My mid-week morning train reads:

• Inside Chernobyl, 200 Exhausted Staff Toil Round the Clock at Russian Gunpoint Trapped since their shift 3 weeks ago, the Ukrainians keeping the abandoned nuclear plant safe from meltdown are ill-fed, stressed and desperate for relief (Wall Street Journal)

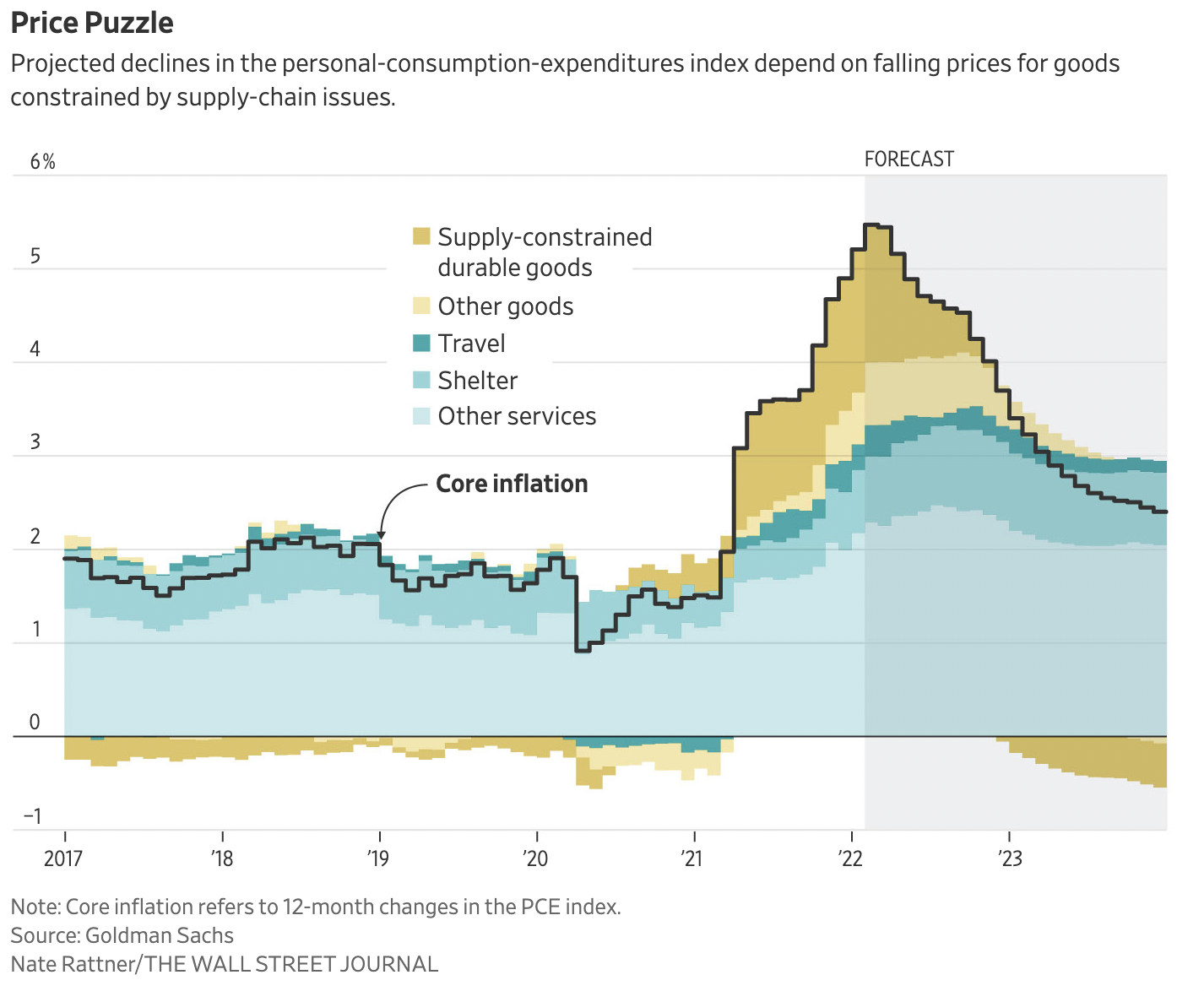

• Powell Admires Paul Volcker. He May Have to Act Like Him. The Federal Reserve is facing the fastest inflation most Americans have ever seen. Its chair says policymakers will do what it takes to tame prices. (New York Times)

• How Kyiv’s outgunned defenders have kept Russian forces from capturing the capital “The Russians were not ready for unconventional warfare,” said Rob Lee, senior fellow at the Foreign Policy Research Institute and an expert on Russian defense policy. “They were not ready for unconventional tactics. They are not sure how to deal with this insurgency, guerilla-warfare-type situation.” (Washington Post) see also Stingers, rifles and ‘St. Javelin’: The global race to arm Ukraine The U.S. and NATO are leading a multibillion-dollar effort to ship high-end weaponry to Ukraine. Will it change the course of the war? (Grid)

• Predicting the Next Recession The Fed cannot ease pandemic related supply constraints (except by curbing demand), and the Fed cannot stop the war. So, there is a possibility that the Fed will tighten too much and that will lead to a “hard landing” (aka recession). (Calculated Risk)

• Investors Haven’t Faced a Market Like This in Decades. Here’s How They’re Coping. Inflation and geopolitical risk are “back with a vengeance” just as volatility is spiking. (Institutional Investor)

• Russia Is Spiraling Toward a $150 Billion Default Nightmare What happens with bond payments due Wednesday could kickstart Russia’s first foreign-currency default since the 1917 revolution. (Bloomberg)

• How a wrinkle in the oil futures market has clogged America’s oil pump Big deal, you may say. Traders are speculating. That’s just what they do. But it’s not just traders who watch the futures market. Oil companies watch the market closely, too, as do the investors who invest in them, to determine whether it’s worthwhile putting money in the ground. (NPR)

• Major breakthrough on nuclear fusion energy: European scientists say they have made a major breakthrough in their quest to develop practical nuclear fusion – the energy process that powers the stars. (BBC)

• If your hospital suddenly feels more like an Apple store or greenhouse, biophilic design is why Healthcare spaces are increasingly using nature as a way to make their buildings better for patients. (Fast Company)

• The Senate just voted to make daylight saving time permanent. Good. The case against changing clocks is less about extending sunsets later all year and more about staying consistent. (Vox)

Be sure to check out our Masters in Business interview this weekend with Michelle Seitz, Chairman and Chief Executive Officer of Russell Investments, the 6th largest manager in the world. The firm manages over $331. billion in assets and advises on another $2.8 trillion.

The Inflation Hits Just Keep Coming, Raising Stakes for the Fed

Source: Wall Street Journal