The weekend is here! Pour yourself a mug of Danish Blend coffee, grab a seat where you can see the snowdrifts, and get ready for our longer-form weekend reads:

• Big Hot Sauce Wants More Hot Sauce Spice king McCormick’s acquisitions of Frank’s RedHot and Cholula give it the edge to own “the next ketchup.” McCormick has a way to go before it can make hot sauce as big as ketchup. The latter market is nearly $2 billion larger worldwide, according to Euromonitor. Whereas Heinz faces relatively little competition for its flagship product, the hot sauce business is full of small-batch sellers, private labels marketed by grocery stores, and family-led brands with loyal followings such as McIlhenny’s Tabasco, Huy Fong sriracha, Baumer’s Crystal, and Tapatío, all of which seem to have the same objective as McCormick. (Businessweek)

• The Rules What do you do now? How do you get through this thing? There are rules. Here’s a new version, on account of the hundreds of thousands of new investors who are new and maybe going through this for the first time. If you’ve been around awhile, a lot of this material will be familiar to you. You may even find yourself nodding along because these philosophies have become your philosophies. That’s cool. I didn’t invent any of this stuff, I just know it works. (Reformed Broker)

• Microsoft avoided the latest round of Big Tech antitrust scrutiny. Then it bought a company for $69 billion. Microsoft has had a relatively smooth ride through the scrutiny and criticism that has plagued its four Big Tech rivals — Amazon, Apple, Facebook, and Google — over the last few years, even though it’s worth more than most of them. This conspicuous merger threatens to upend that. How Microsoft’s 20-year-old antitrust battle prepared it for today’s techlash. (Vox)

• What should the White House do to combat inflation? Experts weighed in with 12 ideas. From stopping spending to breaking up big companies, there are no simple solutions. But there are plenty of options. (Washington Post) see also Was Larry Summers Right All Along? How the ultimate Establishment figure became the preeminent critic of the Biden era’s economic consensus. (New York Magazine)

• Infinite Regret: it hits us from every direction, let’s not let it consume us The idea being that even if we make a lot of money on a trade, if we could have made more, we tend not to be thrilled with the objectively excellent outcome. This leads me to thinking about a bigger idea that has been rolling around in my head for a few months — that the NFT space is filled with infinite regret which comes at you from every direction. (Letters From a Zeneca_33)

