Has inflation peaked?

When we look at the data, there are encouraging signs in various sectors. Three of the most signficant are Automobiles, Homes, and Labor/Wages:

• Automobiles: The semiconductor shortage sent new car supplies down and prices higher; this also helped drive used car prices up. But industry insiders are confident semi supplies are normalizing (hopefully, over the rest of the year). And, they are seeing prices begin to roll over.

Here is Nick Woolard, Lead Industry Analyst at TrueCar:

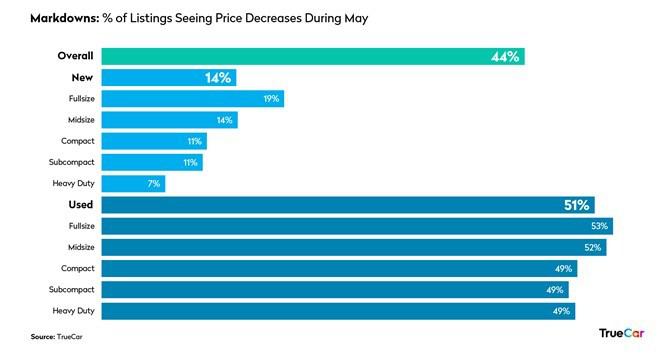

“We’re also now starting to see signs of demand adjusting. Higher interest rates combined with higher fuel prices present a headwind to demand, which may explain why average used list prices are decreasing, down 1.6% in May versus April 2022. In terms of price adjustments, compared to the beginning of the month we are seeing more vehicles being marked down than for the same period last year. This is truer for used cars where we are seeing over half of our used listings getting a downward price adjustment since the beginning of the month. This trend is led by the used full-size vehicle segment.” (emphasis added)

Increasing supplies would go a long way, but for now, rising credit costs might be capping new and used car prices.

UPDATE May 27, 2022

Carl Quintanilla shares these details:

Hard deflation in used cars.

Manheim Used Car Index has gone from 54.2 this time last year — to 9.7.

