My mid-week morning train WFH reads:

• 20 Most-Overlooked Tax Deductions, Credits and Exemptions Want to lower your tax bill? Then don’t miss these frequently overlooked tax breaks. (Kiplinger)

• Stock Splits Actually Work—Just Not for the Reason Everyone Thinks There have been about 20 splits a year by U.S. issuers over the past decade, says Dow Jones Market Data. “By itself, a stock split should neither create nor destroy any value.” The real heyday of the split was during the late 1990s tech bubble. From 1997 to 2000, an average of 65 U.S. companies divided their shares each year as markets melted up. Split frequency picked up again in the years before the global financial crisis, at the tail end of another long market rally. (Barron’s)

• Don’t Fall for This Real Estate Myth REITs have gotten a bad rap in rising-rate environments, but historical data tells a different story (Institutional Investor)

• The private market “supercycle” Goldman Sachs reckons that the boom in private capital has much, much further to run: The hottest thing in finance is not passive funds, crypto or even commodities. It is private capital — things like venture capital, infrastructure, private equity and direct lending — and it is absolutely booming. (Financial Times)

• Is The Fed Making a Mistake? This group more or less complains about higher prices but then keeps right on paying them because they can. The problem is it’s probably going to be the bottom 50% that don’t own financial assets that gets hurt the most if we do go into a recession. But the idea is if you can put a dent in the wealth effect and make borrowing more expensive it should slow demand. (A Wealth of Common Sense)

• ‘We’re a Cult’: Inside Bitcoin’s Shameless Hypefest. Evangelists—and a couple of guys selling bitcoin panties—flocked to a Miami Beach convention center last week. (Daily Beast) see also Guns, Gains And God: Four Days In Miami With Crypto’s Most Faithful Fans. The forum is also an occasion for the crypto rich to flaunt the sudden, enormous wealth cryptocurrencies have generated. (Bitcoin’s value alone has soared approximately 1,100% since the conference’s 2019 start.) They get the chance to do so in a city offering bountiful opportunities to strut and spend, a place that has deliberately pitched itself as a Mecca for crypto enthusiasts and techno nonconformists. (Forbes)

• The Fake Artists Problem Is Much Worse Than You Realize: Recent revelations from an alleged industry insider paint a disturbing picture (The Honest Broker)

• You’re Still Being Tracked on the Internet, Just in a Different Way Apple and Google are pushing privacy changes, but a shift in digital tracking is giving some platforms a bigger advertising advantage. (New York Times)

• The Surprisingly Bulky Particle That Might … Break Physics? What is the W boson, why is it such a big deal, and what happens next? (Slate) see also Fermilab Says Newly Measured Particle Is Heavy Enough to Break the Standard Model A new analysis of W bosons suggests these particles are significantly heavier than predicted by the Standard Model of particle physics. (Quanta Magazine)

• The Unsinkable Molly Shannon In a new memoir, “Hello, Molly!”, Shannon — the “Saturday Night Live” alumna — recounts her comedy career and the devastating family tragedy that changed her life. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Jonathan Lavine, co-managing partner of Bain Capital, and Bain Capital Credit’s Cheif Investment Officer. He is co-chair of the Board of Trustees of Columbia University.

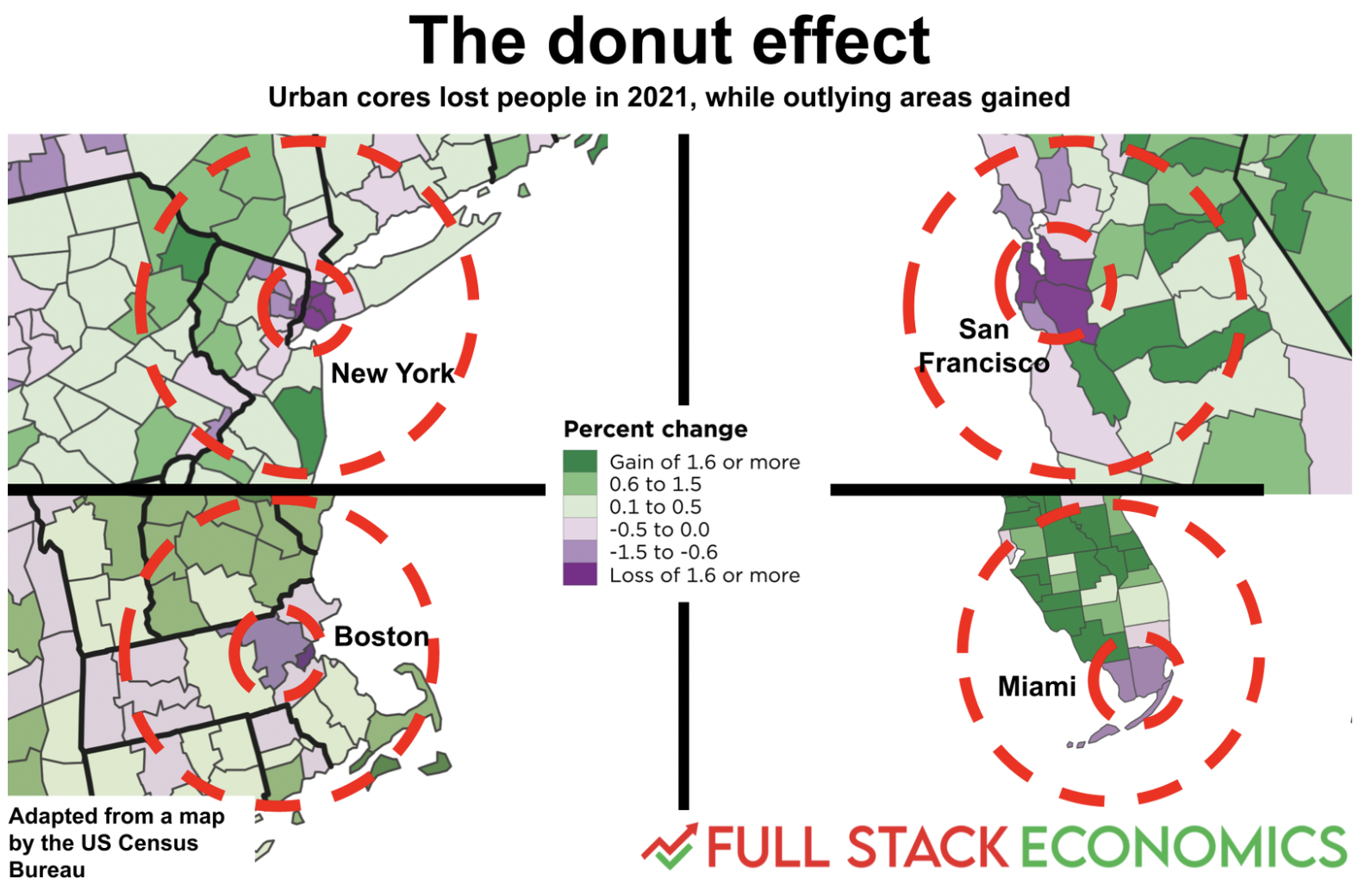

The Donut Effect: How the Pandemic Hollowed Out America’s Biggest Cities

Source: Slate

Sign up for our reads-only mailing list here.