My mid-week morning train WFH reads:

• The best- and worst-case scenarios for Covid-19 this winter Last year, almost nobody was vaccinated against Covid-19. 56% of the US population is fully vaccinated as of October 7. That includes 84% of people over 65, who are generally the most vulnerable to dying from the virus. FDA will soon consider whether to authorize a vaccine for children as young as 5, which would push vaccination rates higher. More than half the population being vaccinated is the primary reason for optimism about the coming months. (Vox)

• Why Airports Hold Promise for Asset Allocators Investments in airports are increasingly popular among American institutional investors—less on US soil than overseas. “Privatizing airports is common outside the US.” The allure: Absent a global scourge, airports’ annual returns can be in the high single digits, or, using leverage, in the low teens. Despite US constraints and pandemic headwinds, odds are they’ll spring back to their old growth level, analysts say. (CIO)

• Nadig: The Problem With a Bitcoin Futures ETF Lost in the mix here is the fact that, for most folks, Bitcoin futures are honestly a pretty second-rate way to get exposure to crypto. The biggest issue with any Bitcoin futures ETF — indeed, with any futures-based ETF at all — is that buying the ETF does not mean that you’re buying the actual headline asset. With a Bitcoin futures ETF, you’d no more be buying bitcoin than you would be buying barrels of oil by owning the United States Oil Fund (USO). Instead, you’re buying exposure to derivatives based on that asset — I’ve listed a few of their drawbacks. (ETF Trends)

• Al Gore’s $36 Billion Fund Sees New Urgency to Cut Off Oil Money Five years. That’s roughly how much time the investment universe has left to stop feeding capital to greenhouse-gas emitters before it’s too late. “The urgency of the challenge will require us to think differently around capital allocation,” Blood said in an interview. “And we don’t have 15 years or 18 years to get there. We have probably five years.” (Bloomberg Green)

• There Is Shadow Inflation Taking Place All Around Us Some companies haven’t been raising prices. Instead, they’ve been cutting back customer services and conveniences, but how should that be measured?(Upshot)

• Nations agree to 15% minimum corporate tax rate Most of the world’s nations have signed up to a historic deal to ensure big companies pay a fairer share of tax. Some 136 countries agreed to enforce a corporate tax rate of at least 15%, as well a fairer system of taxing profits where they are earned. It follows concern that multinational companies are re-routing their profits through low tax jurisdictions. (BBC) see also The Rich Have Found Another Way to Pay Less Tax Most of the world’s nations have signed up to a historic deal to ensure big companies pay a fairer share of tax. Some 136 countries agreed to enforce a corporate tax rate of at least 15%, as well a fairer system of taxing profits where they are earned. It follows concern that multinational companies are re-routing their profits through low tax jurisdictions. apparently failed to appreciate the cleverness and aggressiveness of lawyers, accountants and money managers employed by the wealthy. They found myriad ways to exploit opportunity zones to reduce clients’ tax bills without much attention to those who live in the zones. (New York Times)

• Want to add healthy years to your life? Here’s what new longevity research says. Death comes for us all. But recent research points to interventions in diet, exercise and mental outlook that could slow down aging and age-related diseases — without risky biohacks such as unproven gene therapies. A multidisciplinary approach involving these evidence-based strategies “could get it all right,” said Valter Longo, a biochemist who runs the Longevity Institute at the University of Southern California’s Leonard Davis School of Gerontology. (Washington Post)

• What Does Frances Haugen Want From Facebook? I don’t think she loves the product in the current form. I think she considers it to be a threat to democracy and human life. But in terms of the general idea that this technology doesn’t have to be this way and that a company that is committed to Facebook’s stated mission of connecting the world and bringing people closer together, that that is a possible thing. If people just ended up being angrier at Facebook as a result of what she’d done, it was kind of a waste. (Slate)

• 85% of the world’s population has been affected by human-induced climate change Researchers used machine learning to analyze more than 100,000 studies of weather events and found four-fifths of the world’s land area has suffered impacts linked to global warming. (Washington Post)

• An Umpire Took One Too Many Foul Balls to the Face. He Invented a Solution. A former minor-league ump has created a new mask that is designed to minimize the risk of concussion and other head injuries. It’s winning over MLB catchers. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Chamath Palihapitiya, founder of Social Capital. He began his career as an engineer and team leader at AOL, Facebook, and Slack, but soon moved into Venture Capital. He earned the nickname “SPAC King” for numerous successful deals he has done, and today is a part-owner of the Golden State Warriors.

