My mid-week morning train WFH reads:

• The Case for Patience on Inflation: A close read of the data so far suggests that the current price pressure is still confined to the same batch of idiosyncratic sectors that have been driving inflation all year. Moreover, measures of actual consumer behavior suggest that Americans are responding to higher prices not by hoarding in anticipation of even more inflation, but by postponing their spending in the expectation that affordability will improve. (The Overshoot)

• Investors Know They Own Too Much Tech. This Analysis Shows That It’s Worse Than They Think. An alternative way of looking at market-cap weighted index funds shows that investor exposure to the sector is higher than it was during the tech bubble. (Institutional Investor)

• Investors Hung Their Hats on Peloton and Zoom Last Year. What Now? Some “stay-at-home” stocks that were pandemic-era darlings have experienced brutal sell-offs. (New York Times)

• Why Health-Care Workers Are Quitting in Droves About one in five health-care workers has left medicine since the pandemic started. This is their story—and the story of those left behind. (The Atlantic)

• Crypto companies, on defense in Washington, scramble to assemble a lobbying machine The booming sector has recruited former top regulators and congressional insiders but is struggling to coordinate its approach. (Washington Post)

• Sheila Bair: Why Lael Brainard is best qualified to lead the Fed Anyone can raise interest rates. The hard part is knowing when to do so and how to do so without triggering financial disruption. To meet that challenge, Brainard has far superior qualifications. (Yahoo News)

• NYC’s population actually grew during COVID — and it needs housing fast Results from the 2020 Census confirmed that New York City’s population grew significantly in the decade up to 2020, by 629,000. The city’s population growth happened via natural increase, the excess of births over deaths. About the same number of people migrated to the city, either domestically or internationally, as left during the decade. (New York Post)

• Thank the GOP for the global minimum tax Nobody wants to say it, but the Republican tax plan is the model for a center-left global deal. (Full Stack Economics)

• Why Skyfall is a masterclass in cinematography. It’s a credit to his photographic and cinematographic skills that it isn’t always about adjusting the image later but getting it correct in camera. Photographers take note, even when shooting James Bond, it comes down to the basics: good lighting, composition, knowledge of ISO, exposures, apertures and colour. (Kat Clay)

• Stephen Curry’s Scientific Quest for the Perfect Shot The NBA’s best shooter decided the basket was too big. He used technology to make it smaller. The goal: ‘swishes within swishes.’ (Wall Street Journal) see also Kevin Durant Can Score From Anywhere. Defenses Don’t Know What to Do. The midrange game has largely fallen out of favor in the N.B.A., but not when Durant is on the court. (New York Times)

Be sure to check out our Masters in Business next week with Robin Wigglesworth, the FT’s global finance correspondent based in Oslo, Norway. He focuses on the trends reshaping markets and investing, from technological disruption to quantitative investing. His new book is Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever.

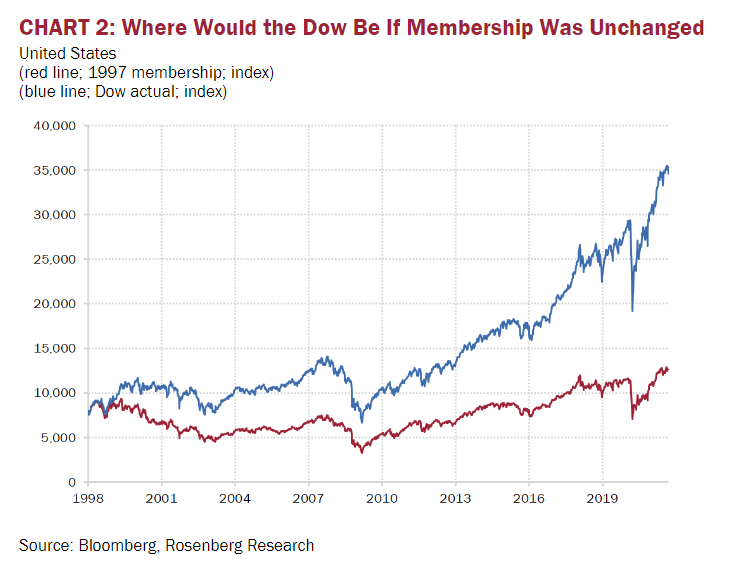

Where the Dow Jones Industrials Would Be if Components Hadn’t Changed Since 1997

Source: Rosenberg Research via Steve Goldstein

Sign up for our reads-only mailing list here.