My mid-week morning train WFH reads:

• Elon Musk Is Acting Like Henry Ford. Uh-Oh. Both auto magnates built dominant companies. Both became global celebrities. Both dove headlong into other pursuits. One lost his edge. So far. (Bloomberg) see also There Are Just Three Explanations for Elon Musk’s Unhinged Behavior Right Now Is he needling Twitter because he still wants to buy it, or because he doesn’t? (Slate)

• Bear Market Playbook The most important thing right now is not to panic and to stick to your plan, assuming you had one. But every market environment presents an opportunity to do something to improve your portfolio or your total financial picture. These actions can help scratch the urge to DO SOMETHING to ease the pain of seeing red on your statements. It is in our human nature to react to fear, and with careful planning and deliberation, perhaps we can harness that energy into something productive rather than destructive. I call this the bear market playbook. (The Belle Curve)

• SPACs Are Sputtering. Desperate New Terms Could Send Them Into a Death Spiral. Bankers, lawyers, and sponsors all said, “It’s different this time.” (Institutional Investor)

• AQR gets rewarded for its ‘sins’ Asness’s Greenwich, Connecticut-based quant shop AQR has nine mutual funds across various alternative categories sitting top or near top of their peer groups. In some cases, they are ahead of the competition by an eye-watering margin. (CityWire)

• Cautionary Tales from Cryptoland Web3 is off to a rocky start. Optimists may rattle on about progress on the horizon, but at present the space is rife with fraud, hacks, and collapses. In this Q&A with Web3 critic Molly White, creator of the website Web3 Is Going Just Great, White argues that as this technology becomes more mainstream, its ability to do harm — financial, emotional, and reputational — will grow, and fast. (HBR)

• All of Those Quitters? They’re at Work. The Great Resignation was in fact a moment many people traded up for a better-paying gig. (New York Times)

• Tech’s High-Flying Startup Scene Gets a Crushing Reality Check Job cuts and a sour investment climate are hitting big companies like Stripe and Instacart, and may slam smaller ones as damage spreads. (Bloomberg) see also In Uncertain Times, Start-Ups Flock to Co-Working Spaces The pandemic’s arrival turned spaces like WeWork into ghost towns. Now people are lining up for low-commitment offices, and providers are working to sustain that trend. (New York Times)

• The Certainty Trap The solution to our broken political conversation won’t be found in censoring ‘misinformation’ but in recognizing the profound limits of our own beliefs. (Tablet)

• Breaking the Black Sea Blockade: This effort has failed, and while Russian forces are continuing with some probing offensives, these have largely been blocked. The campaign map does not look much different to that of a month ago. NATO’s Secretary General Jens Stoltenberg has said that Ukraine ‘can win this war’, while the UK’s Defence Intelligence, having noted that the Russian army has lost a remarkable third of its original ground combat force, observed that it was now ‘significantly behind schedule.’ This is a story of shrinking objectives. (Comment is Freed)

• ‘I told Jackie Chan, your loss, my bro!’: how Everything Everywhere gave Michelle Yeoh the role of a lifetime The action superstar shines in a new multiverse comedy. She talks about her high-risk, low-budget Hong Kong days, why you can be a superhero in your 60s – and whether she could kick James Bond’s butt. (The Guardian)

Be sure to check out our Masters in Business this week with Boaz Weinstein of Saba Capital. The hedge fund specializes in Credit Default swaps, Tail Protection & Volatility trading. Saba is one of the 5 largest SPAC investors. Previously, Weinstein was Co-Head of Global Credit Trading at Deutsche Bank and a member of the Global Markets Executive Committee. Weinstein became infamous as the trader on the other side of the London Whale trade against JPM, which lost the bank $2B and netted Saba 100s of millions in gains.

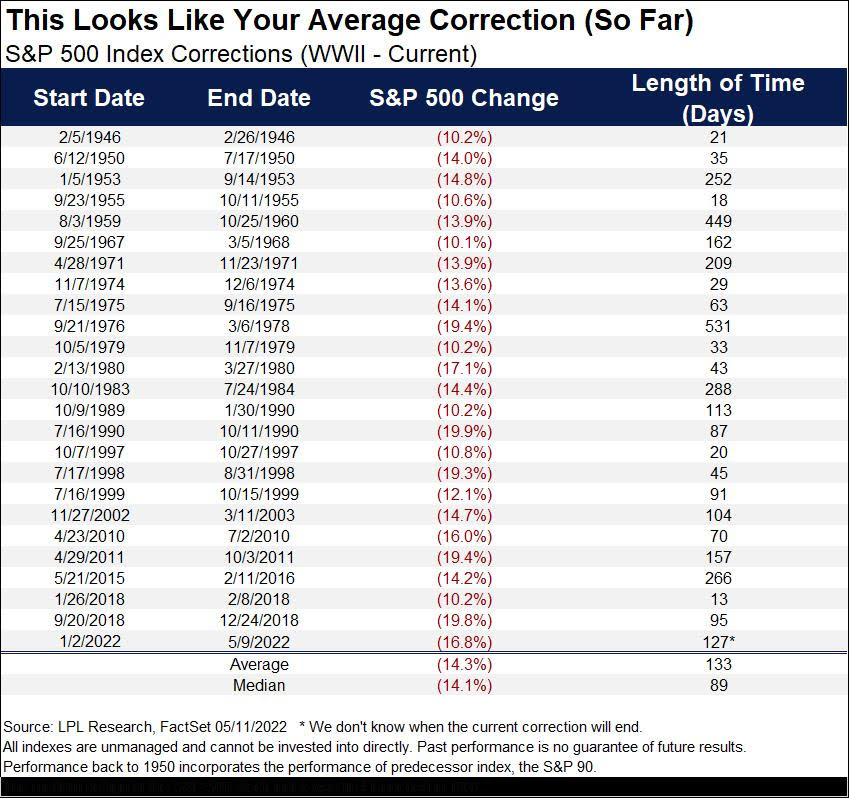

Stock market corrections have had an average length of 133 days from market top to market bottom

Source: @RyanDetrick

Sign up for our reads-only mailing list here.