My back to work morning train WFH reads:

• Meet the Hedge-Fund Manager Who Warned of Terra’s $60 Billion Implosion Kevin Zhou of Galois Capital says he started warning about Terra as a ‘public service to also let everybody else know’ about its dangers. (Odd Lots)

• Is this another tech bubble bursting? And should you, a normal person, care? There are lots of parallels: Like the dot-com era, the stock boom, which began in 2009 and then super-sized during the pandemic, has been fueled in large part by very low to nonexistent interest rates, which made investors more interested in companies that promised to deliver outsized returns. And like the dot-com era, we’ve seen plenty of companies promise products and results they can’t deliver, like hydrogen-powered trucks. (ReCode)

• A Stock is Not an Index: Here is where things break down between buying an individual company that has declined a lot and buying an index that has declined a lot—there is no guarantee that the individual company will ever recover. Netflix may never get back to its old highs — or it may slowly decline into the graveyard of market history. With an index fund like the S&P 500, this is unlikely to occur. (Of Dollars And Data)

• What to Know if You Want to Buy the Stock Market Dip The Federal Reserve is giving the stock market a fright as it ramps up its efforts to control inflation. The volatility may last longer than the past few decades have led investors to expect—but you can still prosper with discipline, patience and courage. (Wall Street Journal)

• The Woebegone Office Sector’s Bright Spot: Class A Buildings What work-from-home problem? The sparkling new properties are in demand. (Chief Investment Officer)

• How Workers Gained an Edge—and Why They Won’t Lose It Soon: Millions of workers who have seized control of their professional lives in the postpandemic economy and leveraged historically tight labor markets into raises, promotions, and a litany of intangible benefits: more-flexible scheduling, more remote work, cheaper healthcare, subsidized child care. With unemployment close to a 50-year low and nearly two job openings currently available for every one unemployed worker—the largest disparity in the U.S. economy on record by far—American workers are enjoying more power than they’ve had in decades. And the results are piling up. (Barron’s)

• The Isolation of Social Media Social media should promote conversation and exchange, yet increasingly it doesn’t. (Harvard Medicine)

• Black Hole Image Reveals the Beast Inside the Milky Way’s Heart In 2019, the Event Horizon Telescope released a historic image of a supermassive black hole in another galaxy. The follow-up — an image of Sagittarius A* — shows it shimmering at the center of our own. (Quanta) see also Behold, the Bottomless Pit Holding Everything Together Astronomers have captured the Milky Way’s supermassive, mysterious abyss, 27,000 light-years from Earth. (The Atlantic)

• Anybody Can Dribble a Basketball. But Few Can Do It Like This. Three elite dribblers of the past — God Shammgod, Tim Hardaway and Oscar Robertson — share their secrets, and name their favorites now. (New York Times)

• In ‘The Time Traveler’s Wife,’ Steve Moffat comes full circle In his latest project, The Time Traveler’s Wife for HBO Max, Moffat, 60, does indeed delve into time travel, but beyond his knack for creative storytelling, it can be hard to pin down a theme among Moffat’s work, which includes the sitcom Coupling, the modern mystery series Sherlock, and a long run as showrunner on Doctor Who (another time travel story). (Inverse)

Be sure to check out our Masters in Business next week with Boaz Weinstein of Saba Capital. The hedge fund specializes in Credit Default swaps, Tail Protection & Volatility trading. Saba is one of the 5 largest SPAC investors. Previously, Weinstein was Co-Head of Global Credit Trading at Deutsche Bank and a member of the Global Markets Executive Committee. Weinstein became infamous as the trader on the other side of the London Whale trade against JPM, which lost the bank $2B and netted Saba 100s of millions in gains.

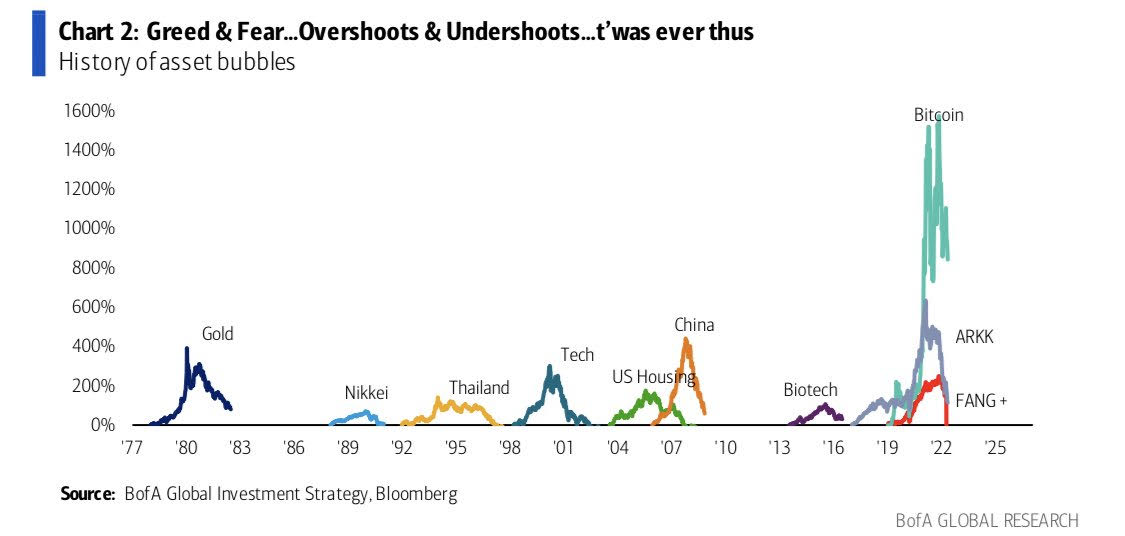

The crash in crypto and speculative tech approaching the internet bubble crash

Source: Bank of America via Carl Quintanilla

Sign up for our reads-only mailing list here.