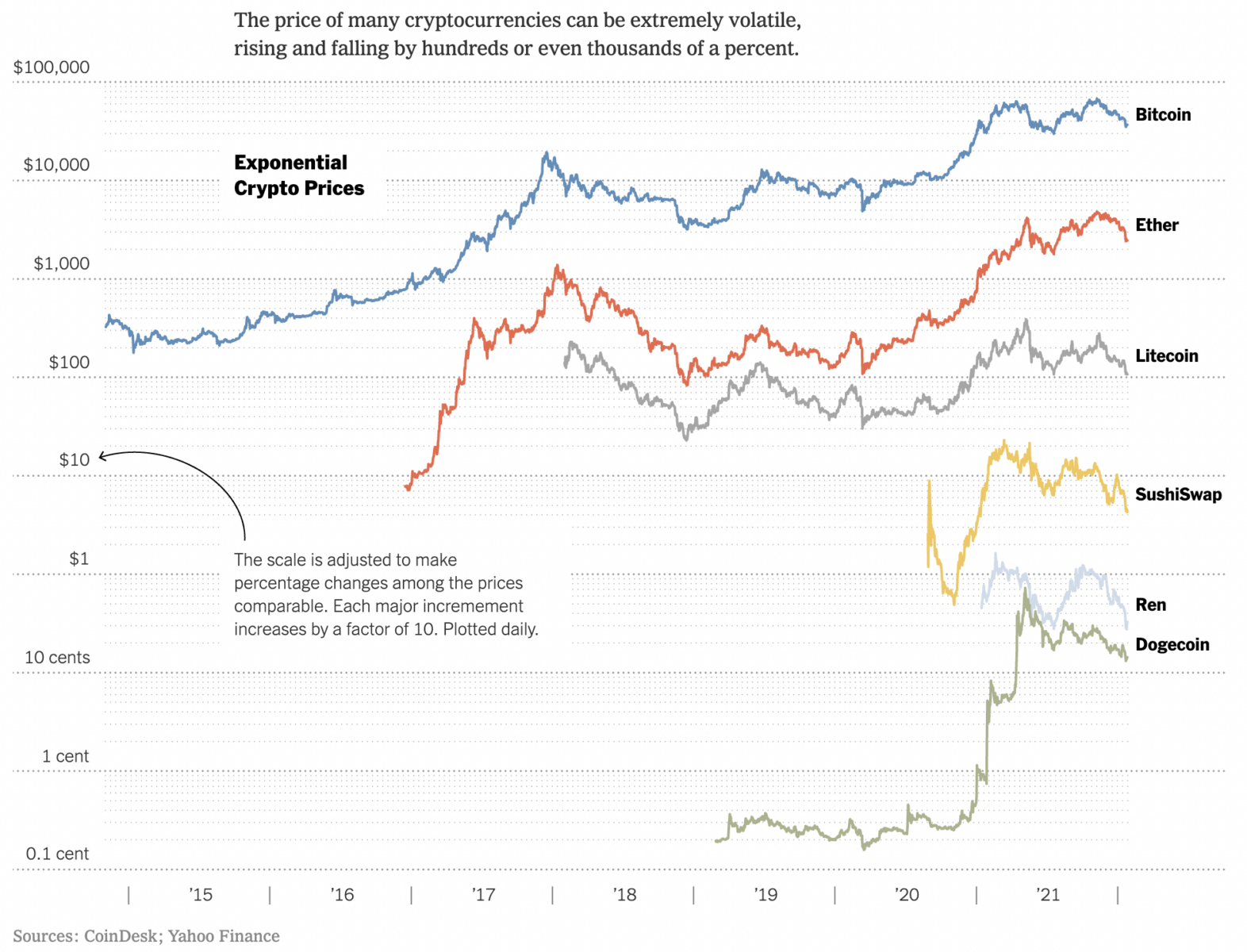

• An Anatomy of Bitcoin Price Manipulation While cryptocurrencies have grown in popularity and market capitalization, the volatility of the price has not diminished. One recurrent feature of crypto price is the BART pattern, where periods of low volatility are punctuated by spikes of extreme volatility. The name comes from the resemblance to Bart Simpson’s head: (Single Lunch) but see also Cryptocurrency Is a Giant Ponzi Scheme Cryptocurrency is not merely a bad investment or speculative bubble. It’s worse than that: it’s a full-on fraud. (Jacobin)

• Plastic-Free Shopping Is Going Mainstream A partnership between America’s largest supermarket chain and a reusable packaging company is the latest sign that no-waste shopping is catching on. (Reasons To Be Cheerful)

• ‘It’s a glorified backpack of tubes and turbines’: Dave Eggers on jetpacks and the enigma of solo flight When inventor David Mayman took to the skies, it seemed he’d answered an age-old longing. So why did no one seem to care? (The Guardian)

• How Covid killed the one-night stand – and made us all kinkier: There has been a sharp drop in one-off encounters, researchers say, but more people are enjoying friends with benefits and getting experimental in bed (The Guardian) see also Caroline Spiegel’s Porn Revolution Can the 24-year-old sister of Snapchat CEO Evan Spiegel create the Peloton of audio porn? First, she has to turn listeners on to the joys of aural sex. (The Information)

• Led Zeppelin Gets Into Your Soul The musicians were diabolically bad as people, and satanically good as performers. Led Zeppelin’s talent and daring went way beyond the capabilities of the headbanging deadweights who hung off the group’s example in the nineteen-seventies and eighties. Yes, Led Zeppelin was “heavy”—to hear “Communication Breakdown” or “Good Times Bad Times” or “Rock and Roll” or “Black Dog” or “Dazed and Confused” for the first time was to hear danger, perilous boundaries, the dirty roar on the other side of music. Page got extraordinary kinds of distortion and fuzz from his guitar, and Bonham hit his snare and his gigantic bass drum killingly. But I liked the fact that Led Zeppelin’s members were, above all, heavy musicians; their talents as virtuoso performers made sense in the largely classical musical world that had shaped me. (NewYorker)

Be sure to check out our Masters in Business interview this weekend with David Conrod, Co-Founder CEO at FocusPoint Private Capital Group. Previously, he was at Guggenheim Partners, where he established the Private Fund Group, with more than $7 billion of fund allocations for general partnerships external to the firm.

It’s Hard to Tell When the Crypto Bubble Will Burst, or If There Is One

Source: New York Times

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.