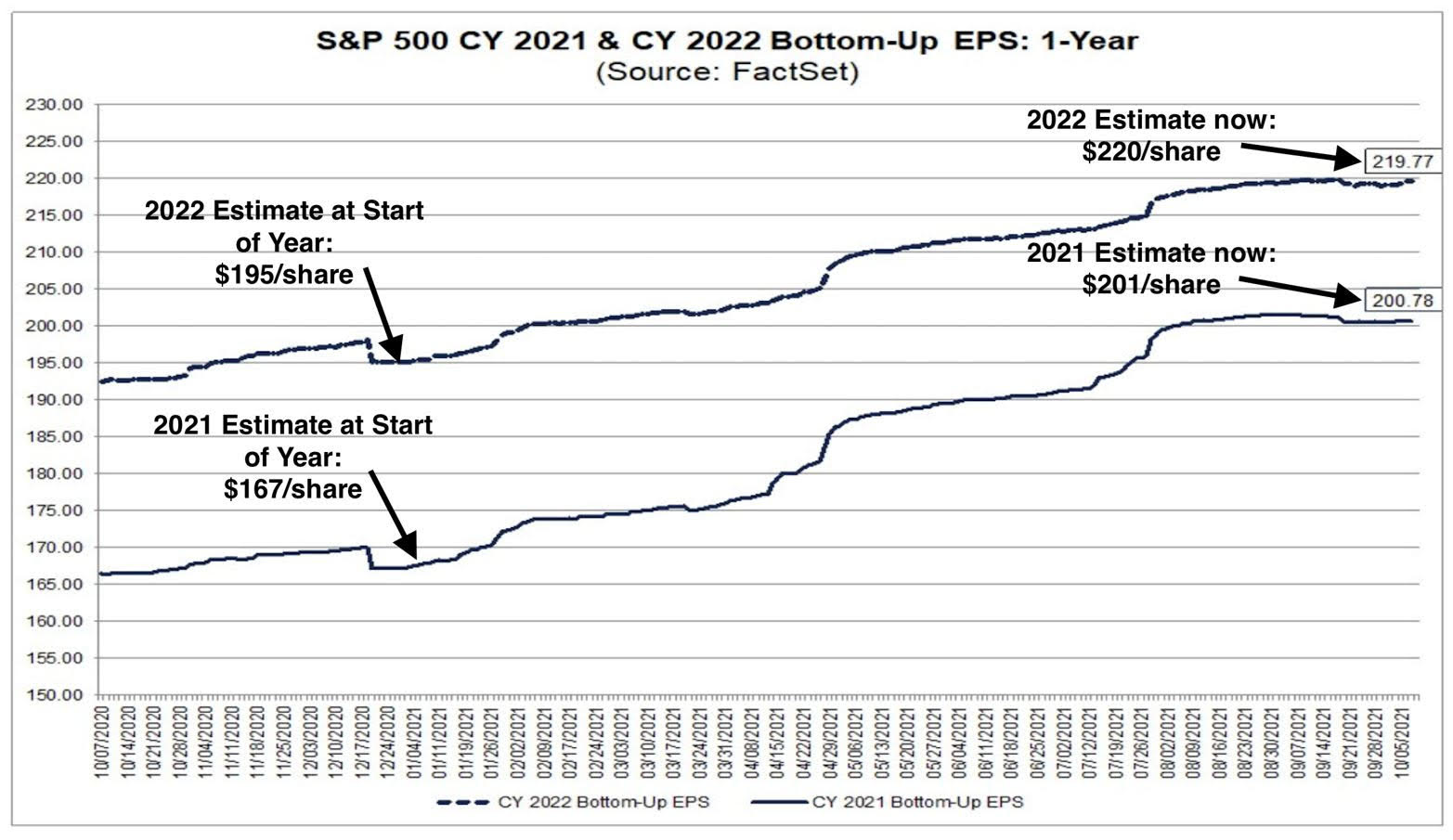

Ever-rising expectations for 2021/2022 US corporate earnings have been the primary driver of S&P 500 returns this year

Source: DataTrek Research

Sign up for our reads-only mailing list here.