My morning train WFH reads:

• The clear and present danger of Trump’s enduring ‘Big Lie’ Call it an insurrection or a coup attempt, it was fueled by what’s known as the “Big Lie”: the verifiably false assertion that Trump won. Joe Biden won 306 votes in the Electoral College, while Trump received 232. In the popular vote, Biden won by more than 7 million votes. (NPR) see also Beyond the riot, Jan. 6 was a dangerously close call. How Trump’s plot nearly succeeded: But this was a close call. Attempts by Trump and his followers to overturn the results of the 2020 election — multi-dimensional efforts of which the assault on the Capitol building was only one element — came dangerously close to succeeding. (ABC News)

• Rules for Buying Crashing Growth Stocks Reasonable people can differ about what’s causing the selloff. If you wanted to blame it on crazy multiples coming back down to earth, momentum, or anything else, I wouldn’t argue. The question is, what does one do about it. (Irrelevant Investor)

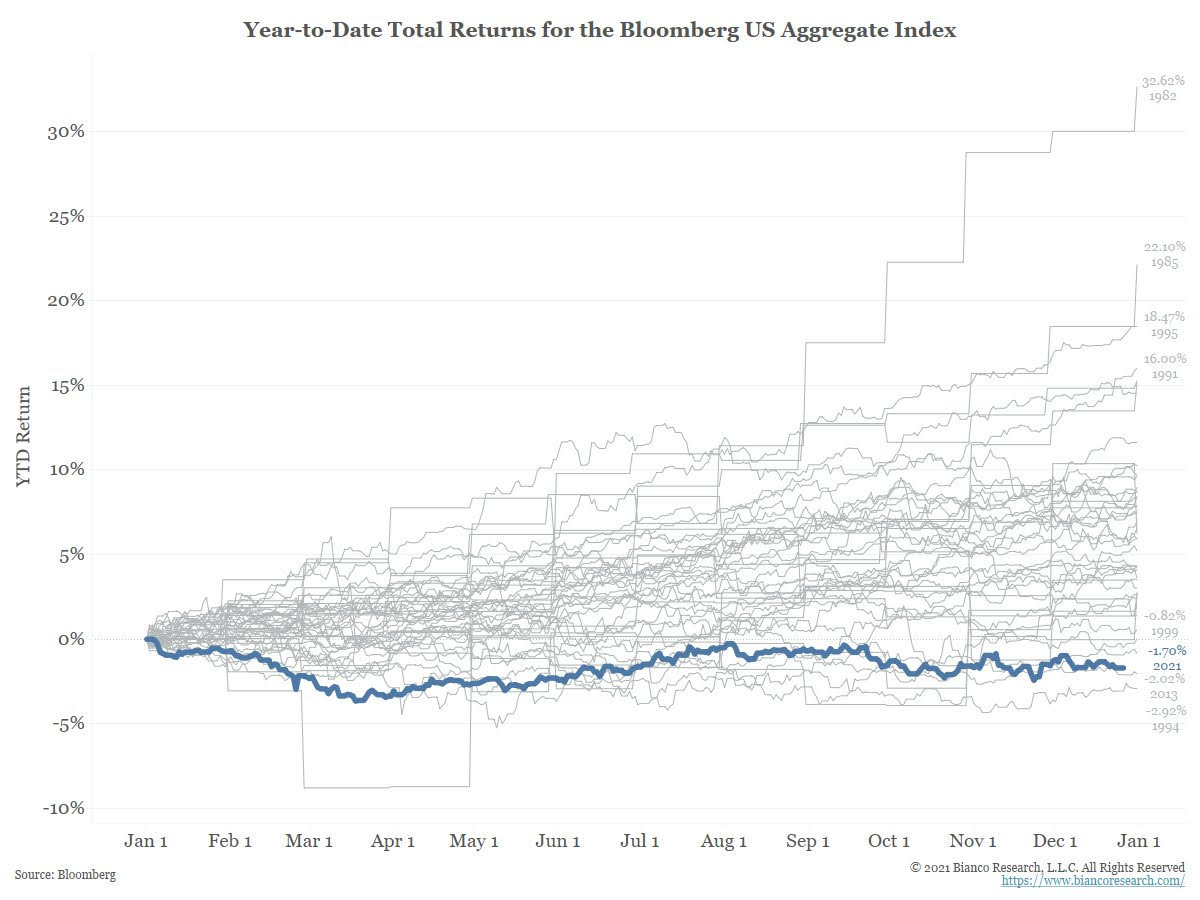

• What Happens When Bonds Lose Money With the Federal Reserve focused on fighting inflation, rate hikes could mean losses for the “safe haven” side of your portfolio. (Businessweek)

• Your B.S. Detector Is Rusty. Time to Sharpen It. We’ve spent much of the pandemic isolated. As we go back out into the world, we’re coming face-to-face with more B.S. (Wall Street Journal)

• Money in the Metaverse: In a virtual world full of virtual goods, finance could get weird. (New Yorker)

• ‘It Takes More Than Money’: Inside AllianceBernstein’s Efforts to Retain Diverse Talent Amid the great resignation, the asset manager’s two-year-old coaching program is yielding good results. (Institutional Investor)

• Does Not Compute Alot of things don’t make any sense. The numbers don’t add up, the explanations are full of holes. And yet they keep happening – people making crazy decisions, reacting in bizarre ways. Over and over. (Collaborative)

• How Bad Are Plastics, Really? Plastic production just keeps expanding, and now is becoming a driving cause of climate change. (The Atlantic)

• Ninety-Nine Fascinating Finds Revealed in 2021 The year’s most exciting discoveries include a Viking “piggy bank,” a lost Native American settlement and a secret passageway hidden behind a bookshelf. (Smithsonian Magazine)

• Shaken by the Jan. 6 attack, Capitol workers quit jobs that once made them proud The trauma suffered by thousands of legislative aides, police officers and blue-collar workers after the insurrection has prompted some to leave the Capitol. (Washington Post) but see Why Jan. 6 Aftershocks Defy Expectations: A year after the riot, Donald Trump remains dominant among Republicans and his election-fraud myth lives on (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Ray Dalio, founder, co-chairman and co-chief investment officer of the world’s largest hedge fund, Bridgewater Associate s. Dalio’s latest book, Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail.

US Aggregate bond market total-return was the 3rd worst year ever.

Source: @biancoresearch

Sign up for our reads-only mailing list here.