My Two-for-Tuesday morning train WFH reads:

• Pay Me More or I Quit: Workers Play Risky Game With Their Bosses More than 60% of Americans say using a job offer from another company for the sole purpose of receiving a salary increase is an ethical practice. (Bloomberg) see also Worker Absences From Covid-19 Hold Back Companies’ Growth The Omicron variant has hit staffing hard, and lingering pressures remain for some employers (Wall Street Journal)

• 4 Lessons From ARK’s Rapid Rise—and Fall The meteoric rise of fund company ARK Invest and its outspoken founder Cathie Wood was the biggest success story of 2020. Last year, however, was a very different story. ARK Innovation the firm’s flagship fund, peaked in February 2021. As we near that anniversary, the fund is down 52% from the peak. This is bad news for recent investors in the fund, but there are lessons here for everyone. (Barron’s)

• Are You Diversified? A lot of the highflyers have come down a lot. Many of them – the ubiquitous EV makers, the SPACs, the meme stocks, the metaverse plays, fuel cells, payment processing, crypto assets, and development-stage biotechs – are still ridiculously expensive. A lot of good companies out there with valuations that just aren’t supported by the fundamentals and they are being weighed. (Alhambra)

• Inside Spotify’s Joe Rogan Crisis: The streaming giant that started as a tech platform is now lurching toward being a media company responsible for what it distributes (Wall Street Journal)

• The Crypto Backlash Is Booming Web3 is making some people very rich. It’s making other people very angry. (The Atlantic) see also Maybe There’s a Use for Crypto After All Helium, a wireless network powered by cryptocurrency, hints at the practical promise of decentralized services. (New York Times)

• The Nuclear Industry Argues Regulators Don’t Understand New Small Reactors Advocates say the plants offer a climate fix, but opponents decry them as dangerous. (Businessweek)

• ‘Pandemic of the unboosted’: low US Covid jab uptake piles pressure on hospitals: Almost half of the US Covid-19 hospitalisations this winter could have been averted if the country had matched the vaccination coverage of leading European countries, according to a Financial Times analysis of the Omicron variant’s impact on either side of the Atlantic. (Financial Times) see also Why Are So Many Americans Still Dying of COVID? For those attuned to the ongoing, horrifying pandemic death toll, it may seem a continuation of the country’s failure stretching back to last spring. (New York Magazine)

• They Said the Tornado Would Hit at 9:30. It Hit at 9:30. Scientists have reached success rates of nearly 100 percent in predicting when and where violent tornadoes will strike. That hasn’t stopped people from being killed in the ferocious winds. (New York Times)

• The GOP has become the Jan. 6 Party. It stands for insurrection and authoritarianism. The Jan. 6 Party has little in common save its name with the one I joined in the 1980s. It is no longer a conservative party but a radical nationalist-populist party that poses a dire danger to U.S. democracy — and to the lives of ordinary Americans. The fact that so many voters are flocking to the Republican banner anyway sends a dismaying signal about America’s future. (Washington Post) but see Pence says ‘Trump is wrong’ to say then-vice president had the right to overturn 2020 election. Speaking at the Federalist Society Florida Chapters conference near Orlando, Pence delivered his strongest response yet to Trump’s ongoing efforts to relitigate the 2020 presidential election, calling it “un-American” to suggest one person could have decided the outcome. (CNN)

• A new theory helps explain the epic mystery of bird migration Birds are way better than people at finding their way. Here’s one reason why. (Vox)

Be sure to check out our Masters in Business interview this weekend with Rebecca Patterson, Director of Investment Research at Bridgewater Associates, the world’s largest hedge fund, where she is also a member of the firm’s investment committee. Previously, she was Chief Investment Officer at Bessemer Trust, managing $85 billion of client assets.

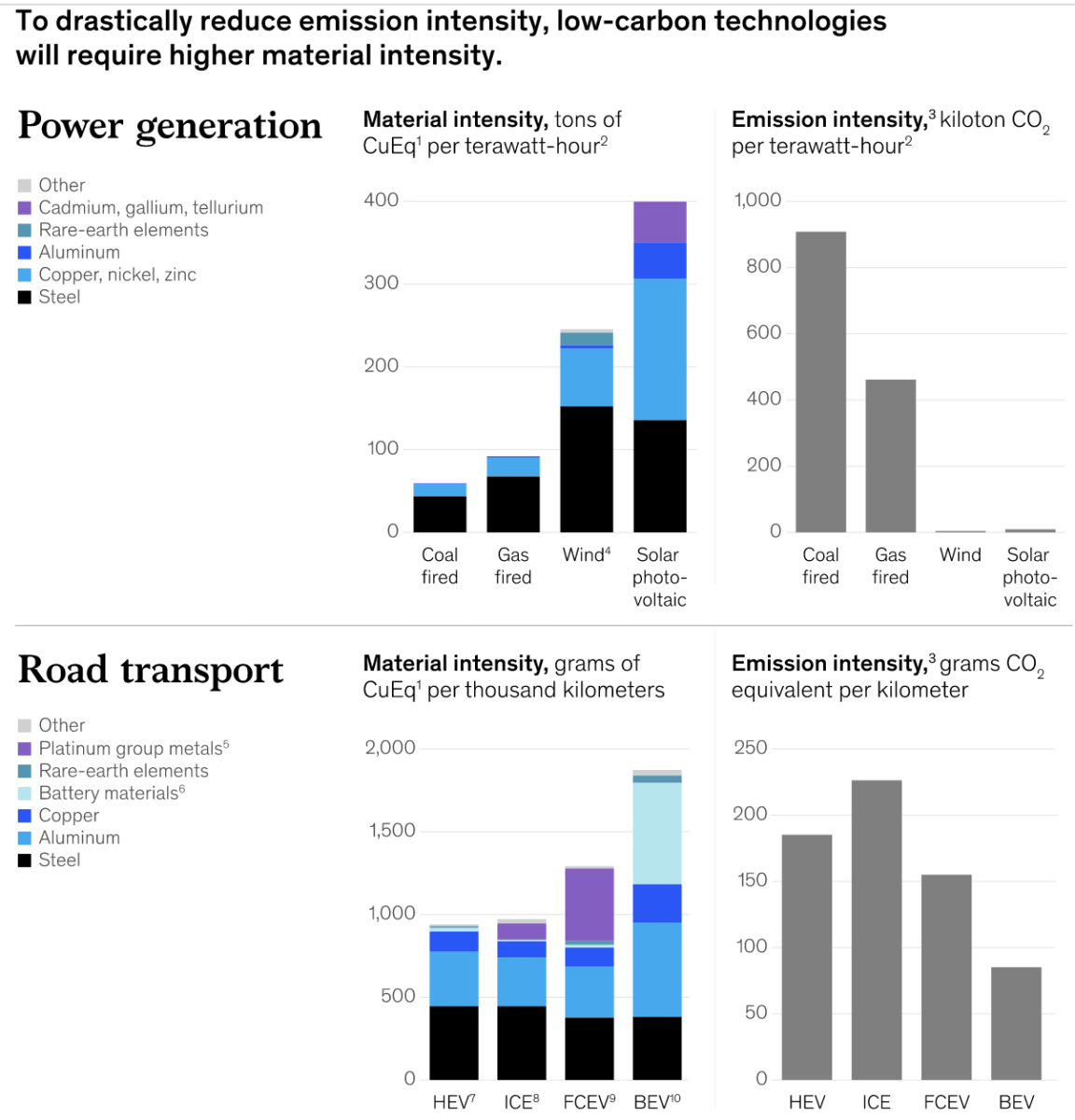

The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition

Source: McKinsey