My mid-week morning train WFH reads:

• This is the most important thing Biden can do to get inflation under control The truth is that presidents have relatively limited tools for fighting inflation. Biden has been reluctant to pull even those levers, such as lifting tariffs or accelerating the process for legal immigration. By law, it’s the Federal Reserve’s job to maintain stable prices. If Biden is truly worried about the threats posed by inflation, he will immediately nominate three professionals with a track record of political independence and a credible commitment to stabilizing prices. (Washington Post)

• Are We Bullish Enough? I know how extreme this sounds after the last decade or so of U.S. stock returns, but what if it’s not a market crash we need to worry about but a melt-up? What if the world recovers from Covid in a way that takes markets to a whole new level? (Of Dollars And Data)

• Look Ahead to 2032, at the Very Least: In this season for forecasts and resolutions, investors will be better off if they are able to think 10 or more years ahead, our columnist says. (New York Times)

• Four reasons you’re seeing empty grocery store shelves The omicron surge, extreme weather and record December sales are among the reasons that toilet paper aisle is looking shaky again. (Washington Post) see also Why Grocery Store Shelves Are Bare. Again. Supply chains are made of people. (Slate)

• 50 Company Stocks to Watch in 2022 From Airbnb to Volkswagen, keep an eye on these global stocks this year. Factors include growth prospects, management changes, and planned releases of noteworthy products and services. The impact of the Covid-19 pandemic was important, as were growing sales of electric vehicles, the transition to clean energy, China’s increasing regulatory scrutiny, power shortages, and opportunities in the metaverse. (Businessweek)

• New York Business Owners Sidestep Billions in Federal Taxes With State’s Help Pass-through business owners paid $11 billion to state that will escape federal SALT deduction cap. (Wall Street Journal)

• What Is Antivirus Company Norton Even Doing Mining Crypto on Your Computer? when a prominent antivirus firm takes a turn toward cryptocurrency, it’s certainly possible to interpret that move as a sneaky money grab. That was the general gist of Cory Doctorow’s tweet about Norton Crypto this week, in which he pointed out that Norton takes a cut of the cryptocurrencies its users mine (15% percent of the crypto allocated to each miner). But perhaps the more interesting question is what it says about the market for antivirus software that one of the most prominent manufacturers of those products is now going the way of Kodak. (Slate)

• Who is Web3 Really Good for? It’s just business. The short of it is that these firms that have brought you Web 2.0** style centralization with all its benefits and downsides, are now looking for their next big hit. And while Big Tech has already grown to a democracy-defying size while making all their early investors and employees wealthier than gods already, crypto promises a whole lot more; an ability to own and fully control entire economies. (Margins)

• Are we witnessing the dawn of post-theory science? Does the advent of machine learning mean the classic methodology of hypothesise, predict and test has had its day? (The Guardian)

• The App Store Is (Well, Was) Lousy With Blatant Wordle Rip-Offs: Apple’s App Store is lousy with Wordle rip-offs. I mean not just the concept — there’s a long history of “guess the word” games, including a defunct game show called “Lingo” that was clearly an inspiration for Wordle — but literally the name “Wordle” and its design (Daring Fireball)

Be sure to check out our Masters in Business interview this weekend with Ray Dalio, founder, co-chairman and co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates. Dalio’s latest book, Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail.

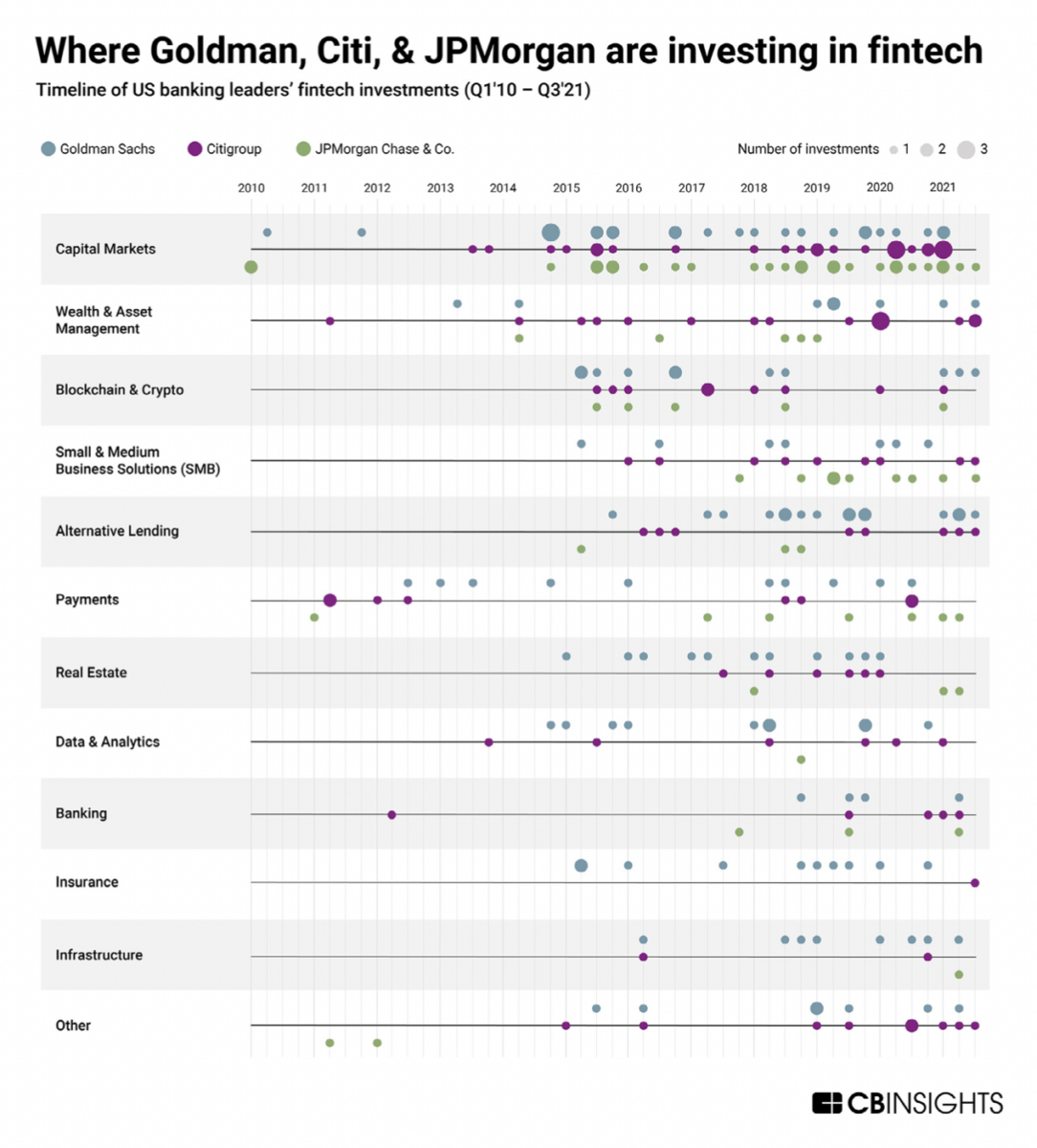

Where Top US Banks Are Betting On Fintech

Source: CB Insights

Sign up for our reads-only mailing list here.