My back to work morning train WFH reads:

• Does New Cash Make Stocks Go Up? Financial theory said more investors coming into the market doesn’t matter. Then meme stocks hit. Flows of cash really do move prices—is catching on among the data-minded investors known as quants. That’s partly thanks to an influential 2020 paper by academics Xavier Gabaix of Harvard and Ralph Koijen of the University of Chicago. It’s also a matter of timing: The stock price surges unleashed by Reddit chat boards have shown what can happen when new investors pour into a stock. “It’s really important that this event on the Reddit stocks happened suddenly,” says Bouchaud, chairman of Capital Fund Management. It threw light on the idea that “prices move because people do things independently of fundamental value.” (Businessweek)

• Nobody Really Knows How the Economy Works. A Fed Paper Is the Latest Sign. Many experts are rethinking longstanding core ideas, including the importance of inflation expectations. It is vivid evidence that macroeconomics, despite the thousands of highly intelligent people over centuries who have tried to figure it out, remains, to an uncomfortable degree, a black box. The ways that millions of people bounce off one another — buying and selling, lending and borrowing, intersecting with governments and central banks and businesses and everything else around us — amount to a system so complex that no human fully comprehends it. (Upshot)

• A Lot of Money Sloshing Around in Everything The Great Depression created an entire generation of frugal spenders and savers. The pandemic may have created an entire generation of degenerate gamblers and speculators. Most people assumed speculative activity in the markets would cool off once sports came back, the casinos opened up again and people were able to move about more freely with their normal activities. Judging by the action in options trading, that’s not the case. If anything, there is even more speculation going on in 2021 than 2020. (A Wealth of Common Sense)

• This Is How Much Crypto to Hold in Your Portfolio Nothing about crypto is that simple, of course, including its value as an alternative asset. Yes, some brokerages argue that adding a dollop may boost returns in a well-diversified portfolio. But the market is evolving so fast that data sets from even a year ago may now be stale. More governments including China are cracking down on digital tokens than embracing them. Investors also need to separate the tokens from the technology: Blockchain networks have the potential to revolutionize financial markets. If you’re going to bet on crypto, those companies may be safer than speculating on the coins. (Barron’s)

• The feared eviction ‘tsunami’ has not yet happened. Experts are conflicted on why. When the Supreme Court decided to strike down a federal ban on evictions in August, lawmakers and housing experts mentioned a slew of devastating metaphors — cliff, tsunami, tidal wave — to describe the national eviction crisis they saw coming. One month later, however, many of those same authorities find themselves wondering: Where is the cliff? Eviction filings have fallen or remained flat in many areas after the moratorium was struck down. (Washington Post)

• Facebook Is Weak Facebook is in trouble. Not financial trouble, or legal trouble, or even senators-yelling-at-Mark-Zuckerberg trouble. What I’m talking about is a kind of slow, steady decline that anyone who has ever seen a dying company up close can recognize. It’s a cloud of existential dread that hangs over an organization whose best days are behind it, influencing every managerial priority and product decision and leading to increasingly desperate attempts to find a way out. Insiders see a hundred small, disquieting signs of it every day — user-hostile growth hacks, frenetic pivots, executive paranoia, the gradual attrition of talented colleagues. (New York Times)

• YouTube is banning prominent anti-vaccine activists and blocking all anti-vaccine content The Google-owned video site previously only banned misinformation about coronavirus vaccines. Facebook made the same change months ago. (Washington Post)

• As Britney Spears’s Father Is Suspended From Conservatorship, Supporters Target Larger Reform There are an estimated 1.3 million active adult guardianship or conservatorship cases with courts overseeing at least $50 billion in assets. Defenders of conservatorships say the legal arrangements can protect people from harming themselves or being exploited by others. Still, the arrangement can result in financial abuse, with those in power misappropriating funds. (Wall Street Journal)

