My end of week morning train WFH reads:

• Wall Street Finally Learns It Can’t Ignore Crypto and NFTs Digital currencies have been around for a while, but 2021 was the year the wider crypto world made its mark. Its “memeification” and pop culture normalization happened at a pace that detractors found baffling and that true believers argued was still too slow. As it gained another raft of high-profile supporters, it also captured the attention of Wall Street as a force that could no longer be ignored—and of regulators. (Bloomberg)

• The Volatility is the Point If not for the volatility, the fluctuation and drawdown, the pain of seeing dollars on a screen disappear, then premium returns over the interest rate on a checking account would not exist. That’s where the term ‘risk premium’ comes from. No risk, no premium. Showing off your ignorance of this concept lets everyone know how immature, inexperienced, uninformed and short-sighted you are. (Reformed Broker)

• Legendary investment guru Peter Lynch says the move to index funds is a ‘mistake.’ He’s wrong Lynch, of course, was the quintessential active investment manager, renowned for his stock-picking skills. Fidelity Magellan Fund, the mutual fund he ran from 1977 to 1990, was the quintessential actively managed mutual fund. By giving Magellan investors an annualized return of more than 29% — compared with an annualized gain in the Standard & Poor’s 500 index of about 15% during the same period — Lynch grew Magellan’s assets under management from $18 million to $14 billion, making it the largest mutual fund in the world. (Los Angeles Times)

• Half a Billion in Bitcoin, Lost in the Dump: For years, a Welshman who threw away the key to his cybercurrency stash has been fighting to excavate the local landfill. (New Yorker)

• Elon Musk, Other Leaders Sell Stock at Historic Levels as Market Soars, Tax Changes Loom Insiders like the Waltons, Mark Zuckerberg and Google’s co-founders have sold $63.5 billion through November, up 50% from 2020 (Wall Street Journal)

• From the Great Resignation to Lying Flat, Workers Are Opting Out In China, the U.S., Japan, and Germany, younger generations are retinking the pursuit of wealth. (Businessweek)

• What’s Really Behind Global Vaccine Hesitancy: Countries with low vaccination rates are suffering from more than just inequity. South Africa has 150 days’ worth of vaccine supply. It’s now facing the same problem that’s bedeviling countries the world over: Lots of people don’t want to get their shots. South Africa recently paused deliveries of the J&J and Pfizer vaccines because it has more stock than it can use. “We have plenty [of] vaccine and capacity but hesitancy is a challenge.” (The Atlantic)

• QAnon, a year after Q For a movement ignited by lengthy and byzantine clues, the final Q message, released exactly a year ago, felt like an anticlimax. Nor was there any sign off from Q, the alleged high-ranking government employee, whose three-years’ worth of posts had helped build massive online communities of self-proclaimed researchers across the world. The lessons from a super-conspiracy theory are not limited to its direct impacts. (Financial Times)

• Burying Leni Riefenstahl: one woman’s lifelong crusade against Hitler’s favourite film-maker Nina Gladitz dedicated her life to proving the Triumph of the Will director’s complicity with the horrors of Nazism. In the end, she succeeded – but at a cost (Guardian)

• Computers Revolutionized Chess. Magnus Carlsen Wins by Being Human Chess engines were supposed to make classical chess more predictable. Instead, they made the most inventive player of all time more creative. In an age when computers dominate chess training, world champion Magnus Carlsen can disarm opponents by playing more like a human. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Maureen Farrell, former Wall Street Journal reporter (now with the New York Times), and co-author (with Elliot Brown) of the book “The Cult of We: WeWork, Adam Neumann, and the Great Startup Delusion.”

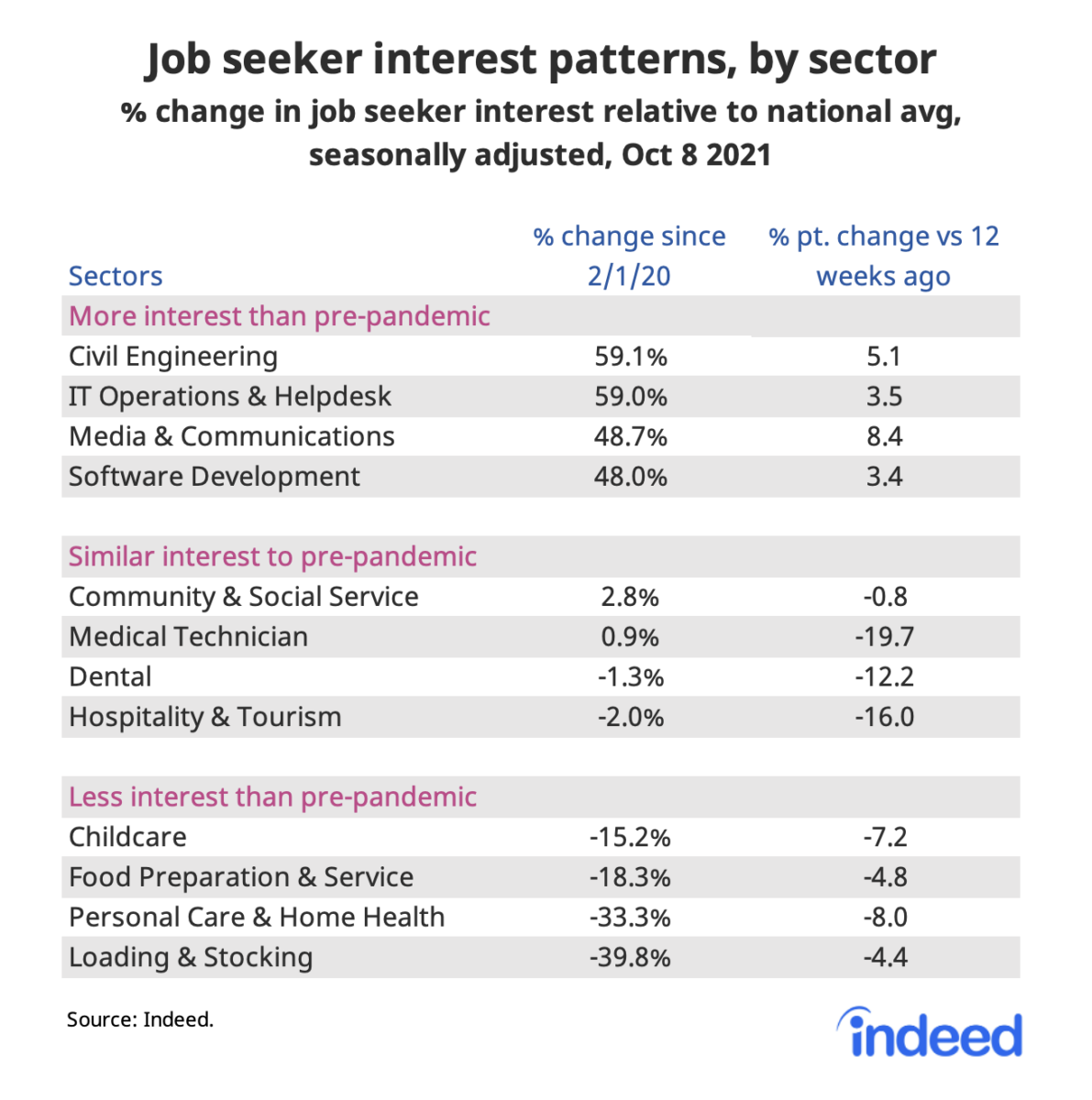

Job Seeker Interest Shifting Toward Higher Wage Jobs

Source: Indeed Hiring Lab

Sign up for our reads-only mailing list here.