My back to work morning train WFH reads:

• Profits Soar as U.S. Corporations Have Best Year Since 1950 New data show earnings jumped 35% in 2021, while workers got an 11% bump. (Businessweek)

• Big Stock Sales Are Supposed to Be Secret. The Numbers Indicate They Aren’t. Share prices fall ahead of 58% of large sales, a WSJ analysis finds. Regulators are investigating. (Wall Street Journal)

• Five Things I Know about Investing Dartmouth finance professor Kenneth R. French explains five principles he uses as the foundation for a holistic approach to portfolio design. French develops a flexible and comprehensive framework for portfolio design using the global average of all investors and the global portfolio of all stocks, bonds, and other financial assets as reference points. (Dimensional Fund Advisors)

• From VW to JPMorgan, the Unlikely Cast Behind Nickel’s Big Squeeze The nickel market remains paralyzed after this month’s crisis. (Bloomberg)

• How One Man Helped Create a Nation of Investors Ned Johnson, the longtime leader of Fidelity, changed the way the middle class thought about its money. (Dealbook)

• The Infinite Exploitation Of Cryptocurrency. What’s worse is cryptocurrency’s “HODL” mantra likely means that people have faithfully kept their money in the system that now doesn’t have any money to give them back. It isn’t quite a ponzi scheme because the money existed in some way, but it suffers the same fate – there is no money to pay anyone with. (Where’s Your Ed At)

• Bill Ackman to abandon public battles for quieter investment approach Founder of activist hedge fund Pershing Square intends to work behind the scenes with companies (Financial Times)

• Facebook paid GOP firm to malign TikTok The firm, Targeted Victory, pushed local operatives across the country to boost messages calling TikTok a threat to American children. “Dream would be to get stories with headlines like ‘From dances to danger,’ ” one campaign director said. (Washington Post)

• ‘He Goes Where the Fire Is’: A Virus Hunter in the Wuhan Market For years, Edward Holmes worried about animal markets causing a pandemic. Now he finds himself at the center of the debate over the origins of the coronavirus. (New York Times)

• A Glimpse Into a Fearful, Angry, Imaginary World Ginni Thomas’s texts offer a window into a dark and conspiratorial mindset. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Bill Gross PIMCO co-founder who managed the Total Return Fund, which at $293B was the world’s largest mutual fund. Gross advised Treasury on the role of subprime mortgage bonds, and was named Morningstar’s Fund Manager of Decade in 2010.

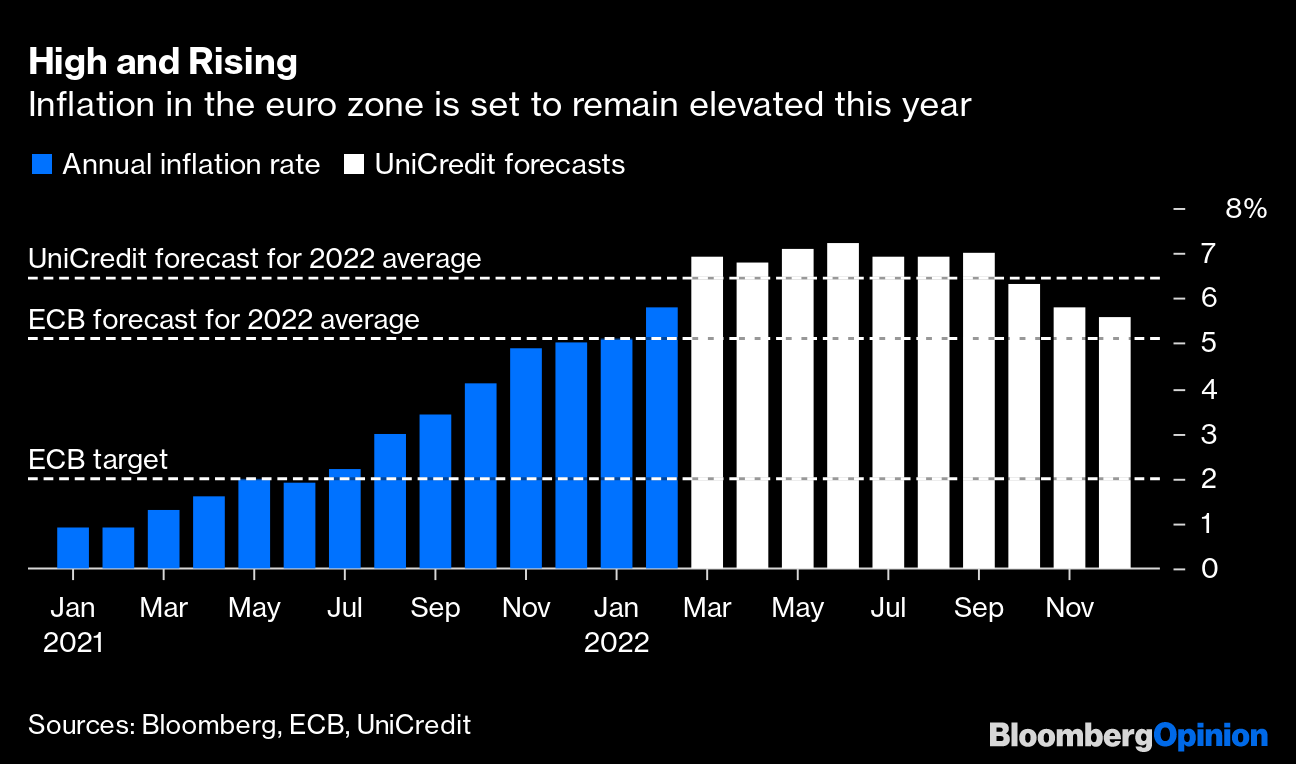

The balance between soaring inflation and slowing growth should lead to a monetary-policy compromise

Source: Bloomberg

Sign up for our reads-only mailing list here.