and 2019. Technology firms accounted for the largest share—$9.0 trillion—of the total, but telecommunications, energy and healthcare/pharmaceutical stocks created wealth disproportionate to the numbers of firms in the industries (Alpha Architect)

• Why There Is Not Enough Housing For Sale or Rent Across the Country: Homebuilding collapsed during the housing crash over a decade ago and has been slow to recover. Construction of high-end homes and apartments recovered first, and there is now an oversupply in some urban areas across the country. However, the construction of reasonably priced homes to rent or own has only recently begun to increase and continues to lag demand. (Moody’s)

• Time Horizon is Everything For Investors Two investors can have completely different opinions about a specific stock or the market and both can be right (or both can be wrong). It all depends on the time horizon. (A Wealth of Common Sense)

• ‘I quit’ is all the rage. Blip or sea change? We’ve met a once-in-a-generation “take this job and shove it” moment; For a lot of workers is their financial situation is much better than it was coming out of the Great Recession, with the expansion of the social safety net and the stimulus payments during the pandemic period. (Harvard Gazette)

• After 25 Years, Celebrating the Little Car That Saved Porsche Stuttgart gives fans a special edition Boxster that commemorates the anniversary of the time Porsche almost died. (Bloomberg)

• Sequoia Productive Capital Tech is inherently deflationary, which could be balancing out the inflationary potential of printing new money. The dramatic shift in monetary policy over the last 13 years — prompted by the Great Recession, but perfectly aligned with the tech revolution — is a very complex topic. (Stratechery)

• The Senior Investment Role That’s Dominated by Women Female investors are increasingly ascending to the senior ranks of their firms as newly appointed heads of sustainability. (Institutional Investor)

• I found my stolen Honda Civic using a Bluetooth tracker. It’s the latest controversial weapon against theft. AirTags and other Bluetooth trackers can find stolen cars, bikes and bags. But what happens when you find the person who took them? (Washington Post)

• How Punk Bands ‘Selling Out’ Changed the Mainstream Music Landscape Dan Ozzi talks about his latest book ‘SELLOUT’, which documents the major label “feeding fenzy” that swept through punk in the 90s and 00s. (Vice)

Be sure to check out our Masters in Business interview this weekend with Lisa Jones, CEO of Amundi U.S., the $100 billion arm of the French asset management giant. Amundi has over $2 trillion (€1.729) in AUM via 100 million clients from 36 countries, making it the second-largest asset manager in Europe and one of the world’s top 10 asset managers.

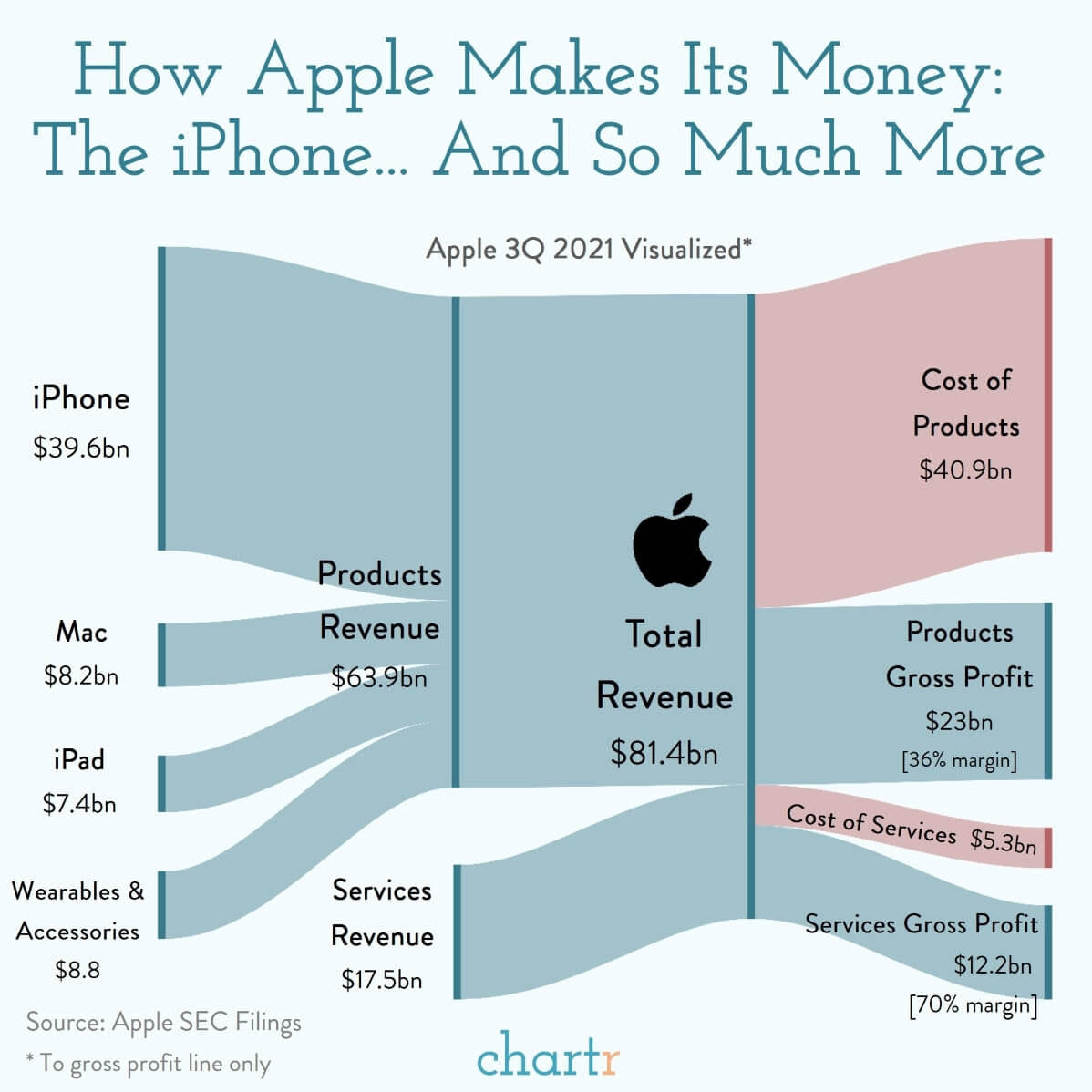

How Apple Makes Its Money

Source: Chartr

Sign up for our reads-only mailing list here.