My mid-week morning train WFH reads:

• The 477 Price Checkers Who Determine Inflation To calculate how much prices are rising, hundreds of government workers spend their days tracking down costs for individual goods and services. (Wall Street Journal)

• Trading stocks is like playing a Wimbledon champion: To make things even harder, the vast majority of trading nowadays is done by professionals. Unlike amateur traders, they work full-time; they have the latest data and technology at their disposal. The best ones are hugely intelligent and they have vastly more skill and trading experience than you do. (Evidence Based Investor) see also Your Three Investing Opponents “Watch a pro football game – the guys on the field are far faster, stronger and more willing to bear and inflict pain than you are. Surely you would say, ‘I don’t want to play against those guys!’ 90% of stock market volume is done by institutions, and half of that is done by the world’s 50 largest investment firms, deeply committed, vastly well prepared – the smartest sons of bitches in the world working their tails off all day long. I don’t want to play against those guys either.” (The Big Picture)

• How to Think and Act For the Long-Term: Remind yourself why you’re investing: Returns are often viewed through the prism of risk. Stocks are risky, and therefore investors demand compensation for bearing it. This is true, but at an even more basic level, stocks go up over time because things get better over time. This manifests itself through expanding earnings which filters through to its owners. As profits grow over time, so does the value of the business. (Irrelevant Investor)

• Mauboussin on Wealth Transfers: Redistribution of Value via Capital Allocation: Astute investors appropriately focus on a management’s ability to invest in the business, but they should also pay attention to management actions with regard to buying and selling the company’s stock. (Morgan Stanley)

• Meet Pinky Cole, the force behind Slutty Vegan’s booming empire She meant the name to be jarring. “I merge the two most pleasurable experiences: sex and food,” she says. “I wanted to create a dialogue that was so racy. I’m either going to inspire you for being so creative, or I’m going to piss you off because you couldn’t believe that I would name a business after this.” The provocative language can be found throughout the company, such as in menu items called “One Night Stand,” “Ménage à Trois” and “Fussy Hussy.” (Washington Post)

• How Twitter made me smarter The website everyone loves to hate has an upside. (The Ruffian)

• NFTs are plunging in popularity? Yeah, that makes sense. Blockchain-backed avatars of the Bored Ape variety appear to be going the way of Beanie Babies. (MSNBC) see also What Is Happening to the People Falling for Crypto and NFTs For reasons that don’t seem much deeper than weird things happen online, bored apes have become a hot commodity in the market for nonfungible tokens, or NFTs. (New York Times)

• Mapping the Brain to Understand the Mind: New technology is enabling neuroscientists to make increasingly detailed wiring diagrams that could yield new insights into brain function (Scientific American)

• The Working-Class Alternative to the Westminster Dog Show The Farm Dog of the Year contest features the kind of dog you want to have a beer with (Wall Street Journal)

• ‘People took so many drugs, they forgot they played on it’ – stars on Exile on Main St, the Rolling Stones’ sprawling masterpiece Recorded during several hedonistic months in a fabulous Côte d’Azur villa, Exile on Main St is seen as the Stones’ epic, creative peak. As the classic album turns 50, stars tell us how it got their rocks off. (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Alex Guervich of Hon Te Advisors, a discretionary global macro hedge fund. Previously, Guervich ran JP Morgans’s macro book. In 2020, Hon Te was ranked 2nd in net return, and a top 10 emerging manager. He is the author of The Next Perfect Trade and most recently, The Trades of March 2020.

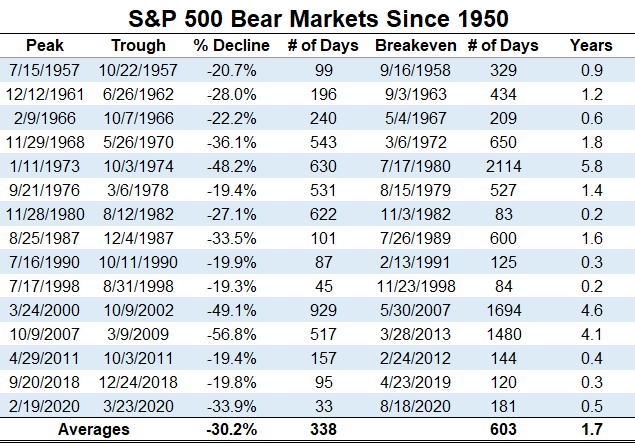

How Long Do Bear Markets Last?

Source: A Wealth of Common Sense

Sign up for our reads-only mailing list here.