My end of week morning train WFH reads:

• About 200 years ago, the world started getting rich. Why? Two economic historians explain what made the Industrial Revolution, and modern life, possible. (Vox)

• Crypto Just Had Its Lehman Moment. What’s Next? Crypto investors confront hard truths in the wake of the Terra debacle. (Part of the crypto column series.) (Institutional Investor) see also First she documented the alt-right. Now she’s coming for crypto. Molly White, a veteran Wikipedia editor, is fast becoming the cryptocurrency world’s biggest critic. (Washington Post)

• How Come Volatility Is So Darn Wild? Lots of bad news is one reason. But changes in the market’s structure figure in, too. (Chief Investment Officer)

• When Shipping Containers Sink in the Drink We’ve supersized our capacity to ship stuff across the seas. As our global supply chains grow, what can we gather from the junk that washes up on shore? (New Yorker)

• What Nobel Prize-winning economist Robert Shiller thinks about the stock market right now: Nobel Prize-winning economist Robert Shiller is not particularly alarmed by what some market watchers argue are troublingly high valuations in the stock market. He also addressed the current state of the widely-followed cyclically adjusted price-earnings (CAPE) ratio for the S&P 500. (TKer)

• “Worst Housing Affordability” since 1991 (excluding Bubble) In real terms, house prices are now above the previous peak levels. On a price-to-rent basis, the Case-Shiller National index is at a record high, and the Composite 20 index is back to November 2005 levels. By all of the above measures, house prices appear elevated. (Calculated Risk) see also The Real Estate Frenzy is Over: Things are still wild out there, but they’re no longer insane. We used to have 50 bidders for every asking price, now it’s down to just 5. We’re seeing price drops in what were some of the hottest housing markets last year. (Irrelevant Investor)

• TikTok trends or the pandemic? What’s behind the rise in ADHD diagnoses By 2016, the reported incidence of adult ADHD rose by 123% in the US – increases in stimulant medication prescriptions suggest its rise continues. (The Guardian)

• Will more countries want nuclear weapons after the war in Ukraine? From the Middle East to East Asia, nuclear crises loom. (Grid)

• The Multifarious Multiplexity of Taika Waititi: He makes big movies and little movies, funny movies and sad movies—but mostly big-little funny-sad movies. Waititi is a bundle of contradictions. (Wired)

• Three Big Questions About the 2022 NBA Finals Will the Warriors’ elite offense best the Celtics’ elite defense? Will Steph Curry finally have his Finals MVP moment? Here’s a first look at the 2021-22 season’s championship matchup. (The Ringer)

Be sure to check out our Masters in Business interview this weekend with Dan Chung, CEO and Chief Investment Officer at Alger Management, which manages $35.3 billion in client assets. After graduating Harvard Law Review, he served as law clerk for the Honorable Justice Anthony M. Kennedy, United States Supreme Court. The firm lost 35 people, including its CEO, on September 11th and donates profits from its Alger 35 ETF in their memories.

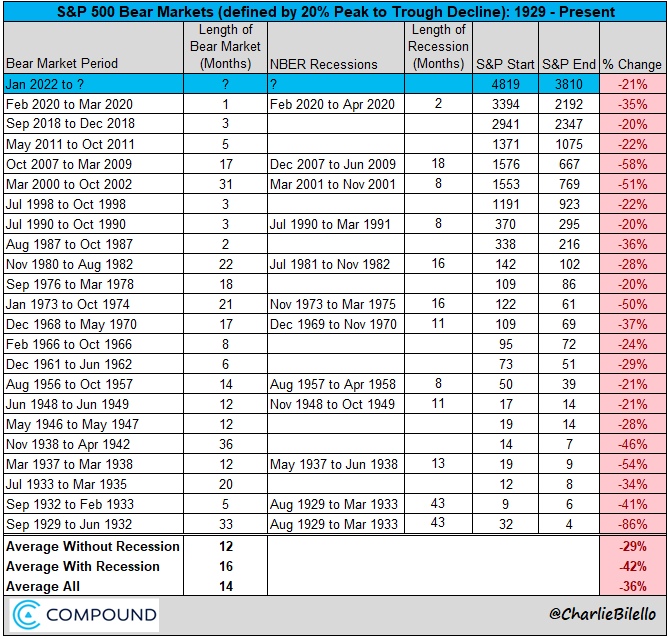

Every Bear Market is Different

Source: Compound

Sign up for our reads-only mailing list here.