My morning train WFH reads:

• How inflation became America’s greatest economic problem: The last time inflation was this high, the Fed engineered a severe recession. Unfortunately, the problem is much more complex now. Can the off-ramp to spiking inflation go better this time? (Grid)

• Twenty Lessons Learned Memes are not fundamentals. You didn’t know this was going to happen. You don’t know what’s going to happen next. Cash is not trash. Past performance is not indicative of future performance — Past behavior is. Investing is hard. (Irrelevant Investor)

• Are NFTs really art? Collectible and cartoonish, these digital multiples, traded in cryptocurrency, confer membership of an exclusive club – sometimes literally. But do they have any aesthetic value? A critic weighs in. (The Guardian)

• Ups and Downs: You have “Disruptrepreneur” in your profile? Bro, you got disrupted by two interest rate hikes. Maybe relax. (Reformed Broker) see also When People Stop Believing In Unicorns, Fear and Loathing Return to Tech Start-Ups: Workers are dumping their stock, companies are cutting costs, and layoffs abound as troubling economic forces hit tech start-ups. (New York Times)

• Wait, Trader Joe was a real guy? Turns out Trader Joe was a real guy, and his shrewd instincts led him to create a counter-culture grocery empire. (CNN)

• Weak links in finance and supply chains are easily weaponized Russian sanctions highlight how network analysis is urgently needed to find and protect vulnerable parts of the global economy. (Nature)

• A Touching Goodbye for iPod In its time, the iPod Touch was extraordinary. It debuted as a surprise in early September 2007, just 10 weeks after the original iPhone went on sale. It was, basically, spec-for-spec an iPhone without the phone (Daring Fireball) see also An illustrated history of the iPod and its massive impact The iPod grew out of Steve Jobs’ digital hub strategy. Life was going digital. People were plugging all kinds of devices into their computers: digital cameras, camcorders, MP3 players. (Cult of Mac)

• The Children Left Behind by Long Covid: As the world pretends the pandemic is over, at least a half-million children in the U.S. are struggling with the mysterious disease. (Businessweek)

• What It’s Like to Drive 11 Hours in a $169,000 Lucid Air Electric Car The Air isn’t perfect, but it stirs optimism about the future of electric vehicles. And while I wouldn’t choose the Lucid Air over an EV from a heritage luxury automaker like Mercedes or Porsche, I would choose it over something from Tesla. (Bloomberg)

• The minor league broadcaster you have to hear to believe There is joy in Fredericksburg this season, both on the field and in the broadcast booth. That’s where exuberant play-by-play voice Joey Zanaboni has baseball fans talking about the FredNats for the creative way he talks about the Washington Nationals’ Class A affiliate. (Washington Post)

Be sure to check out our Masters in Business next week with Boaz Weinstein of Saba Capital. The hedge fund specializes in Credit Default swaps, Tail Protection & Volatility trading. Saba is one of the 5 largest SPAC investors. Previously, Weinstein was Co-Head of Global Credit Trading at Deutsche Bank and a member of the Global Markets Executive Committee. Weinstein became infamous as the trader on the other side of the London Whale trade against JPM, which lost the bank $2B and netted Saba 100s of millions in gains.

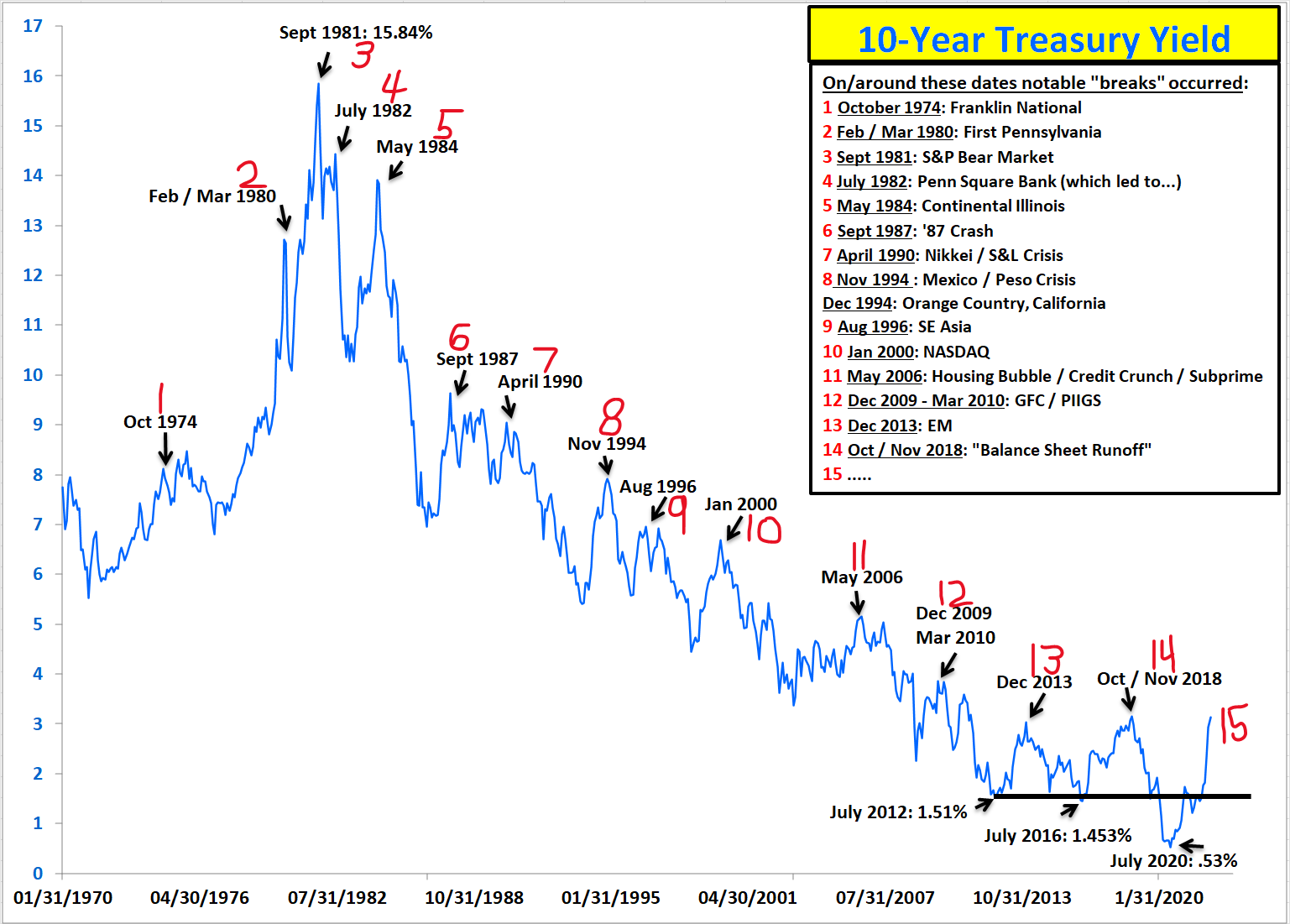

The bond market never lies: Each of the prior 14 rate rising cycles something broke

Source: 22V Research via John Roque

Sign up for our reads-only mailing list here.