My morning train WFH reads:

• Markets Are a Beauty Contest: If I gave you information from the future, how confident are you that you could beat the market? (Irrelevant Investor)

• The Titans of Junk Debt Turned Trash Into Bond-Market Treasure Netflix—or “Debtflix,” if you prefer—Tesla, T-Mobile, and Dell borrowed billions in an era of historic low rates. They’ve been getting some timely upgrades. (Businessweek)

• Value Investing Is Back. But for How Long? Value investing—buying stocks that are cheap on measures such as earnings or book value—is having a renaissance. Up to last Thursday, large value stocks beat more expensive “growth” stocks by the most of any 50-day period since the technology bubble burst in 2000-01, with the exception of the post-vaccine rebound early last year. (Wall Street Journal)

• Cathie Wood’s True Believers Are Sticking With Her While many investors bought high, minimal outflows show that ARK Innovation’s fans still have faith. (Bloomberg)

• Goldman Sachs destroys one of the most persistent myths about investing in stocks 🤯 CAPE, or cyclically adjusted price-earnings, was popularized by Nobel prize-winning economist Robert Shiller.1 It’s calculated by taking the price of the S&P 500 and dividing it by the average of 10 years’ worth of earnings. When CAPE is above its long-term average, the stock market is thought to be expensive. Many market watchers use above-average CAPE readings as a signal that stocks should underperform or even fall as it reverts back to its long-term mean. But CAPE’s mean doesn’t actually have much pull. (TKer)

• How one company took over the NFT trade The NFT gold rush made OpenSea into a $13 billion company — but can it stay on top? (The Verge)

• Fashion is just TikTok now: The video app absolutely dominates style trends and discussion around fashion. What does that mean for the way we dress? (Vox)

• How to roll out big ideas and avoid the Museum of Failure Scaling is the process of rolling out something on a large scale. Whether it’s a social movement seeking to improve society with a policy to reduce inequality, or a corporation trying to make a buck, scaling is central to what most major organizations are usually trying to achieve. “If an idea doesn’t scale to change the world, then what is an idea really worth in the end?” (NPR)

• In the World’s Fastest Drummer, Scientists See a Bionics Breakthrough: The same A.I. technology that runs Jason Barnes’ prosthetic arm can teach people how to read Braille or play the piano in a matter of hours. (Reasons To Be Cheerful)

• A Solution to the Faint-Sun Paradox Reveals a Narrow Window for Life: Back when the sun was 30% dimmer, Earth should have frozen solid. Yet water flowed and life blossomed. The solution to the paradox shows that we might have that faint sun to owe for life’s existence — with critical consequences for the possibility of life outside Earth. (Quanta Magazine)

Be sure to check out our Masters in Business interview this weekend with Rebecca Patterson, Director of Investment Research at Bridgewater Associates, the world’s largest hedge fund, where she is also a member of the firm’s investment committee. Previously, she was Chief Investment Officer at Bessemer Trust, managing $85 billion of client assets.

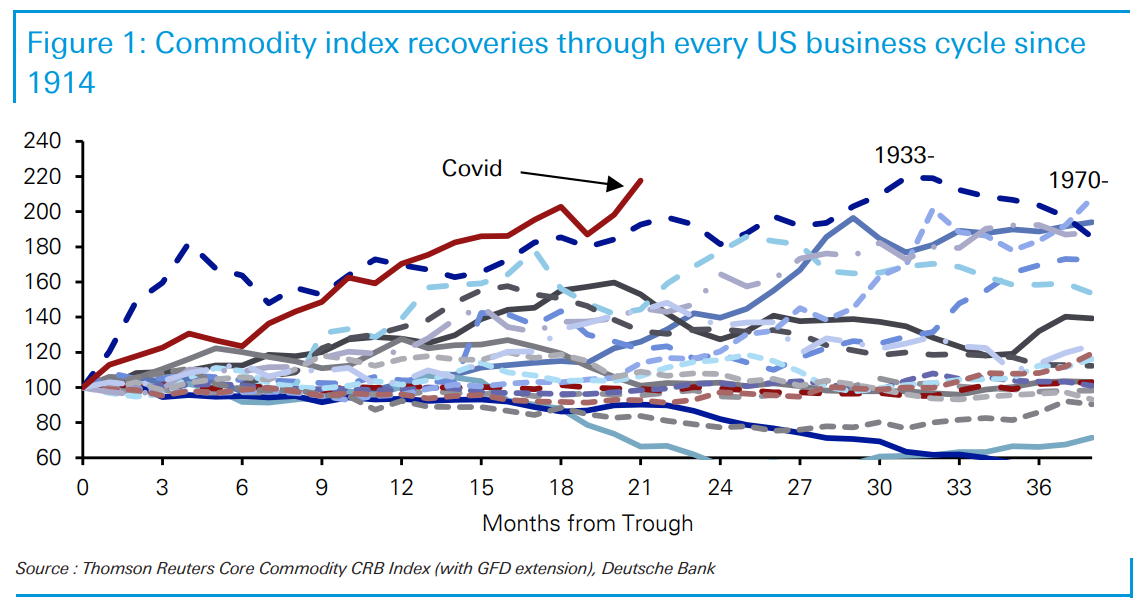

The strongest commodity recovery in history

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.