(via @JohnSpall247) pic.twitter.com/QsatslG7bJ

— Carl Quintanilla (@carlquintanilla) May 27, 2022

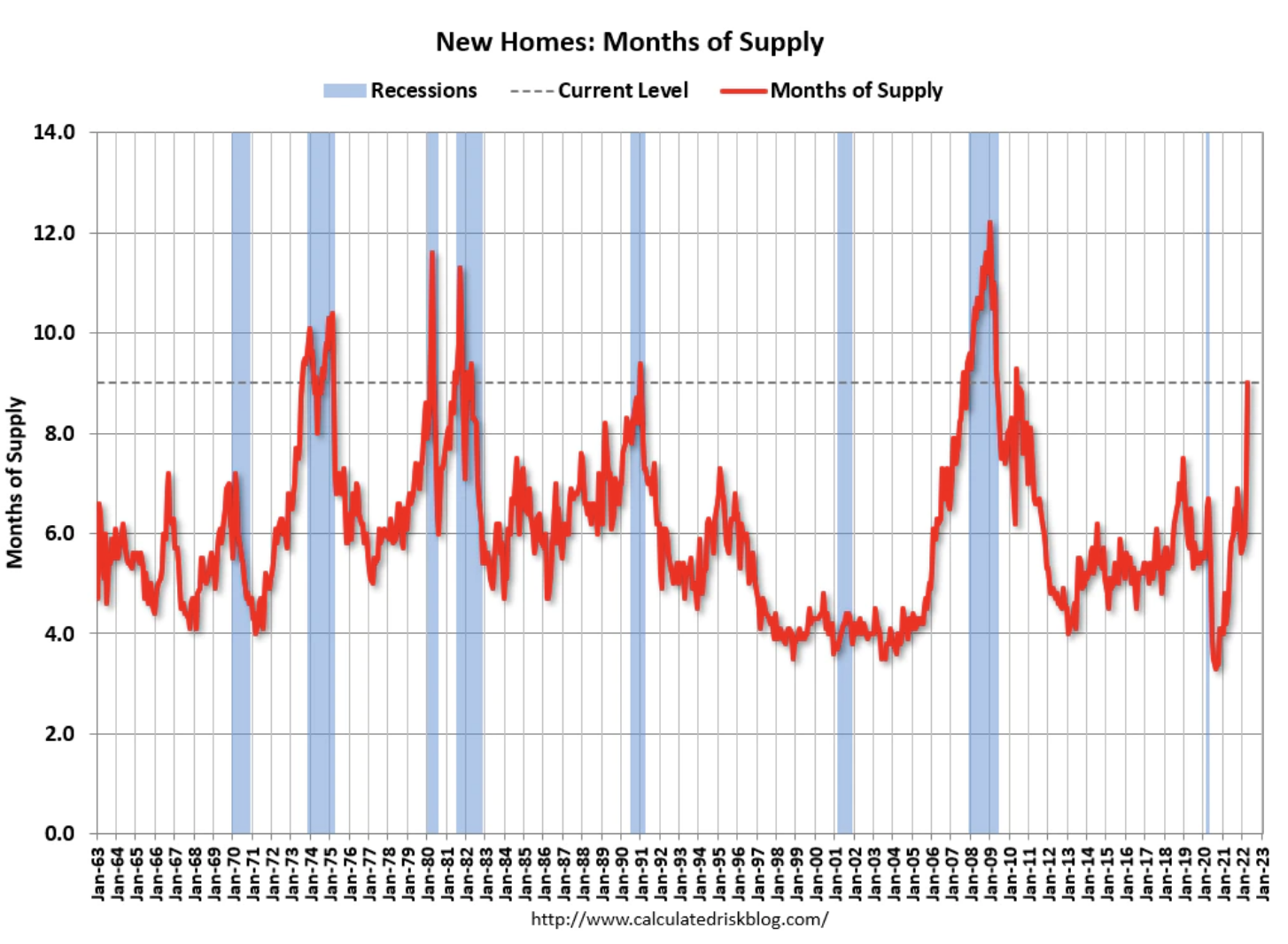

• Homes: Inventory is increasing, with 6 months of new home supply under construction. Sales of new homes are falling, feeling the bite of higher mortgage rates.

April New Home Sales fell precipitously — the 4th consecutive monthly drop. And Existing Home Sales in April also fell — down 2.4% from the previous month, and down 5.9% year over year. We now have had 6 straight months of declines in EHS.

But we have yet to see prices roll over. The biggest obstacle to falling prices remains the low supply of homes relative to demand. The best hope for prices to moderate is for supply to rise. In the meantime, elevated rates are putting a cap on prices, especially for the under $1m homes.

Ideally, Single Family Home prices stabilize and then drift lower. At the very least, we are looking for signs that the unsustainable rate of increase we showed yesterday has peaked.

• Labor & Wages: Anecdotally, we are hearing that lots of companies hiring sprees are over. Some retailers that may have overhired — Amazon, Walmart, Target — are even doing layoffs.

My colleague Josh Brown observes:

“We’re going to have a very healthy and happy labor force, paid more than it had been prior to the pandemic. But the labor shortage is going to ease considerably in the second half of this year. We’re already hearing about this easing on conference calls across several industries. Including from both Walmart and Amazon, the largest and second largest private employers in America. They say they’re overstaffed. Other CEOs and CFOs have been telling Wall Street that finding people has become easier this spring. Or that they will simply need less people. The effect is the same.”

Labor has received a great reset over the past few years to the upside. That seems to be ending, as Wages are stabilizing. The increases were overdue, but the mad scramble and hiring bonuses are coming to an end.

~~~

These are encouraging signs that inflation has likely peaked, but falling prices are not occurring across every sector. Most notably, we see Energy and Food remain elevated. Some of that is a function of the Russian invasion of Ukraine, but that’s not the only driver of price in these areas.

Rents are also high, following a plummet in 2020, a full recovery in 2021, and an ongoing rise in rents since.

Still, it is encouraging to see supply come online, prices moderate, and demand cool in three important sectors . . .

See also:

TrueCar Releases Analysis of May Industry Sales. (AP News, May 25, 2022)

Employment-related inflation has peaked. (The Reformed Broker, May 25, 2022)

New Home Sales Decline Sharply, ~6 Months of Inventory Under Construction. (Calculated Risk, May 19, 2022)

Existing-Home Sales Decreased to 5.61 million SAAR in April (Calculated Risk, May 19, 2022)

Previously:

Aspirational Pricing (May 25, 2022)

Transitory Is Taking Longer than Expected (February 10, 2022)

How Everybody Miscalculated Housing Demand (July 29, 2021)