My morning train WFH reads:

• Don’t tell people how to feel about inflation. Everyone is worried about inflation. Of course, they are. We should never tell people how to feel, and that’s true now more than ever. Policymakers must act. (Stay-At-Home Macro)

• How America’s Farmers Got Cut Out of the Supply Chain As shipping companies concentrate on the most lucrative routes from China to California, almond growers are struggling to transport their wares. (New York Times)

• The Stock Market’s Future Ain’t What It Used to Be In recent years, investors often got rewarded for taking reckless risks, but in unforgiving markets, it’s harder to recover from mistakes. (Wall Street Journal)

• 4 Reasons the Housing Market Won’t Crash Many young people did put off settling down for longer than their parent’s generation, but eventually people grow up. They have kids and responsibilities and move to the suburbs. And when this happens most people want to buy a house. That’s exactly what’s happening. Millennials accounted for more than half of all mortgage loan applications in 2021. (A Wealth of Common Sense)

• 4 Big Cities Where Rent Actually Has Gotten Cheaper During the Pandemic: San Francisco, San Jose, Chicago, Washington D.C. are all bucking the national trends. (Money)

• It Makes Total Sense if You Still Don’t Want to Get COVID Between people going maskless on planes and politicians attending fancy dinners, there’s a lot of pressure to just move on. (Slate) see also The Lifting of the Mask Mandate Is a Gift to Democrats A federal judge’s ruling may succeed in getting an awkward topic off the party’s agenda. (Bloomberg)

• U.S. social media giants vowed to remove Russian war propaganda. It’s still there. Grid found dozens of pro-invasion posts and accounts on YouTube, Facebook and Instagram that appeared to violate the companies’ policies and public statements. (Grid)

• Rick Scott became the Senate GOP’s election general, then went to war With an aggressive fundraising effort and a controversial policy plan, the Florida senator has been upsetting colleagues. He’s okay with that. (Washington Post)

• Leave your shoes outside, these scientists say We are environmental chemists who have spent a decade examining the indoor environment and the contaminants people are exposed to in their own homes. On the question of whether to shoe or de-shoe in the home, the science leans toward the latter. It is best to leave your filth outside the door. (CNN)

• Nicolas Cage Is in on the Nicolas Cage Jokes In his new movie, “The Unbearable Weight of Massive Talent,” the actor plays “himself” in all his meme-ified glory. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Mark Jenkins, Head of Global Credit, at Carlyle. The firm manages over $300 billion in assets. Carlyle’s Global Credit platform manages over $73 billion in assets in liquid, illiquid, and real asset strategies.

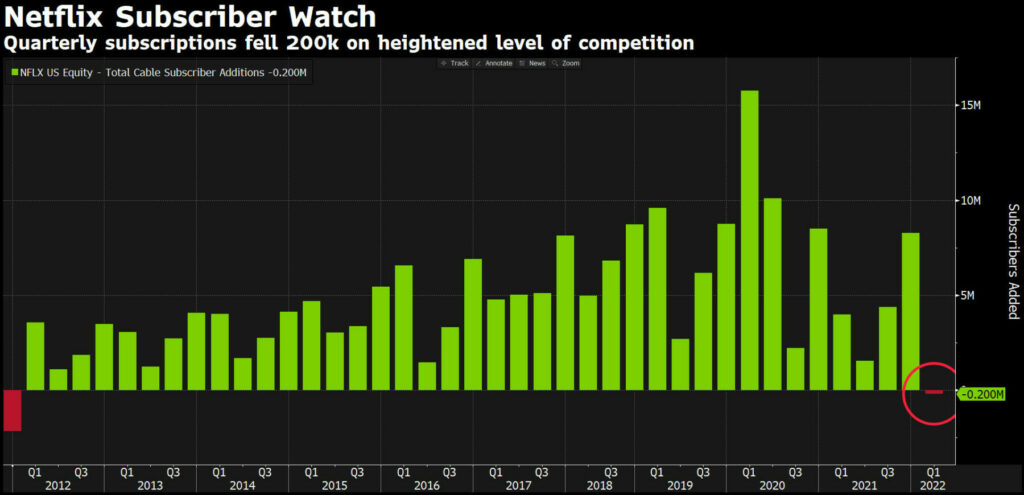

First Subs Drop in a Decade Leads NFLX to be Worst Performer YTD in S&P 500 and Nasdaq

Source: Kriti Gupta

Sign up for our reads-only mailing list here.