My Two-for-Tuesday morning train (yes, Train!) reads:

• Omicron Needs 3 Evolutionary Surprises to Wreak Havoc Basic principles of biology show that the worst-case scenario is possible but not probable, a fact that should help separate prudence from panic. (Bloomberg) but see U.S. Covid-19 Deaths in 2021 Surpass 2020’s Pandemic continues to exact huge toll despite vaccines as Delta variant spreads (Wall Street Journal)

• Wall Street Grudgingly Allows Remote Work as Bankers Dig In Finance employees who couldn’t imagine working from home before the pandemic are now reluctant to return to the office. Their bosses can’t figure out how to bring them back. (New York Times)

• Workers Quit Jobs in Droves to Become Their Own Bosses Seeking flexibility or escape from corporate bureaucracy, employees discover their inner entrepreneur (Wall Street Journal) see also Who Is Quitting and Why? Its not “The Great Resignation” — that’s backward-looking. A better description of what is going on now: “The Great Disruption.” (The Big Picture)

• The Shocking Truth About Today’s P/E Ratios: P/Es don’t fit the narrative of a wildly overpriced stock market. (Fisher Investments)

• Is Crypto Bullshit? I regret to inform you that it’s totally legit and crypto/blockchain networks really might be technologically, economically, and politically transformative. Ugh. (Model Citizen) see also WisdomTree CEO: I am all in on Defi We started as a financial media company, transitioned to ETFs when I saw how transformative they were for the investing process. I believe DeFi is going to meaningfully transform the economics of financial services. (WisdomTree)

• The Holiday Shopping Season Is Here, but Is It Back? Shoppers are returning to stores in much bigger numbers than last year, but the atmosphere is not quite as carefree as the prepandemic days of 2019. (New York Times)

• Getting Inflation Right Is a Make-or-Break Moment on Wall Street For a generation of investing pros, stable prices were a fact of life. What do you do when the old assumptions stop making sense? (Businessweek) see also Inflation Is Not a Tide That Lifts All Boats Equally Prices of goods and services typically don’t rise at the same time or pace, even during bouts of rapid growth. (Bloomberg)

• In Charlottesville trial, jurors learn to decode the secret slang of white supremacists Over the past four weeks, plaintiffs’ attorneys have tried to make their case by carefully breaking down the jokes and catchphrases favored by far-right extremists, in an effort to teach jurors how to decode white supremacists’ secret vocabulary of hate. (Washington Post)

• Priceless Roman mosaic spent 50 years as a coffee table in New York apartment Long-lost mosaic commissioned by Emperor Caligula disappeared from Italian museum during second world war (Guardian)

• Reese Witherspoon Isn’t Afraid to Say She’s the Best: With her recent nine-figure money moves and a full slate of upcoming projects, the Morning Show star is like the Lebron James of Hollywood — and she’ll be the first to tell you. (InStyle)

Be sure to check out our Masters in Business this weekend with Steven Fradkin, President of Northern Trust Wealth Management, a division of the insurance giant. The group has $355 billion in assets under management, serving 1 in 5 of the wealthiest families in America. Fradkin was previously Chief Financial Officer and was head of the international business for NT.

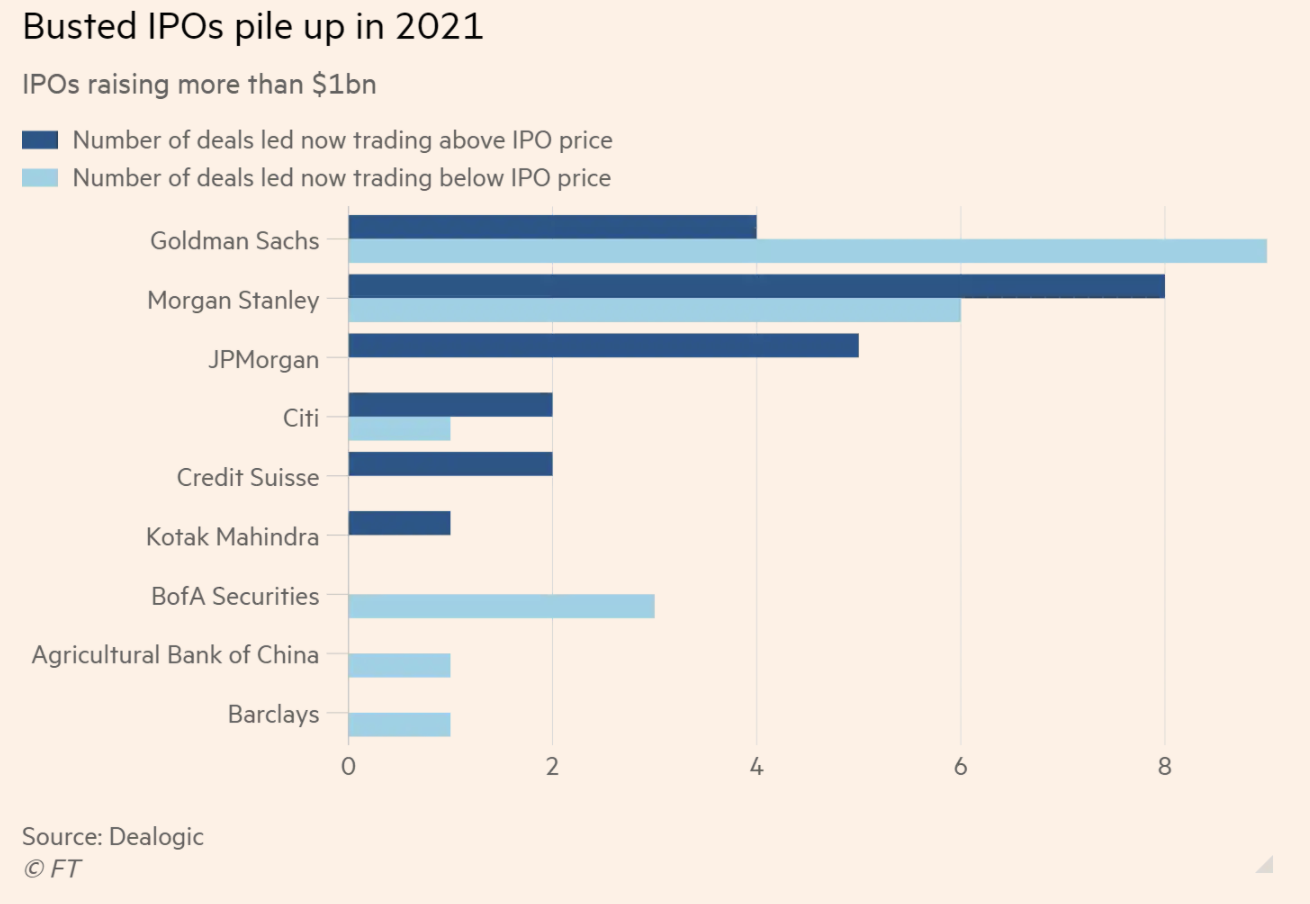

Half of this year’s big IPOs are trading below listing price

Source: Financial Times

Sign up for our reads-only mailing list here.