My back to work morning train WFH reads:

• Is the Fed Deflating Prospects for Speculative Stocks? ‘Story’ stocks and crypto have had a run of bad performance since early November (Wall Street Journal)

• Crypto Barrels Toward 2022 After Adding $1.5 Trillion in Value Digital assets had a breakout year in 2021 and prices took off, but there’s more to the story. Five key charts tell the tale. (Bloomberg) see also The ‘To the Moon’ Crash Is Coming A longtime venture capitalist sees the religious dedication to Elon Musk, hype, and YOLO investing as almost a dot com-style pyramid scheme in the making. (Vice)

• Finding Some Middle Ground Between Paul Volcker & Jerome Powell The problem is it’s not like taking interest rates from 0% to 0.75% or 1% is all of the sudden going to fix the supply chain issues. The Fed can’t make more semiconductors. They can’t unpack container ships at the LA ports. They can’t create more houses out of thin air. (Wealth of Common Sense)

• The Pareto Funtier: More fun making money, and more money having fun Web3 is a vortex for talent, money, culture, and brainspace. I’ve been trying to figure out why, and explain it in the simplest terms. I think I have it, my tailwit explanation:(Not Boring)

• The Sports Gambling Gold Rush Is Absolutely Off the Charts Legal sports betting in the U.S. — once confined to Nevada — has gone mainstream. Since the Supreme Court in 2018 ended federal bans on the industry’s expansion, dozens of states have legalized it, and a multibillion-dollar betting boom is afoot. More money is now wagered on sports in New Jersey than in Nevada. California, which may become the biggest market of all, will vote on legalization next year. (Bloomberg)

• A Classic Car Giant With a Lofty Mission: Save Driving The Hagerty brand insures collectible autos — two million of them — and its articles and videos draw crowds. After going public, it has bigger plans. (New York Times)

• Inside Apple Park: first look at the design team shaping the future of tech Led by Evans Hankey and Alan Dye, the Apple Design Team holds enormous sway over our evolving relationship with technology. Opening the doors to their studio at Apple Park in Cupertino for the first time, they offered us a deep dive into the working processes behind their latest creations. (Wallpaper)

• Bugatti? Check. Patek Philippe? Check. North Fork Vineyard? Check. Long Island properties with wineries, grape-growing operations, or enough open land to build them, are becoming the hot new status symbol for acquisitive millionaires (Wall Street Journal)

• Why the coronavirus’s delta variant dominated 2021 Delta’s unique constellation of mutations explains why it has wreaked so much havoc. (Science News) see also Late Stage Covid: It is a weird moment. 20 months into this pandemic, we’re entering a new phase with different dynamics. Even the culture-warring around COVID is of a different flavor. (The Atlantic)

• US Supreme Court will hear case of Nazi-looted Pissarro painting: The decades-long dispute between the heirs of a Jewish woman who fled Nazi Germany and the Thyssen-Bornemisza Collection Foundation is embroiled in procedural questions about foreign sovereigns’ liabilities in US courts (The Art Newspaper)

Be sure to check out our Masters in Business interview this weekend with Michael Mauboussin, who runs consilient research at Morgan Stanley’s buyside firm, Counterpoint Global. Mauboussin (and his co-author, Alfred Rappaport ) revise and update their book Expectations Investing: Reading Stock Prices for Better Returns.

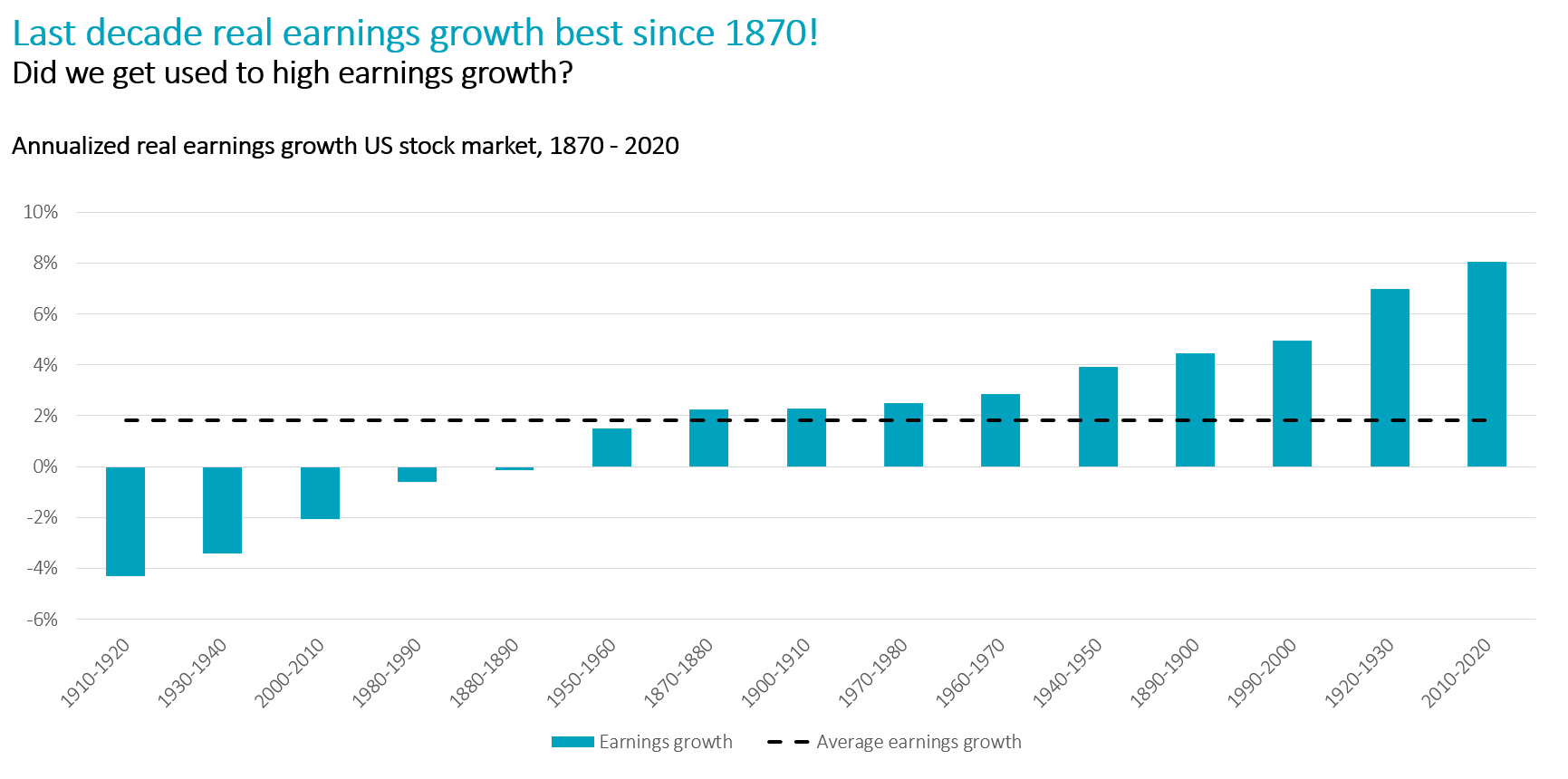

The 2010s were even better than the 1990s and roaring 1920s for real earnings growth

Source: @paradoxinvestor

Sign up for our reads-only mailing list here.