My Two-for-Tuesday morning train WFH reads:

• How to Think About the Covid Recession This was a recession like no other in recent memory. The pandemic downturn was driven by all those industries that are supposed to be recession-proof — trips to the dentist, electricity usage in offices and malls, and so on. And the normally countercyclical education sector had big enrollment drops despite the bad economy. (New York Times) see also The Economic Rebound From Covid-19 Was Easy. Now Comes the Hard Part. As supply-chain disruptions worsen and inflation surges, executives and policy makers must navigate a delicate transition to a more normal economy (Wall Street Journal)

• The Intrinsic Futility of ES(G) Investing As predicted by financial theory, stocks of companies with positive environmental, social, and corporate governance (ESG) records underperformed the market. But the problems for ESG investors don’t stop there. Worst of all, ESG funds underperformed the non-ESG funds run by the same managers. (Advisor Perspectives)

• Our Self-Imposed Scarcity of Nice Places We need to learn how to separate form from (current) function. In fact, our shortage of nice places is almost totally self-imposed. And it’s precisely because 98% of the North American built environment is so blah that the 2% of places that are really well-designed environments quickly get bid up by the rich and become inaccessible to the rest of us. The solution to this isn’t to stop creating such places, but to create vastly more of them. (Strong Towns) see also Zillow Quits Home-Flipping Business, Cites Inability to Forecast Prices “It feels like this would be a hard time to lose money buying and selling houses,” said Benjamin Keys, professor of real estate at the Wharton School of the University of Pennsylvania. “This is a time frame where prices have gone up in a lot of places, dramatically.” (Wall Street Journal)

• Rich Millennials to Financial Advisers: Thanks For the Golf Invite, But You Can’t Invest My Money Wealthy young investors don’t see much use for the wealth-management firms their parents rely on. They would rather pick their own stocks or plow their money into crypto. (Wall Street Journal)

• Shipping is broken. Here’s how to fix it. Holiday season shipping is making supply chain problems worse, but there’s hope for next year. (Recode) see also We chartered a boat with a logistics expert to look at port congestion up close and saw how American greed is leading to shortages and empty shelves The Ports of Los Angeles and Long Beach are on the frontlines of the shipping crisis. Container ships sit anchored on the coast, with some waiting since late August to dock. (Yahoo)

• Where Did All of the Food & Beverage Workers Go? Help wanted. Really wanted. That’s the situation that many food & beverage companies find themselves in. It’s always been tough to get people to work in a food plant; the pandemic ratcheted up that difficulty. Labor scarcity is now the No. 1 issue for many food processors (and not just food processors). It’s a major cause of the kinks that now are roiling the entire food supply chain. (Food Processing)

• Bitcoin for the Open-Minded Skeptic Bitcoin is empirically one of the best investments of the past decade, it still remains controversial. Is it a new form of money? A speculative bubble? Or a bit of both? (Matt Huang) see also 7 Things To Read About Bitcoin (For Institutional Investors) Many investors and institutions ask us: what else should we read to get smarter on Bitcoin? Here are some favorites. (Matt Huang)

• Gold’s Bad Vaccine Year May Contain a Troubling Message The metal’s strange decline at a time of surging inflation may signal a possible tantrum in the bond market and a correction in stocks. (Bloomberg)

• What the Hell Is ‘Right-Clicker Mentality’? A Twitter meme reveals everything you need to know about NFTs and the culture around it. (Vice) but see also Right-Clicker-Mentality: NFTs have blown up into a massive, fraud-ridden speculative bubble that is blazing through whole rain-forests’ worth of carbon while transfering billions from suckers to con-artists. (Pluralistic)

• Eliud Kipchoge: Inside the camp, and the mind, of the greatest marathon runner of all time He’s the greatest marathoner in history, a national hero in Kenya, and an icon for runners around the world. But despite his fame and wealth, Eliud Kipchoge chooses to live the most basic lifestyle. Cathal Dennehy travels to the highlands of Kenya for an inside look at his training camp and to meet a champion with a quiet, complex personality (Irish Examiner)

Be sure to check out our Masters in Business interview this weekend with Tom Gayner, Markel Corporation’s co-president and chief investment officer of the financial-holding company He has been dubbed the “next Warren Buffett.” From 2000 to 2015 Gayner returned an average of 11.3% annually, while the S&P 500 index of big U.S. stocks returned 4.2%, (including dividends).

