My Two-for-Tuesday morning train WFH reads:

• Wait, What if People Did Just Stay Home in Their Pajamas? New neighborhood businesses far from Midtown are thriving. Maybe it’s time to redefine what “comeback” means. (New York Times) see also Sure, Work Makes Us Want to Swear. But Should You? These people dropped f-bombs at the office. Here’s what happened. (Wall Street Journal)

• The Inverted Yield Curve Omen There are few things investors fear more than an inverted yield curve (the relatively uncommon situation where short-term yields are higher than longer-term yields). Why? Because it tends to be a pretty good indicator of future economic weakness. (Compound)

• Baillie Gifford’s James Anderson: ‘There will always be the Ides of March out there’ The unlikely star of tech investing on backing ‘outliers’, the future for China’s entrepreneurs — and the comfort of 19th-century literature. (Financial Times) see also MiB: James Anderson, Baillie Gifford The fund management business is ‘irretrievably broken’ with “fund managers addicted to the near-pornographic allure of earnings reports and macroeconomic headlines.” They are overly focused on short-term returns while failing to recognize that great companies take years to develop. (The Big Picture)

• Economics: The Discipline That Refuses to Change. Behavioral economics upended the idea that humans act solely in their rational self-interest. So why do most undergrads barely learn anything about the field? (The Atlantic)

• Homeowner Groups Seek to Stop Investors From Buying Houses to Rent Suburban neighborhoods are rewriting rules as rental investors’ purchases surge. (Wall Street Journal) but see also The Sky-High Pandemic Housing Market Finds Gravity Does Exist Mortgage costs have jumped as the Federal Reserve has raised rates. With higher rates come fewer offers. (New York Times)

• How Greenwood Became the Most Hyped Startup in Black America Founders Paul Judge and Ryan Glover knew little about banking, but 700,000 believers joined their exclusive waitlist. So can their fintech company actually repair centuries of racist banking? (Bloomberg)

• The Battery That Flies: A new aircraft being built in Vermont has no need for jet fuel. It can take off and land without a runway. Amazon and the Air Force are both betting on it. So who will be in the cockpit? (New York Times) see also How to build a better battery For the electric vehicle takeover, batteries need a major makeover. (Vox)

• Something Happened By Us: A Demonology A theory of why we’re all going nuts online (The New Atlantis)

• Americans’ taxes used to be public — until the rich revolted As Americans send off their tax returns by Monday’s deadline, they don’t have to worry about their neighbors knowing how much they earned or paid. But for a while in the 1920s, everybody’s tax payments were public records for all to see. And the richest Americans were not happy about it. (Washington Post) see also America Must Choose Between Great Wealth or Democracy: Biden is now promoting a tax on the top 0.01% and billionaires are already fuming. It’s a start to what’ll be necessary to bring back a functioning democracy & middle class (Hartmann Report)

• The Most Progressive and Perverse of Devo, According to Mark Mothersbaugh Okay, sure, Devo is also a band, but why define them by a simple noun when they’ve spent more than four decades preaching about anti-stupidity and pro-intelligence, all while looking like a bunch of energy-dome aliens beaming in from their own Spud-nik satellite? Emerging from Akron in 1973, the classic lineup of Gerald Casale, Mark Mothersbaugh, Bob Casale, Bob Mothersbaugh, and Alan Myers critiqued what it meant to be in the New Wave and post-punk genres at the time (Vulture)

Be sure to check out our Masters in Business interview this weekend with Luana Lopes Lara, co-founder of Kalshi, which has been approved by the Commodity Futures Trading Commission (CFTC) as an authorized Designated Contract Market (DCM). Kalshi operates a federally regulated exchange allowing investors to trade directly on the anticipated outcome of future events.

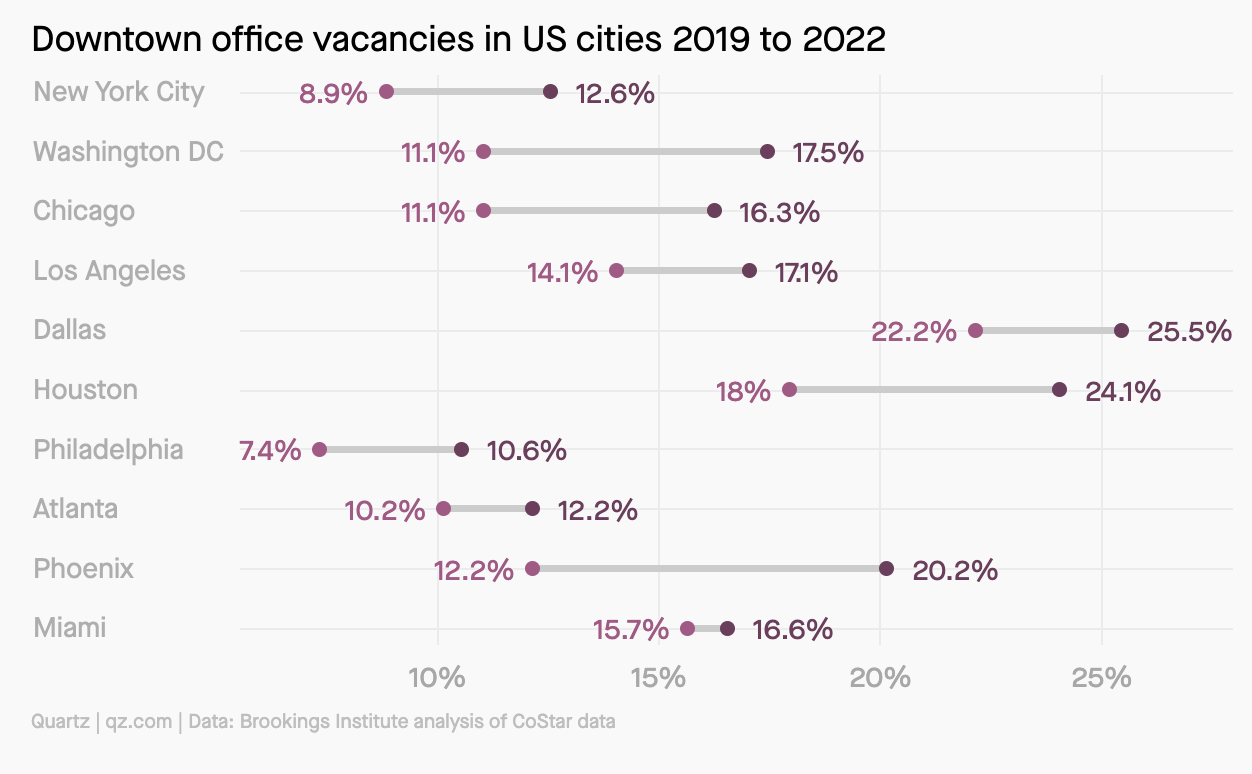

What’s in store for empty downtown office buildings?

Source: Quartz