My morning train WFH reads:

• Retail Trading Is About to Change: Payment for order flow, etc. I don’t know. The basic situation is: Retail investors in US stock markets get to trade for free and get really good execution on their stock trades. Everybody is mad about it. (Money Stuff)

• Timing a Recession vs. Timing the Stock Market Seven out of 10 Republicans think we’re currently in a recession. More than half of all independents and 43% of Democrats think the same. The unemployment rate is still 3.6%. Wages are rising. Consumers are still spending money like crazy. (A Wealth of Common Sense) see also Beware of a Bear Market That Is More Than a Cub Many stock investors have never experienced the pain that a long downturn can inflict and may be mistaken that selloffs are always brief. (Bloomberg)

• The wealthiest crypto owners don’t spend it There’s a wealth gap in cryptocurrency ownership: Those who invest in crypto are better off than those who spend or send it. (Quartz)

• Record Labels Dig Their Own Grave. And the Shovel is Called TikTok. With each passing month, record labels grow more attached to TikTok—but it now looks more like addiction. Some have reached the point where they won’t release an album until the music goes viral on TikTok. (The Honest Broker)

• Oliver Burkeman’s last column: the eight secrets to a (fairly) fulfilled life After more than a decade of writing life-changing advice, I know when to move on. Here’s what else I learned. (The Guardian)

• The simple, impactful way to make cars cleaner In the age of electric vehicles, higher gas mileage is more important than ever. (Vox) see also How Safe Are Systems Like Tesla’s Autopilot? No One Knows. Automakers and technology companies say they are making driving safer, but verifying these claims is difficult. (New York Times)

• Solve Life Backwards: His idea was to visualize your future and then move backwards through time to figure out each step prior until you reach where you are today. This concept is similar to Stephen R. Covey’s 2nd habit from 7 Habits of Highly Effective People—begin with the end in mind. (Of Dollars And Data)

• This Optical Illusion Has a Revelation About Your Brain and Eyes: Your pupils may be dilating when you see images like this one as your brain tries to anticipate the near future. (New York Times)

• How the White House lost Joe Manchin, and its plan to transform America: After his Fox News interview, Manchin turned his phone off, which meant he missed a call from Biden, who left a frustrated voice mail. When the pair connected, the conversation was heated and tense. For several weeks, Biden and Manchin did not speak again. In private, the president criticized Manchin to aides, expressing doubt about his intentions. (Washington Post)

• The Doctors Who Preserved Klay Thompson’s Career—and the Warriors’ Dynasty After missing two full seasons, the Golden State star couldn’t help but think about the operating tables, the surgeons who treated him and the rehab that could’ve broken him (Wall Street Journal)

Be sure to check out our Masters in Business next week with Mark Mobius of Mobius Capital. Known as the “The Godfather of Emerging Markets,” he was tapped by Sir John Templeton in 1987 to run Templeton Emerging Markets, one of the first EM funds in the world. Over the next 30 years, he visited 112 countries, invested in 5,000+ companies, and traveled 1,000,000+ miles. This helped to grow the Templeton Emerging Markets Group from $100 million in six markets to over $40 billion in 70 countries.

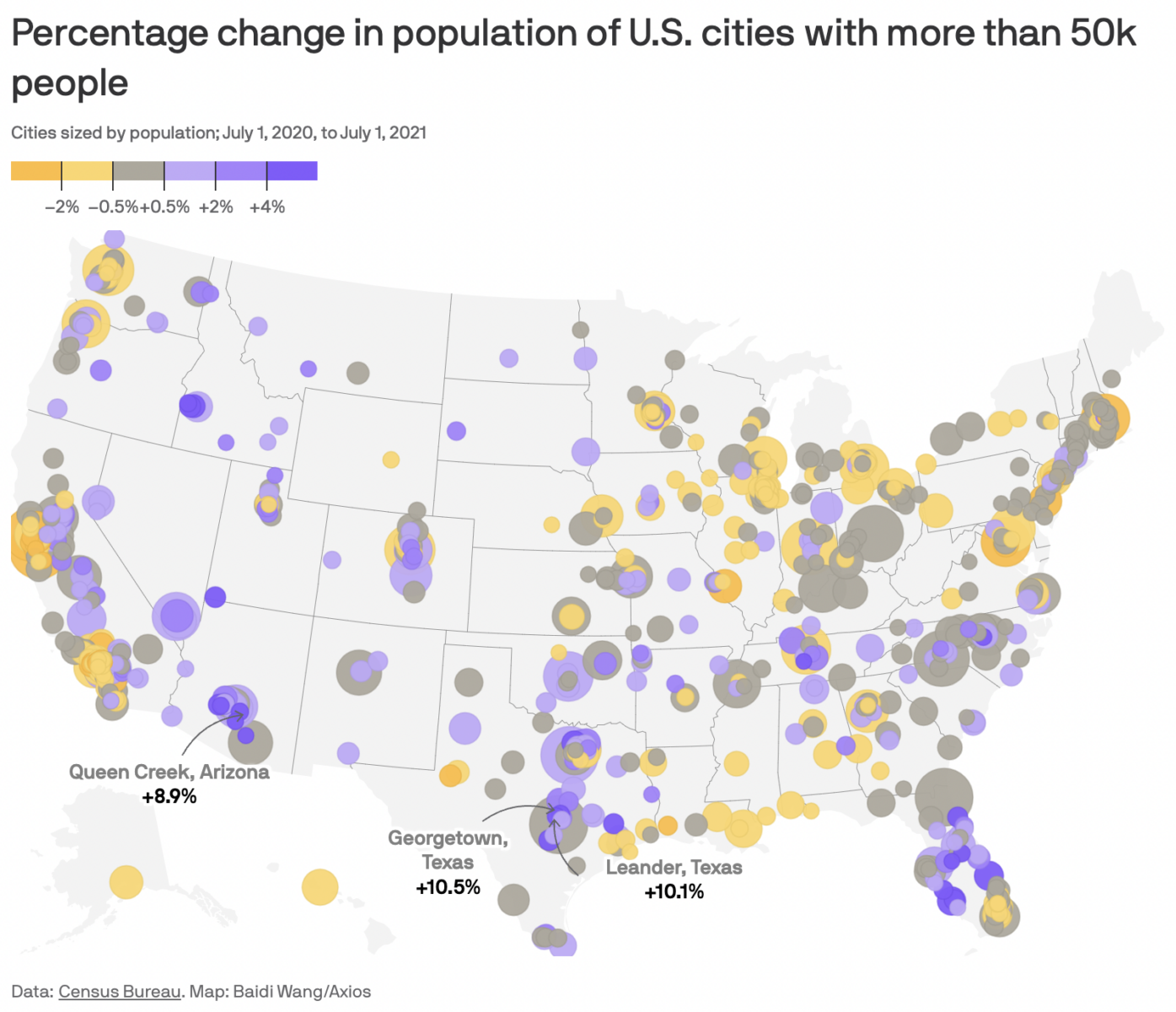

Where America’s cities are growing

Source: Axios

Sign up for our reads-only mailing list here.