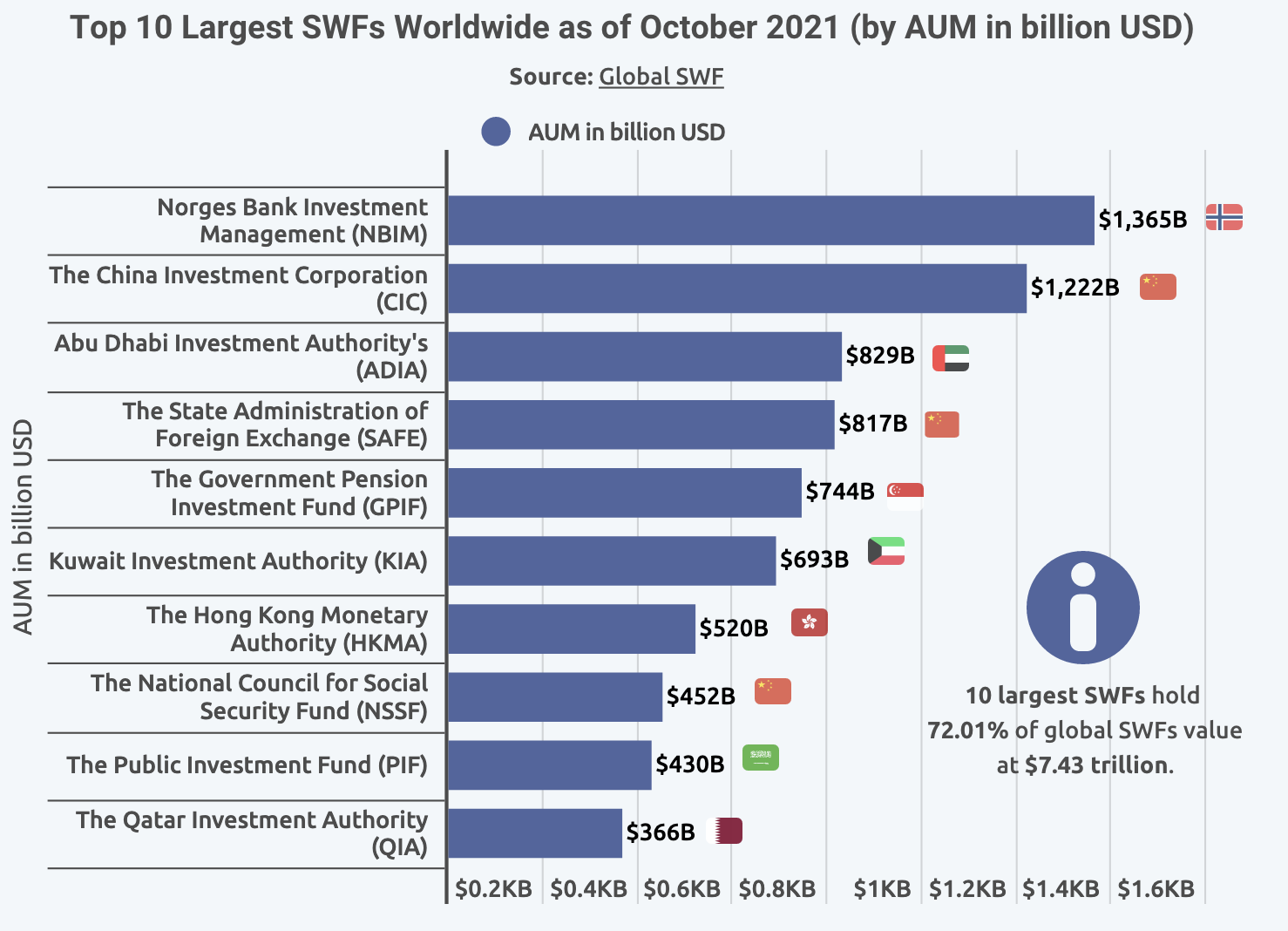

10 Largest Global Sovereign Wealth Funds Have $7.43 trillion in Assets

Source: Finbold