My mid-week morning train WFH reads:

• We have no theory of inflation Inflation is the biggest debate in macro. The models don’t work. Forecasting is hard. Forecasting inflation is especially tricky. And economists are, in the main, bad at it. This is, as one might expect, an especially unhappy problem for the economists working in central banks who are guiding policy which is itself targeting a given rate of inflation. (Value Added)

• I Collect Cashflows I collect shares of businesses. Been doing it since my late teens. Not always successfully. I use a certain type of non fungible token called a stock certificate for this. I never lay hands on the certificate, it’s in digital form, living somewhere in the multiverse. A company called DTC makes sure the shares I’ve bought are the shares I get. And then I hold them. Sometimes I will trade them for digital dollars that I also don’t ever see or touch, but then soon after I am trading those dollars for another pile of virtual stock certificates. People will say “You’re crazy, why would you want to buy a fraction of a company you will never touch and hold in your hands?” And I’m like “You just don’t understand.” (Reformed Broker)

• The fractionalization of everything: Sophisticated Wall Street investors have been using fractionalization for years to mix and match intricate securities from commercial real estate to agriculture futures. Now, fractionalization is making its way to the general public in just about every way imaginable. One interesting caveat to most fractional investments aimed at retail investors is that buyers don’t actually own the things they buy. They’re simply buying a stake in the asset, betting that it will rise in value and they’ll be able to sell their portion at a higher price than what they paid. (Vox)

• Private Equity is Notoriously Opaque. Researchers and Investors Say This is No Longer OK. Without true transparency, it’s hard to prove definitively that private equity works and to make the economic case for it. (Institutional Investor)

• Will TikTok Make You Buy It? In three short years, TikTok has grown in the public imagination from an app for dancing teens into an all-purpose cultural powerhouse, driving trends in music, food, news and politics, and changing the way people communicate online. In the process, it’s also become something else: a place where people buy things. Lots of them. Give any social media platform long enough, and it turns into a mall. (New York Times) see also A flood of unknown products is making online shopping impossible These days, navigating Amazon, Walmart and Google’s maze of third-party sellers or judging hip-looking social media ads requires the same kinds of skills as identifying misinformation and conspiracy theories. Even with the best research, there’s often no clear answer to the question, what kind of product will I get? Mysterious brands are flooding shopping sites and social media ads, making it difficult to tell the real from the low-quality. (Washington Post)

• Patreon Battles for Creators by Investing in Original Content All these big companies are aping Patreon Inc., the tech startup that’s spent the past eight years building tools to allow content creators to accept recurring payments from their fans. Patreon is in the midst of a hiring spree, and in April it raised $155 million from investors who valued it at $4 billion, triple its valuation from an investment round in September 2020. It plans to go public in the near future. (Businessweek)

• Lousy Management, Knucklehead Hires Plague Operations of Real-Life Sopranos Failure to stick with best business practices and a younger generation of bumbling suburban-bred mobsters kneecap a storied New York clan (Wall Street Journal)

• Why You Should Always Switch: The Monty Hall Problem (Finally) Explained A clue comes from the overconfident justifications that the know‑it‑alls offered for their blunders, sometimes thoughtlessly carried over from other probability puzzles. Many people insist that each of the unknown alternatives (in this case, the unopened doors) must have an equal probability. That is true of symmetrical gambling toys like the faces of a coin or sides of a die, and it is a reasonable starting point when you know absolutely nothing about the alternatives. But it is not a law of nature. (Behavioral Scientist)

• How tropical storms and hurricanes have hit U.S. shores with unparalleled frequency A record 18 storms and hurricanes have made landfall in the past two years; climate change could increase these stormy stretches in coming decades (Washington Post)

• ‘A magic world’: An oral history of the Red Hot Chili Peppers’ ‘Blood Sugar Sex Magik’ “Blood Sugar Sex Magik,” featuring “Under the Bridge,” “Breaking the Girl” and “Give It Away,” was released on Sept. 24, 1991, the same day as Nirvana’s “Nevermind.” It would become the Chili Peppers’ critical and commercial breakthrough, eventually selling more than 7 million copies. “Before ‘Blood Sugar,’” says Kiedis, “we were relatively unknown.” After, he continues, “I remember walking down my street in the Hills and cars driving by and hearing our songs coming out of the radio.” (Los Angeles Times)

Be sure to check out our Masters in Business interview this weekend with Jack Schwager, author of various Market Wizard books. He is also the founder of Fund Seeder, a platform designed to match undiscovered trading talent with capital worldwide. His latest book is “Unknown Market Wizards: The best traders you’ve never heard of.”

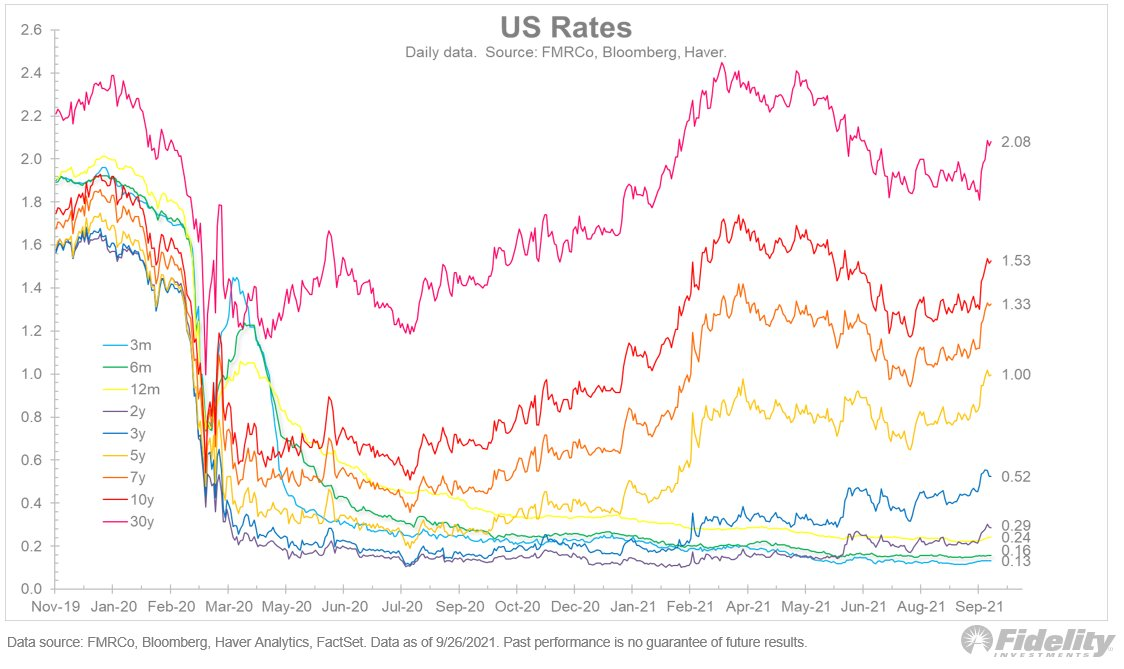

The Fed’s hawkish tilt has resulted in a rise in yields, especially in the belly of the curve

Source: @TimmerFidelity

Sign up for our reads-only mailing list here.