• America’s pandemic is now an outlier in the rich world The one big exception to this story is America at 2,000 covid-19 deaths a day. That is only 40% below the country’s January peak. But the true death toll is even worse. The Economist’s excess-deaths model, which estimates the difference between the actual and the expected number of deaths recorded in a given period, suggests that America is suffering 2,800 pandemic deaths per day, with a plausible range of 900 to 3,300, compared with 1,000 (150 to 3,000) in all other high-income countries, as defined by the World Bank. Adjusting for population, the death rate is now about eight times higher in America than in the rest of the rich world. (Economist)

• Ladies and Gentlemen, Daniel Craig At long last, the star of the James Bond franchise bids farewell to 007 with “No Time to Die” (and learns for the first time about his life as an internet meme). (New York Times)

Be sure to check out our Masters in Business interview this weekend with Jack Schwager, author of various Market Wizard books. He is also the founder of Fund Seeder, a platform designed to match undiscovered trading talent with capital worldwide. His latest book is “Unknown Market Wizards: The best traders you’ve never heard of.”

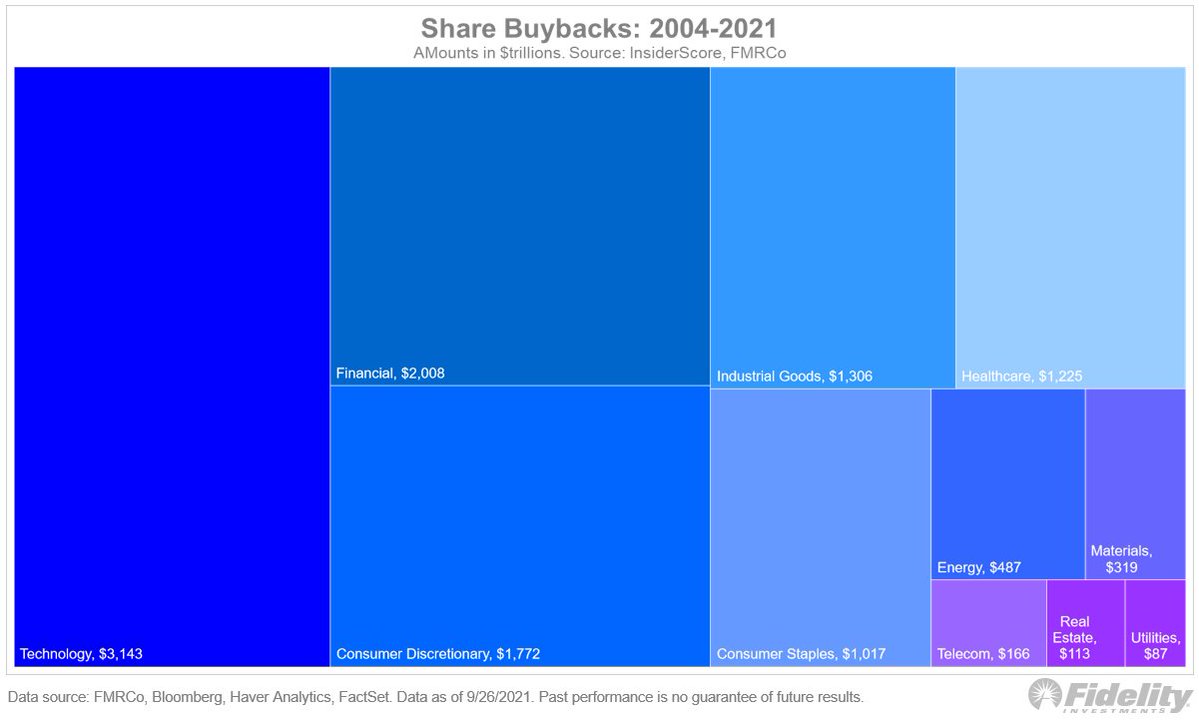

Since 2004, US companies repurchased $11 trillion or 25% of publicly-traded US equities

Source: @TimmerFidelity

Sign up for our reads-only mailing list here.