My morning train WFH reads:

• Bill Browder Warned Westerners Not to Take Russian Oligarch Money. They Should Have Listened. More than 100 hedge funds and private-equity funds have been forced to freeze sanctioned money — but what happens next? (Institutional Investor)

• Stock Market History as a Rorschach Test. The S&P 500 was up 15.8% per year from 2009 to 2021. However, look at the earnings numbers — they were up 22.0% per year. Earnings have outperformed the stock market! (A Wealth of Common Sense) see also Rorschach-Test Economics. Within that full range of the crowd being monolithic and right or monolithic and wrong, is an ambivalent phase where the full spectrum of beliefs is in evidence. The data pretty much support whatever viewpoint you choose to hold. I liken these periods to a Rorschach test, because you can find whatever it is you might be predisposed to see. (The Big Picture)

• Welcome Back to the Office. Isn’t This Fun? Tech companies really want their employees to be happy — or at least less annoyed — about returning. So they’re providing concerts, food trucks and other perks. (New York Times)

• The death of the gas station As EVs hit the road, gas stations will have to adapt or risk going out of business. (Recode)

• This cheeseburger explains your bigger grocery bill American consumers are seeing food prices rise at the fastest rate in decades. Supply chain snarls, labor shortages and climate challenges (plus the conflict in Ukraine) share the blame. (Politico)

• How Chris Dixon’s Dive Down The Crypto Rabbit Hole Made Him The World’s Top Venture Capitalist. Coinbase is just the crown jewel in a portfolio that has made 50-year-old Dixon the new No. 1 on our annual Midas List of tech’s top dealmakers. Other big Dixon deals : Uniswap, a decentralized crypto exchange ($10 billion fully diluted valuation, which accounts for coins not yet in circulation), Avalanche, an open-source blockchain ($62 billion) and NBA Top Shot creator Dapper Labs ($7.6 billion). (Forbes)

• Disney vs. DeSantis: How the ‘Don’t Say Gay’ war is threatening the House of Mouse’s empire in Florida Disney is used to getting what it wants — quietly. But escalating culture wars and a governor with national ambitions are changing the game. (Grid) see also Political blackmail Since 1967, Florida has granted Disney unusual autonomy in the area surrounding Walt Disney World. Within this area, the company can provide emergency services and even levy taxes. It’s an open question whether Disney should have these powers. But DeSantis and other politicians are threatening to repeal the 1967 Reedy Creek Improvement Act for belatedly opposing their efforts to stigmatize LGBTQ students in Florida schools. (Popular Information)

• How Japan Built Cities Where You Could Send Your Toddler on an Errand The Netflix show Old Enough! offers a glimpse of an alternate reality. (Slate)

• Will the Ukraine War change Europe’s thinking on nuclear? The war is prompting countries like Belgium to delay nuclear phase-outs to be less dependent on Russia, but for countries like Germany, Russia’s missile attacks on nuclear plants reaffirm concerns about safety. (Energy Monitor)

• The Search for a Model Octopus That Won’t Die After Laying Its Eggs A lab in Massachusetts may have finally found an eight-armed cephalopod that can serve as a model organism and assist scientific research. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Luana Lopes Lara, co-founder of Kalshi, which has been approved by the Commodity Futures Trading Commission (CFTC) as an authorized Designated Contract Market (DCM). Kalshi operates a federally regulated exchange allowing investors to trade directly on the anticipated outcome of future events.

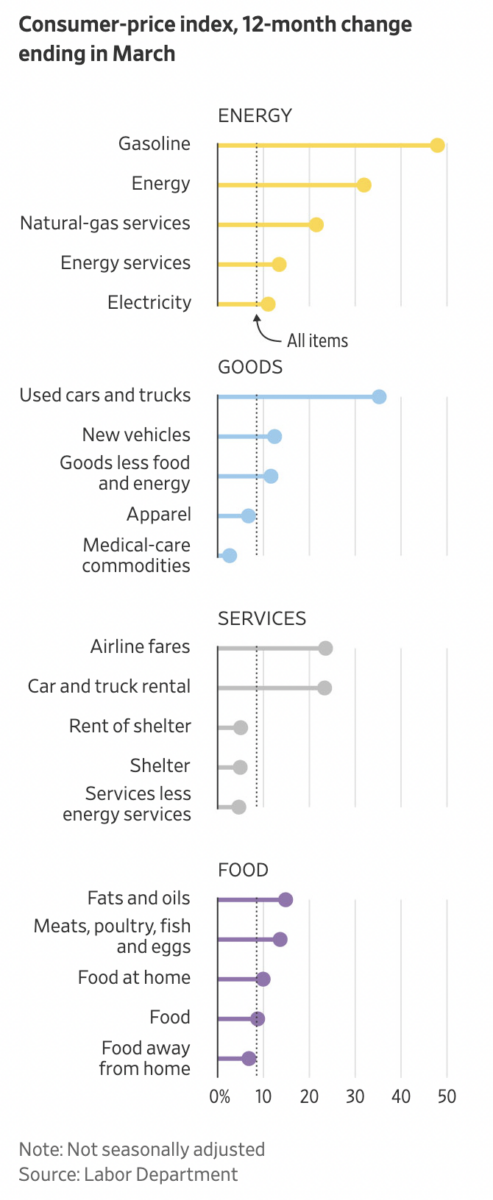

Where Inflation Rose, Cooled the Most in March

Source: WSJ

Sign up for our reads-only mailing list here.