My morning train WFH reads:

• A Wild, Emotional Year Has Changed Investing—Maybe Forever Everyone seemed to become a trader, taking chances on outlandish ideas as excitement and fascination mixed with fear and greed. (Businessweek)

• The 15 Most Influential Crypto Cities in the World Crypto has gone global. Here are the top 15 cities that have—for good or bad—impacted the growing industry. (Decrypt) but see Why bitcoin is worse than a Madoff-style Ponzi scheme A Ponzi scheme is a zero-sum enterprise. But bitcoin is a negative-sum phenomenon that you can’t even pursue a claim against. (Financial Times)

• Come On Ride The Train I purposely held back half of my planned allocation to crypto and will invest more in one of two situations. First, if my account is down 50% from inception, I’ll buy more. If that doesn’t happen, I’ll add the second half of my investment around this time next year. It may not be the perfect solution, but there are no perfect answers when it comes to markets. Markets are still human, after all. (Belle Curve)

• Where Are the Workers? Millions Are Sick With Long Covid. It is hard to quantify the number of people out of the workforce because of lingering Covid symptoms, both because of the many economic changes the pandemic has unleashed and because long Covid is still somewhat of a medical mystery. The pandemic’s effect on the labor market may be more complicated than policy makers and investors have assumed. In turn, expectations about companies’ ability to meet customer demand may be muddied further, along with the inflation outlook. (Barron’s)

• You’re vaccinated and boosted. How should omicron affect your plans? “For so many of us — I don’t necessarily think we need to cancel plans,” echoed Darlene Bhavnani, an assistant professor in the department of population health at University of Texas at Austin’s Dell Medical School. “We can do this safely if we take advantage of the tools we have.” Different people, they all acknowledge, will balance the risks and rewards of each activity differently. (Washington Post)

• Why it’s too early to get excited about Web3 Repeat after me: neither venture capital investment nor easy access to risky, highly inflated assets predicts lasting success and impact for a particular company or technology. Remember the dot-com boom and the subsequent bust? Legendary investor Charlie Munger of Berkshire Hathaway recently noted that we’re in an “even crazier era than the dot-com era.” (O’Reilly)

• Four Ancient Truths to Help You Lead a Modern Life Here’s why you should be a stoic, skeptic, cynic and epicurean. (Bloomberg)

• I Pointed Out That Our Hosts Were Unvaccinated. Airbnb Deleted My Review. I wrote a five-star review, and I with the following line: “At the time of our stay in October 2021, the hosts told us that they were not vaccinated against COVID-19.” Four hours later, I received a message from Airbnb: My review had been removed because it “didn’t have enough relevant information to help the Airbnb community make informed booking decisions.” (Slate)

• A Growing Army of Hackers Helps Keep Kim Jong Un in Power North Korea relies on cybercrime to fund its nuclear arms program and prop up the ailing economy. (Businessweek)

• Carrie-Anne Moss on the ‘Matrix’ Movies and Playing an Action Hero in Her 50s The actress synonymous with Trinity faced the weight of expectations when she reunited with Keanu Reeves and Lana Wachowski for the new sequel. (New York Times)

Be sure to check out our Masters in Business this week with, Max Chafkin is a features editor and tech reporter at Businessweek. His work has also appeared in Fast Company, Vanity Fair, and the New York Times Magazine. His most recent book is “The Contrarian: Peter Thiel and Silicon Valley’s Pursuit of Power.”

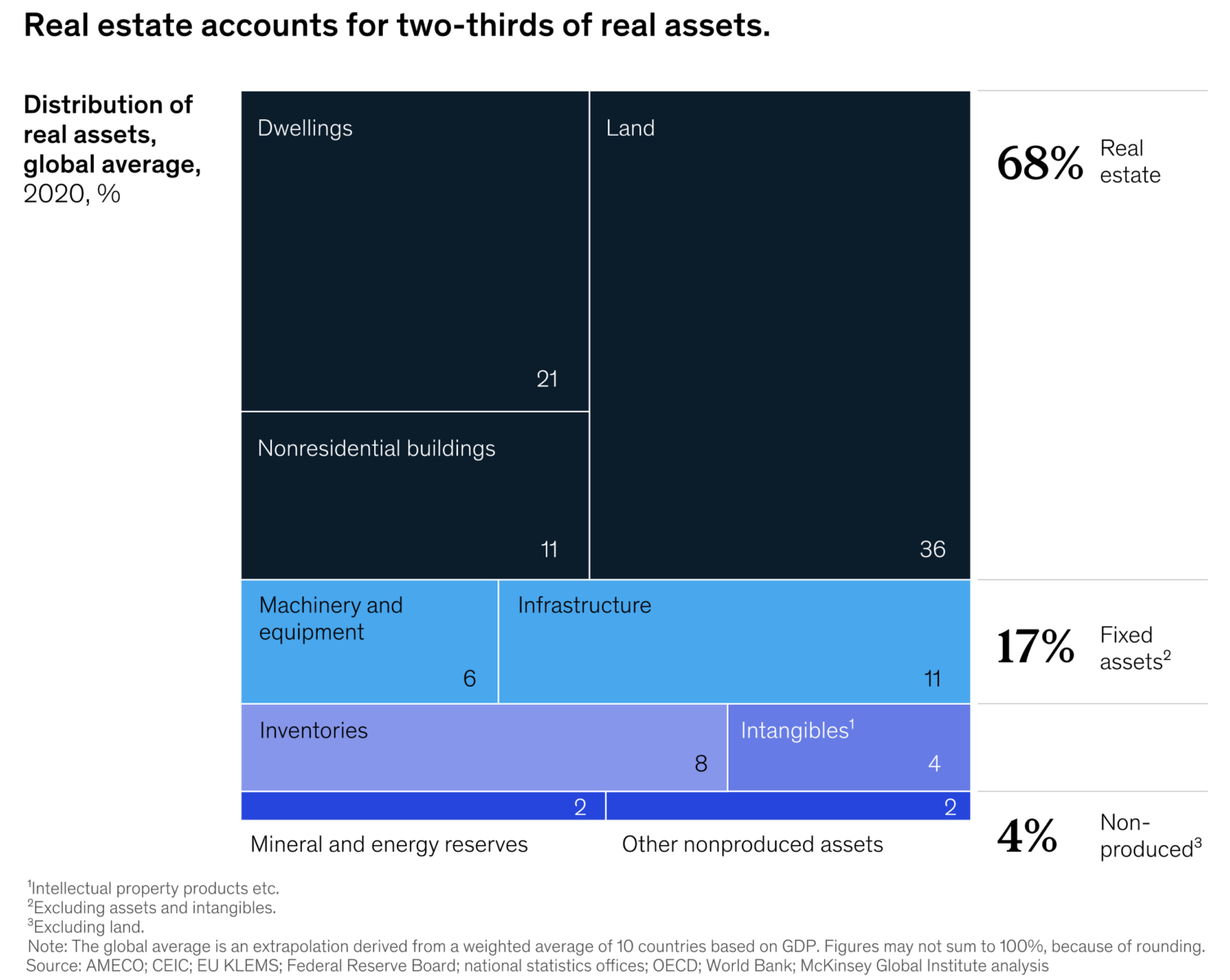

Residential real estate amounted to nearly half of global net worth in 2020

Source: McKinsey

Sign up for our reads-only mailing list here.