My Two-for-Tuesday morning train WFH reads:

• America Wasted Its Chance to Push the Economy Forward: Interest rates were low for years. Imagine how much the country could have gotten done. (The Atlantic) see also Rising Interest Rates Will Soon Make Needed Infrastructure Repairs More Costly (2013) More Costly (The Big Picture)

• Cancelled flight? Shoddy clothing? Disappointing meal? Blame skimpflation, the hidden curse of 2022 Reluctant to raise prices, refusing to sacrifice profits, travel companies, retailers and restaurateurs are cutting corners wherever they can, usually without telling their customers. Is poor quality the new normal? (The Guardian)

• Mike Novogratz on His Big Crypto Mistake and What’s Ahead for Bitcoin The crypto crash, in luna and the industry more broadly, has burned Galaxy’s portfolio and, presumably, a chunk of Novogratz’s net worth. To be fair, in our last conversation, around cryptocurrency’s peak last year, he did advise newly rich crypto investors to “be prudent, take some chips and buy yourself a house if you can afford it.” (New York Magazine) see also Can Crypto’s Richest Man Stand the Cold? Changpeng Zhao built Binance into the world’s biggest digital currency exchange. Now he faces a looming regulatory crackdown in a brutal crypto winter. (Businessweek)

• GM and Ford, Driving to Beat Tesla, Turn on Each Other Detroit’s greatest rivalry is intensifying in the race to dominate in electric vehicles; Silverado vs. F-150 Lightning: GM plans to flood the market with a few dozen EV models across a wide price spectrum. Ford plans a narrower range of models but has emphasized speed to market. (Wall Street Journal)

• Goodbye, Robin HoodI’ve traded stocks, options, ETFs, mutual funds, and bonds; I know my way around trading programs, from Instinet to Bloomberg to SOES to Nasdaq Level III. In terms of interface and user experience, Robinhood was less like those professional products — it was closer to CandyCrush than it was NQDS.(The Big Picture) see also The 2022 Intern’s Guide to Trading In our guide to market structure, we talked about how all stocks have a National Best Bid and Offer (NBBO). That is the starting point for how all orders trade. (Nasdaq) see also Good-Bye Robin Hood

• Water Investments Are No Longer Just an Environmental Play “It’s an industry that’s characterized [by] some of the most positive long-duration, inflation-protected pricing power of any industry,” says Water Asset Management’s Matthew Diserio. (Institutional Investor)

• The bad economic news that the Fed is looking for: The economy has been surprisingly disappointing. (TKer) see also Metals Haven’t Crashed This Hard Since the Great Recession Prices for copper, tin and other metals plummeted last week as recession fears grow. (Bloomberg)

• How Parents’ Trauma Leaves Biological Traces in Children Adverse experiences can change future generations through epigenetic pathways. (Scientific American)

• The Supreme Court’s gun ruling sets a disturbing new precedent: Ignoring scientific evidence The partisan 6-3 decision rules out “any means-end test” in concealed-carry laws, eschewing scientific evidence of the dangers of firearms. (Grid) see also The Supreme Court’s Legitimacy Is Already Lost: Regardless of Roe falling, the leaks, and the court’s disregard for the public it is supposed to serve, have already gone too far. (Slate)

• Natural Magic: The creation of Disney’s masterpiece, Snow White, gives us a preview of what may be coming with AI algorithms sophisticated enough to pass for sentient beings (Adjacent Possible)

Be sure to check out our Masters in Business interview this weekend with Jonathan Miller, discussing real estate, home sales, rentals, and whether cities are dead or not. Miller is the CEO and co-founder of Miller Samuel, whose data and analytics on real estate have become the standard for the residential real estate appraisal and brokerage industry.

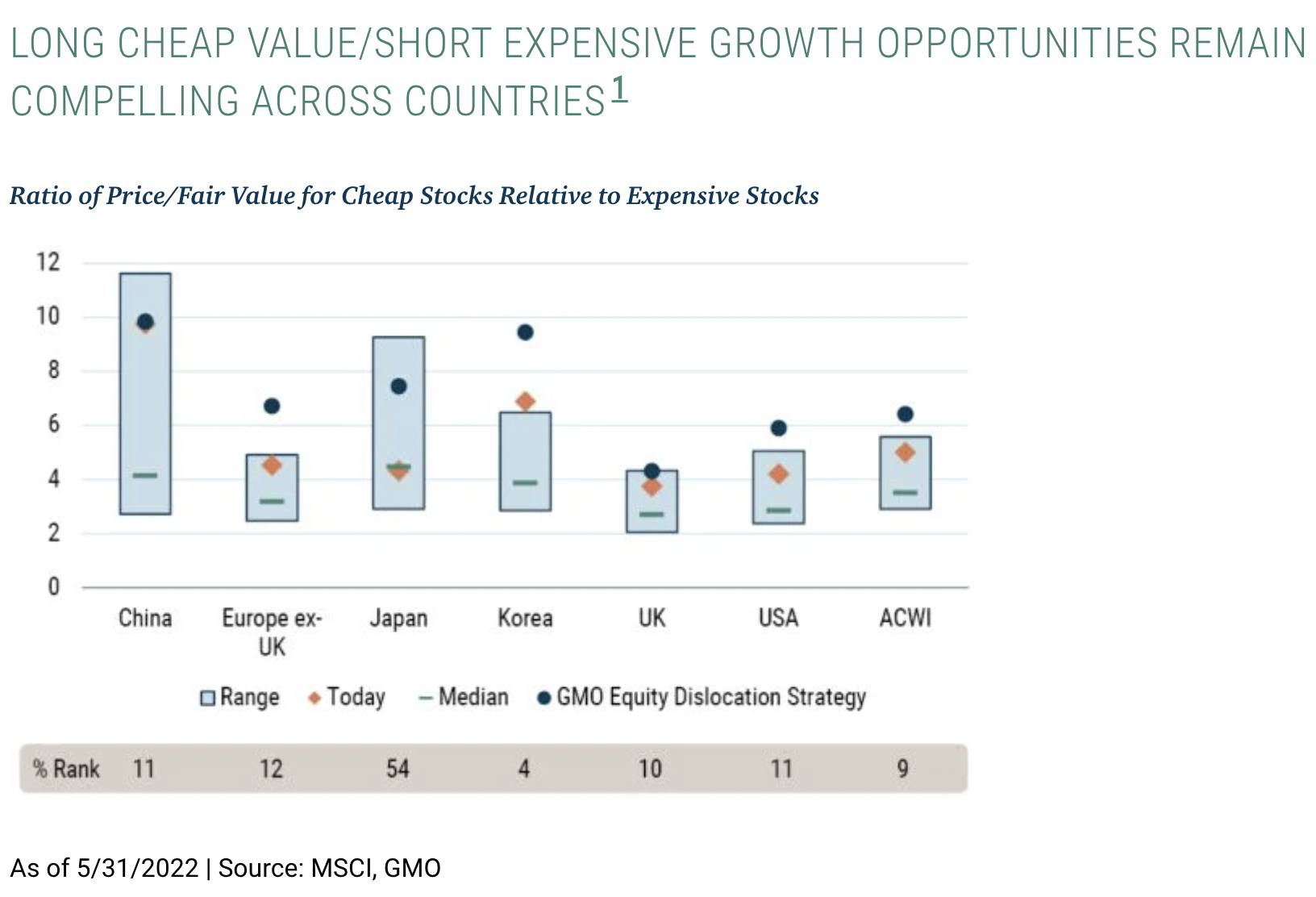

Time to Jump Aboard the Value Train

Source: GMO

Sign up for our reads-only mailing list here.