My mid-week morning train WFH reads:

• Economist Jim O’Neill on Russia: “The West Will Decide on Putin’s Bankruptcy” Jim O’Neill once coined the term BRIC to refer to the rapidly growing economies of Brazil, Russia, India and China. In an interview, he discusses why the Russia of Vladimir Putin has failed to live up to expectations. (Spiegel)

• The Hottest NFT Marketplace is Mostly Users Selling to Themselves LooksRare encourages users to trade via Looks token incentives Trading has effectively helped to mask the cooling NFT demand. (Bloomberg)

• Can Norway’s $1.3 Trillion Oil Fund Actually Give Up Oil? It’s hard to understate how big a shift this is. Ever since the first transfers were made in 1996, Norway has made a careful effort to keep the fund at arm’s length from political aims. It was conceived of as a national savings account to hedge against fluctuations in the price of oil. But from its inception, people feared it could be manipulated for political ends. They saw successive oligarchies in the Middle East grow rich on oil at the expense of their people. Experts warned Norway was being naive to expect that a democratic society could manage such a big cash flow in a sustainable way. (Institutional Investor)

• Apple Makes It Easy to Work Remotely (Unless You Work for Apple) The company’s relatively inflexible remote-work policies are inspiring some employees to look elsewhere. Businessweek (Businessweek)

• The Predictive Power of the Yield Curve: Even if the yield curve does predict a recession yet again you can’t predict: When the recession will happen. If/when the stock market will begin to fall. The magnitude of the recession and stock market correction. What the Fed will do in the meantime. (A Wealth of Common Sense)

• Rich companies are using a quiet tactic to block lawsuits: bankruptcy A growing number of wealthy companies, organizations and individuals accused of serious wrongdoing are using similar bankruptcy tactics, hoping to delay or permanently block lawsuits. They’ve found openings in state and federal law that allow them to leverage the sweeping power wielded by bankruptcy judges when cutting deals. But they’re not being forced to endure the financial pain and exposure that comes with actually filing for bankruptcy. Often this means creating a new subsidiary and pushing it into bankruptcy, as in the J&J case. (NPR)

• How Long Do Boosters Last? Here’s The Deal On Whether You Need Another One. Now that months have passed since getting boosted against COVID, you may be wondering if the shot is still protecting you. Here’s everything experts do — and don’t — know. (Buzzfeed)

• What we can learn from people who take the Flat Earth theory seriously “Flat Earth enables people to cast out all previous information that they didn’t want to believe and rebuild the world from scratch.” (Grid)

• The controversial quest to make a ‘contagious’ vaccine: A new technology aims to stop wildlife from spreading Ebola, rabies, and other viruses. It could prevent the next pandemic by stopping pathogens from jumping from animals to people. (National Geographic)

• Why People Are Acting So Weird: Crime, “unruly passenger” incidents, and other types of strange behavior have all soared recently. Why? (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Bill Gross PIMCO co-founder who managed the Total Return Fund, which at $293B was the world’s largest mutual fund. Gross advised Treasury on the role of subprime mortgage bonds, and was named Morningstar’s Fund Manager of Decade in 2010.

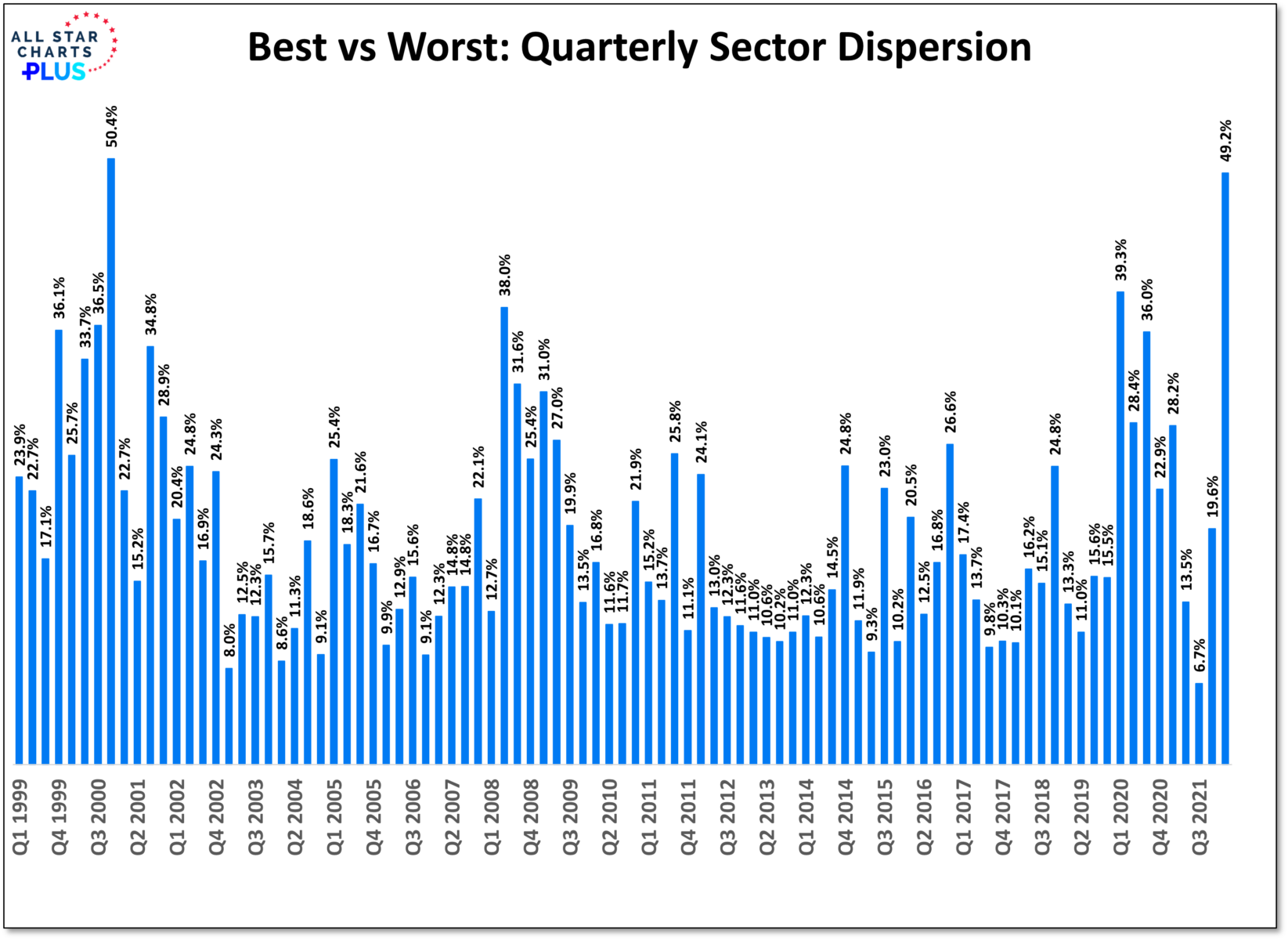

Largest quarterly sector return dispersion (49%) since Q4 2000

Source: All Star Charts

Sign up for our reads-only mailing list here.