My back to work morning train WFH reads:

• Is there a Thanksgiving turkey shortage? An investigation. The best Thanksgiving turkey might be the one you can get. (Vox)

• Inflation Is Suddenly on Everyone’s Mind. How Bad Will It Be? People hate it when prices rise. But this may be the cost we bear for heading off a Covid depression. (Businessweek) see also Wonking Out: Going Beyond the Inflation Headlines It’s largely about the bottlenecks, the now-famous supply-chain snarls that have ships steaming back and forth in front of Los Angeles and factories shut down for lack of chips. Overall demand isn’t that high, but has been skewed: Fewer services but a lot of durable goods. (New York Times)

• China’s Transition Is Risky for Investors. How to Navigate the Changes. As China emphasizes broader prosperity over rapid growth, the impact will be felt worldwide. Our international roundtable highlights the dangers and opportunities—and 13 investment picks. (Barron’s)

• Is Gamification Bad for Investors? We encourage the SEC to figure out which nudges and conflicts are problematic and avoid sweeping changes that could stifle savings. (Morningstar)

• Listen to the gloom about the economy and do something to fix the problems Inflation is higher than in decades, millions are out of work, businesses are struggling to find workers, and people are still dying from Covid. The recent declines in consumer sentiment are real. (Stay-At-Home Macro)

• The Fed’s left-face decision on Jerome Powell reign In 2019, he allowed himself to be bullied by President Donald Trump, backing off necessary Fed rate increases amid a booming economy that would have given the central bank extra juice when it needed it during the height of the pandemic-fueled recession. (New York Post)

• What Went Wrong With Zillow? A Real-Estate Algorithm Derailed Its Big Bet The company had staked its future growth on its digital home-flipping business, but getting the algorithm right proved difficult. (Wall Street Journal)

• No More Side Quests What do you actually care about? Do more of that. Simple but not easy. But now you’re ready for the Less is More mentality. Now you can live it, not just nod along to the phrase when you hear it spoken or see it printed. You can embody it. It takes everyone a different length of time to arrive here, and a different pathway, different challenges and obstacles along the way. Not everyone reaches Less is More. Some get there too late. (Reformed Broker)

• Another Humorous Substack Panic Has the Empire really struck back at “independent newsletters”? Warriors of the information economy have been hustling venture capitalists for ages, decades in some case, in search of the magic wand that will make media fortunes: headline generators, lad-mag layout schemes, all-British editorial staffs, more and bigger chyrons, streaming, Axios-style “Why it matters” bullet-point formats, and so on, and so on. These people have been searching for a gimmick for so long, they think everything is one, including, now, the “independent subscription newsletter.” (TK News)

• The space debris problem is getting dangerous The ISS seems fine after a Russian weapons test blew up a defunct satellite, but these incidents could become more common. (Vox)

Be sure to check out our Masters in Business this week with Edwin Conway, Global Head of BlackRock Alternative Investors (BAI), which runs over $300 billion in total assets. BlackRock’s global alternatives business includes Real Estate, Infrastructure, Hedge Funds, Private Equity, and Credit, and is one of the fastest-growing divisions of the investment giant.

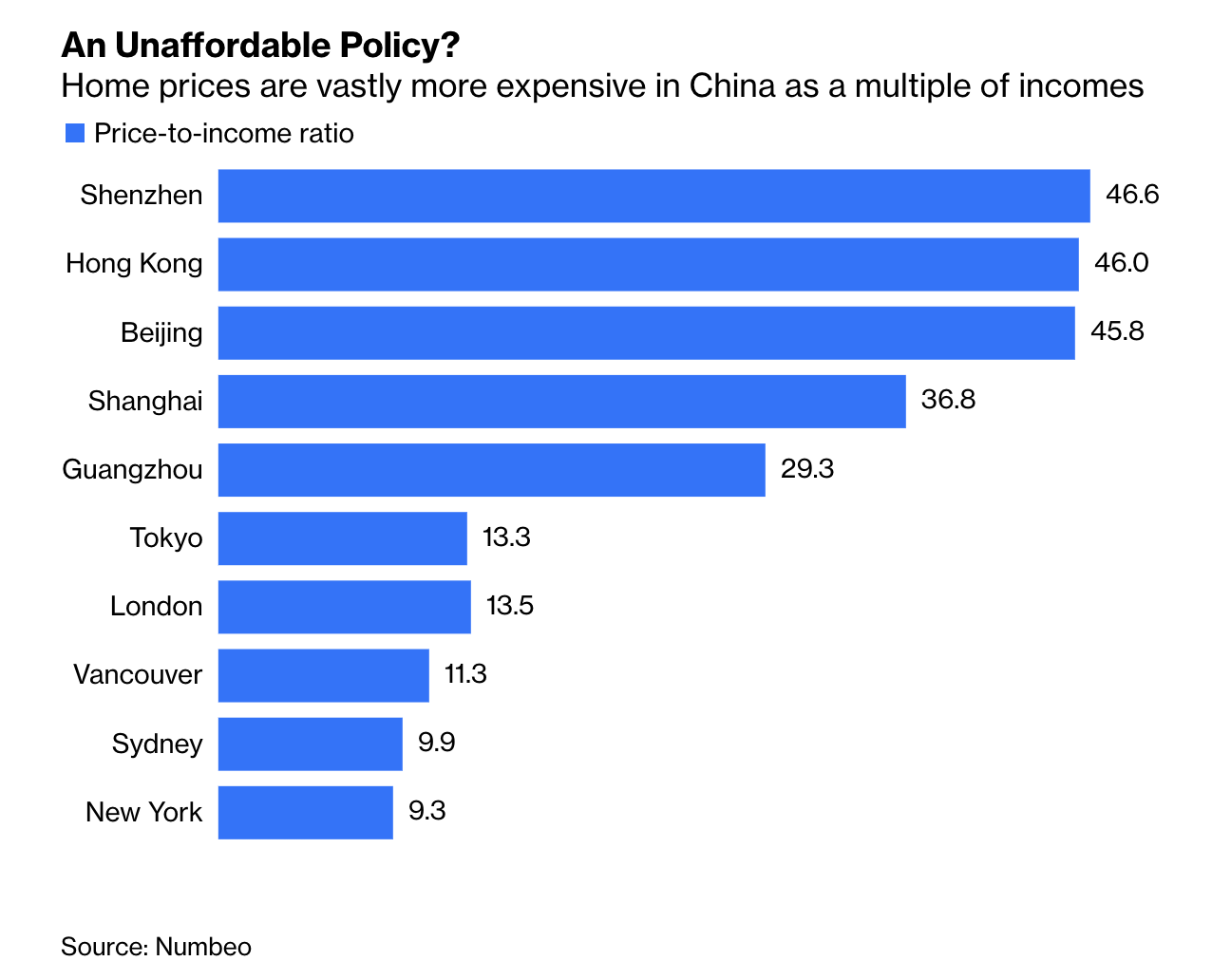

World’s Real Estate Prices Relative to Median Income

Source: Bloomberg

Sign up for our reads-only mailing list here.