The weekend is here! Pour yourself a mug of Organic FT Guatemala Quetzaltenango coffee, grab a seat by the fire, and get ready for our longer-form weekend reads:

• Workers Are Having Their Moment. How Long Can It Last? Most workers are benefiting from a tight labor market that developed during the nation’s recovery from Covid-19. Those in highest demand are in some cases the ones who started out further behind, with fewer gains before the pandemic. They include the young and the less educated, as well as those who work in lower-wage industries and perform blue-collar tasks. Many are based in the South. Wealthier, older, college-educated professionals in other parts of the country are also making gains. Wages are rising, and just about anyone who wants a job can get one in certain industries. The demand for labor is not expected to abate anytime soon. (Wall Street Journal)

• Value Investor’s Guide to Web3 Web3 is attracting a flood of investor interest but is rife with hype and speculation. A value investing approach can help. We adapt our “intangible value” lens to crypto and build a value strategy in small-cap tokens. We also create Web3 industry classifications and crypto stock portfolios. (Sparkline Capital)

• More Homes Than Ever Are Selling for $50 Million. What’s Inside? In 2020, however, the U.S. luxury housing market, fueled by historically low interest rates and a roaring stock market, rose to unprecedented heights. And then it rose even higher. At least 42 residential properties sold for more than $50 million last year, about a 35% increase from the year before. Four of these properties were in the Hamptons, where the Macklowes, three decades ago, decided to buy their summer home. (Bloomberg)

• From crypto to Christie’s: How an Indian metaverse king made his fortune: While some observers deride NFTs as a speculative asset, devotees see them as the building blocks of a new digital economy and the next evolution in art collecting. The notion that the internet will develop into a metaverse – a parallel universe of virtual spaces – has gathered such momentum that last month Facebook changed its name to “Meta.” Sundaresan says he buys NFTs chiefly as investments. He has likened owning them to “having an autograph from your favourite artist.” (Reuters)

• The moral calculations of a billionaire After the best year in history to be among the super-rich, one of America’s 745 billionaires wonders: ‘What’s enough? What’s the answer?’ (Washington Post)

• Searching for Susy Thunder In the ’80s, Susan Headley ran with the best of them—phone phreakers, social engineers, and the most notorious computer hackers of the era. Then she disappeared. (The Verge)

• How to fix Facebook Facebook is broken, and after a recent deluge of damning internal company leaks to the press and Congress, the world has unassailable proof of how troubled it really is. Almost 2 billion people around the world use a product owned by Meta (formerly called Facebook), including WhatsApp and Instagram, every day. For many of its users, the company is the internet and their primary platform for communication and information. Millions of us are dependent on its products in one way or another. Can Facebook be redeemed? Twelve leading experts share bold solutions to the company’s urgent problems. (Vox)

• Can the World’s Most Connected Doctor Cure Cancer? He was physician to the late Steve Jobs, pal to Elon Musk and Howard Stern, counselor to both Trump and Biden. Now he’s founded the most cutting-edge cancer center in L.A. (Los Angeles Magazine)

• The Battle for the World’s Most Powerful Cyberweapon A Times investigation reveals how Israel reaped diplomatic gains around the world from NSO’s Pegasus spyware — a tool America itself purchased but is now trying to ban. (New York Times)

• The Comics Cavalcade The rise of a medium: Blame the comic book. Cheap and transportable, a trove of infantile fantasy and psychosexual Pop Art, often spiced with egregious stereotypes and nativist aggression, this humble medium was for a time the United States’ most ubiquitous cultural ambassador. Such is the thesis of Paul S. Hirsch’s Pulp Empire: The Secret History of Comic Book Imperialism, an engaging account of the ways in which comics variously served or confounded official interests. (The Nation)

Be sure to check out our Masters in Business interview this weekend with Rebecca Patterson, Director of Investment Research at Bridgewater Associates, the world’s largest hedge fund, where she is also a member of the firm’s investment committee. Previously, she was Chief Investment Officer at Bessemer Trust, managing $85 billion of client assets.

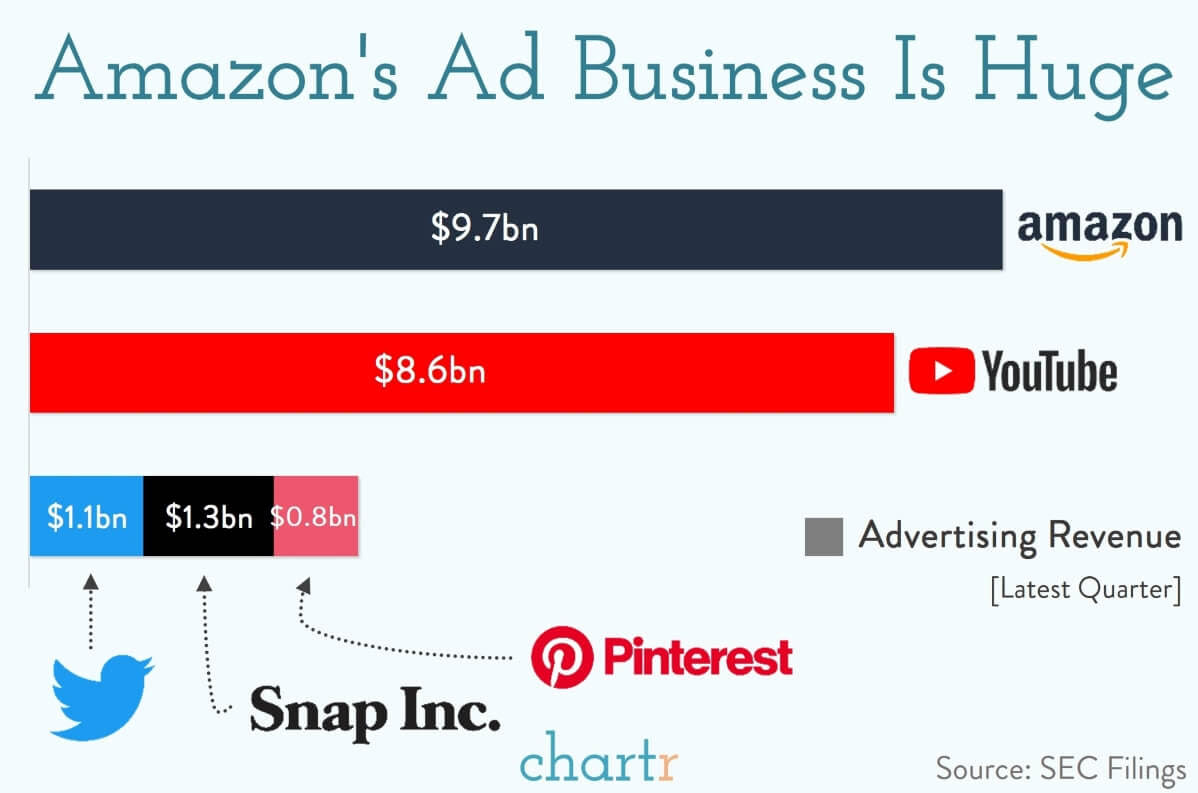

Amazon made almost $10bn last quarter from advertising, bigger than YouTube

Source: Chartr

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.