My Two-for-Tuesday morning WFH reads:

• Dunking on Ackman; When Can We Say Stagflation? In a series of tweets on Tuesday, the Pershing Square founder argued that the Federal Reserve should lift rates aggressively now to stamp out price pressures to avoid having to hike as many times overall. An observation that would have been more accurate a few month ago. (Bloomberg) see also How inflation became America’s greatest economic problem The last time inflation was this high, the Fed engineered a severe recession. Unfortunately, the problem is much more complex now. Can the off-ramp to spiking inflation go better this time? (Grid)

• How to Weather This Stock Market Storm: For some Main Street investors, this year’s decline doesn’t feel like a calamity. It feels like an opportunity. (Wall Street Journal)

• Lithium mining: How new production technologies could fuel the global EV revolution. Lithium is the driving force behind electric vehicles, but will supply keep pace with demand? New technologies and sources of supply can fill the gap. (McKinsey) see also This Is Where Dirty Old Cars Go to Die: The electric vehicle revolution is gathering speed—but what happens to all those polluting cars already on the road? (Wired)

• One Man Helped Credit Suisse Make Billions From Russia Tycoons: A charismatic fixer made the Swiss bank the leading destination for Russia’s wealthiest individuals. Then war and sanctions got in the way. (Bloomberg)

• Endless Uncertainty. But the idea that uncertainty is higher now than it was, say, one or two or five years ago is a strange one. It implies that the future was more predictable in the past, before the pandemic struck and inflation spiked and the war broke out. But it wasn’t, of course. The risks were always there. People were just blind to them. (Collaborative Fund) see also Knightian Uncertainty.Pundits may hate uncertainty — it makes them look foolish — but markets harbor no such bias. Markets thrive on uncertainty — it is their reason for being. (The Big Picture)

• Mark Zuckerberg Is Blowing Up Instagram to Try and Catch TikTok The CEO of Meta Platforms needs Reels—his short-form video feature—to fund his metaverse, and you can smell his desperation from Beijing. (Bloomberg)

• Where Does the Supply Chain Crisis Stand Now? There are signs the tide may be turning even as challenges continue in some sectors. (Morningstar)

• Efficiency is the Enemy: There’s a good chance most of the problems in your life and work come down to insufficient slack. Here’s how slack works and why you need more of it. (Farnam Street)

• 5 facts about guns in America. The country could change the catastrophic status quo without infringing on the Second Amendment. Indeed, many such reforms are immensely popular. But a few dozen Republican Senators continue to stand in the way. In the meantime, the death toll mounts. (Popular Information) see also From Sandy Hook to Buffalo: Ten years of failure on gun control Biden has played a central role in the unsuccessful efforts to enact significant firearms legislation amid thousands of mass shootings. (Washington Post)

• Why Are American Chips So Boring? International chip flavors seem to have all the fun. But to get chip flavors like hot pot or fried crab in America, the snack industry would have to change the way it does everything. (Eater)

Be sure to check out our Masters in Business next week with Adam Parker, founder of Trivariate Research. Formerly Head of Research at Sanford C. Bernstein, he was #1 ranked semi analyst, before becoming Chief US Equity Strategist and Director of Global Quant Research at Morgan Stanley. As a member of MS’s global investment committee, he helped oversee $2 trillion in private wealth.

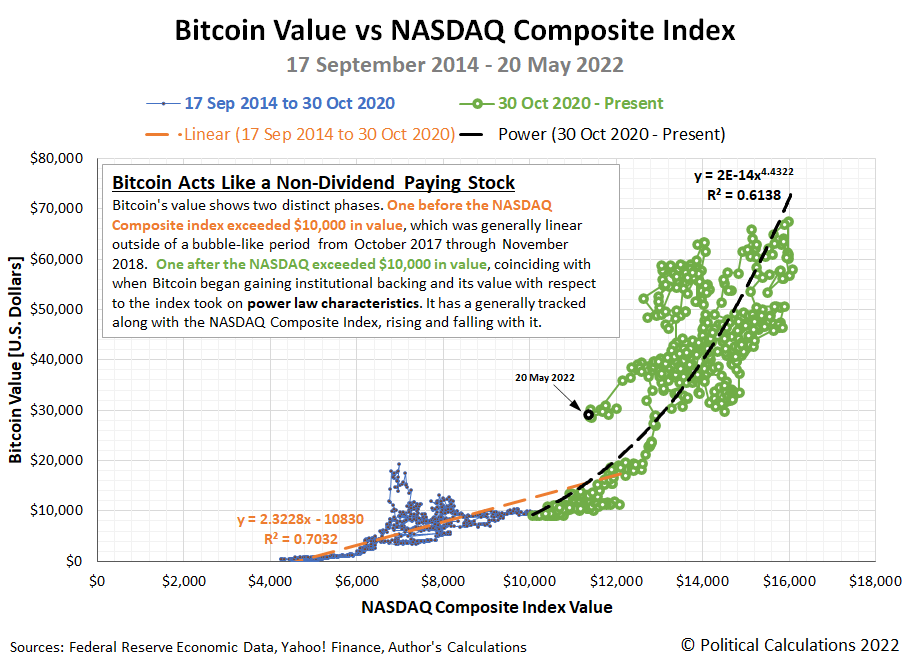

Bitcoin’s correlation with the Nasdaq 100 index reaches a new all-time high

Source: Political Calculations